Stocks soared to record highs last Monday following an announcement from a major pharmaceutical company of positive data on a COVID-19 vaccine. That news, coupled with President-elect Joe Biden’s win, helped buoy investor optimism. Cyclicals and bio-tech stocks led a powerful rally, which drove the Dow up 3.0%. The S&P 500 added 1.2%, the Russell 2000 climbed a robust 3.7%, and the Global Dow shot up 4.2%. The Nasdaq lost value as money moved from tech stocks to value shares. Energy shares jumped more than 14%, while financials advanced more than 8.0%. Crude oil prices, the dollar, and Treasury yields all rose.

Market returns were mixed last Tuesday with the Nasdaq and the S&P 500 losing value, while the Dow, the Russell 2000, and the Global Dow continued to surge. Bond prices fell, sending Treasury yields higher. Crude oil prices and the dollar each rose for the second consecutive day. Weakness in mega-caps and tech stocks offset strength in cyclicals and value stocks. Among the market sectors, utilities, industrials, energy, and consumer staples pushed higher.

By the end of trading last Wednesday, the Nasdaq posted a gain for the first time in the last three sessions. The tech-heavy index climbed 2.0%, followed by the S&P 500 (0.8%), and the Global Dow (0.2%). The Dow and the Russell 2000 moved little. Crude oil prices and the dollar rose, while Treasury yields fell. Technology led the sectors, followed by consumer discretionary. Energy, industrials, and financials fell.

Surging COVID-19 cases prompted a sell-off last Thursday as each of the benchmark indexes listed here lost value. Treasury yields plunged and crude oil prices sank, while the dollar rose. All of the market sectors lost value, with energy and materials tumbling the most. Along with news of advancing virus cases, investors were hit with the prospects of tighter pandemic-related restrictions, continued wrangling over fiscal stimulus, and worsening relations between the United States and China.

Stocks closed the week on a high note as cyclicals and value stocks prevailed over tech shares. The Dow and the S&P 500 each gained 1.4%, the Global Dow rose 1.1%, and the Nasdaq gained 1.0%. The big winner last Friday was the Russell 2000, which vaulted 2.1% on the day. Crude oil prices and the dollar declined, while Treasury yields gained nearly 1.0%. While each of the major market sectors advanced, the market was led by energy, real estate, and industrials. Tech shares gained less than 1.0%.

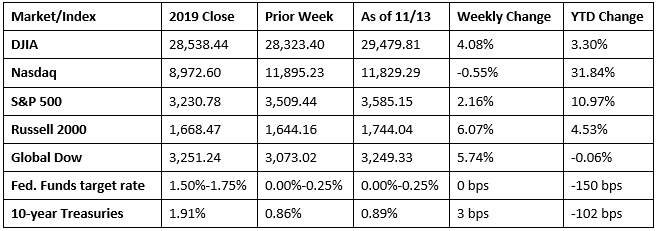

The indexes posted notable gains for the second consecutive week as both the S&P 500 and the Russell 2000 rallied to all-time highs. The Dow advanced to its pre-pandemic level. The Nasdaq, which had been a consistent gainer through much of the year, was the only major benchmark to lose value, as investors pulled away from tech stocks and moved to shares influenced by changes in the overall economy. News that vaccine test results were in the 90% efficacy range outweighed mounting COVID-19 cases. For the first time since late January, all but one of the indexes listed here were ahead of their respective 2019 year-end closing values, and the Russell 2000 was only 0.06 percentage point away.

Crude oil prices advanced for the second consecutive week, closing at $40.20 per barrel by late Friday afternoon, up from the prior week’s price of $37.39 per barrel. The price of gold (COMEX) closed the week at $1,886.70, down from the prior week’s price of $1,953.10. The national average retail price for regular gasoline was $2.096 per gallon on November 9, $0.016 lower than the prior week’s price and $0.519 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Consumer Price Index was unchanged in October after advancing 0.2% in September. Over the past 12 months, the CPI has increased 1.2%. Within the index, food (0.2%), energy (0.1%), and shelter (0.1%) inched up. Offsetting those gains were declines in used cars and trucks (-0.1%), apparel (-1.2%), medical care commodities (-0.8%), and medical care services (-0.3%).

- Prices at the producer level advanced 0.3% in October after climbing 0.4% in September. For the last 12 months ended in October, producer prices are up 0.5%, the largest advance since moving up 1.1% for the 12 months ended in February. However, when excluding food and energy, producer prices are up 1.1% year over year. In October, nearly 60% of the rise in producer prices can be traced to a 0.5% increase in prices for goods. The prices for services moved up 0.2%. Food prices vaulted 2.4% last month, and energy prices increased 0.8%. Trade services rose 0.2%, while transportation and warehousing services advanced 1.1%.

- October, the first month of the federal government’s fiscal year 2021, saw a deficit of $284.1 billion. By comparison, the deficit in October 2019, at $134.5 billion, was 111% lower. Government receipts for the month totaled $237.7 billion, or 3% lower than receipts this time last year. Government outlays were $521.8 billion, 37% greater than last October.

- According to the Job Openings and Labor Turnover report for September, the number of job openings increased by 84,000, the number of hires decreased by 81,000, and the number of total separations fell by 25,000. The job openings rate was unchanged at 4.3%. The number of job openings decreased over the year to 6.6 million (-566,000), reflecting the continued impact of the COVID-19 pandemic on the labor market. Over the 12 months ended in September, hires totaled 70.4 million and separations totaled 76.4 million, yielding a net employment loss of 6.0 million.

- For the week ended November 7, there were 709,000 new claims for unemployment insurance, a decrease of 48,000 from the previous week’s level, which was revised up by 6,000. According to the Department of Labor, the advance rate for insured unemployment claims was 4.6% for the week ended October 31, a decrease of 0.3 percentage point from the prior week’s rate. For comparison, during the same period last year, there were 222,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended October 31 was 6,786,000, a decrease of 436,000 from the prior week’s level, which was revised down by 63,000. The highest insured unemployment rates in the week ended October 24 were in Hawaii (9.9%), California (8.9%), New Mexico (8.5%), and Nevada (8.2%). The largest increases in initial claims for the week ended October 31 were in Illinois (+20,377), Kentucky (+3,868), Pennsylvania (+3,768), Ohio (+3,766), and Kansas (+2,711), while the largest decreases were in Massachusetts (-8,470), Georgia (-6,442), New York (-5,883), Michigan (-3,067), and New Jersey (-2,500).

Eye on the Week Ahead

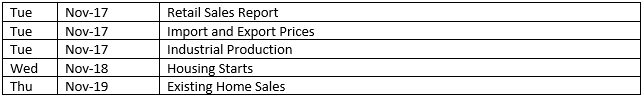

Housing, retail, and industrial production are economic sectors in the news this week. October reports on housing starts and existing home sales are expected to reveal continued strength in the housing sector. Industrial production scaled back a bit in September following a robust August. October’s figures should show continued growth, but at a slower pace. The October retail sales report is out this week. Sales at the retail level advanced nearly 2.0% in September and could continue to climb as more businesses reopen following pandemic-related shutdowns.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.