Tech stocks and consumer shares opened last week on an upswing. Unfortunately, the rest of the market lagged. Investors faced the prospect of more stringent restrictions as COVID-19 cases continued to surge. The Nasdaq (0.5%) and the Russell 2000 (0.1%) posted gains, while the Dow (-0.6%), the S&P 500 (-0.4%), and the Global Dow (-0.2%) fell. Crude oil prices rose, although the energy sector dropped more than 3.5%. The dollar and 10-year Treasury yields declined. On the positive side, vaccines were rolled out in parts of the United States last Monday.

Stocks rebounded last Tuesday on news of the approval of a second virus vaccine and positive developments on additional fiscal stimulus. Each of the benchmark indexes listed here gained value, led by the Russell 2000 (2.4%), followed by the S&P 500 (1.3%), the Nasdaq (1.3%), the Dow (1.1%), and the Global Dow (1.0%). Treasury yields jumped higher as did crude oil prices. The dollar lost value. All of the major market sectors posted gains, with utilities, energy, and materials leading the way.

Investors got more encouraging news on movement toward a fiscal stimulus package as congressional leaders continued to negotiate last Wednesday. Mega-caps, retail, and information technology drove stocks higher as the Nasdaq (0.5%), the S&P 500 (0.2%), and the Global Dow (0.4%) advanced. The Russell 2000 (-0.3%) and the Dow (-0.2%) fell. Treasury yields dropped as bond prices rose. Crude oil prices advanced for the third consecutive day, while the dollar mostly declined.

Investors continued to ride the wave of hope for a new stimulus package before the end of the year. Both the S&P 500 and the Nasdaq reached record highs by the close of trading last Thursday, while the Russell 2000 (1.3%), the Global Dow (0.5%), and the Dow (0.5%) posted solid gains. Crude oil prices and Treasury yields rose, while the dollar fell. Among the sectors, real estate, materials, health care, and utilities led the way, while communication services and energy lagged.

Last week ended on a sour note as more congressional haggling over a fiscal stimulus package dominated the day’s news. Stocks closed lower on the day with the Global Dow falling 0.5%, followed by the Dow and the Russell 2000, each of which dropped 0.4%. The S&P 500 and the Nasdaq came down from their record highs, losing 0.4% and 0.1%, respectively. Materials, health care, industrials, and consumer staples were the only market sectors to gain ground last Friday, but only marginally. Crude oil prices, the dollar, and Treasury yields all closed higher.

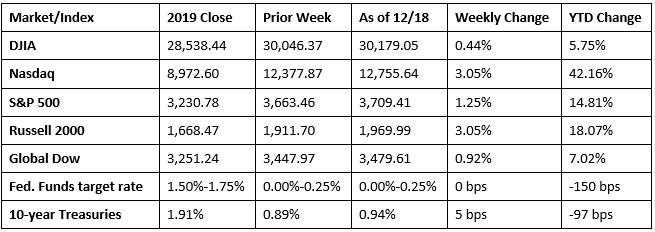

Despite the ongoing negotiations over additional fiscal stimulus, investors continued to see value in stocks, pushing each of the benchmark indexes higher last week. The Nasdaq and the Russell 2000 enjoyed solid gains, followed by the S&P 500, the Global Dow, and the Dow. Barring a major downturn, all of the indexes will close the year ahead of their 2019 marks, with the Nasdaq nearly 45.0% higher, followed by the Russell 2000, the S&P 500, the Global Dow, and the Dow.

Crude oil prices advanced for the third consecutive week, closing at $49.05 per barrel by late Friday afternoon, up from the prior week’s price of $46.58 per barrel. The price of gold (COMEX) closed at $1,886.30 last week, up from the prior week’s price of $1,842.90. The national average retail price for regular gasoline was $2.158 per gallon on December 14, $0.002 higher than the prior week’s price but $0.378 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Following its meeting last week, the Federal Open Market Committee decided to keep the target range for the federal funds rate at 0.00%-0.25%. The Committee expects it will maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2.0% and is on track to moderately exceed 2.0% for some time. The Committee will also continue to increase its holdings of Treasury securities and mortgage-backed securities at the current pace.

- Prices for U.S. imports ticked up 0.1% in November after edging down 0.1% in October. Higher fuel prices in November (4.3%) more than offset lower nonfuel prices. Despite the recent increases, prices for imports decreased 1.0% from November 2019 to November 2020. Export prices also rose in November, increasing 0.6% following advances of 0.2% in October. Export prices fell 1.1% from November 2019 to November 2020, despite increases in each of the last six months.

- Retail sales stepped back in November, falling 1.1% behind their October pace. However, retail sales are 4.1% ahead of last November’s totals. Retail trade sales were down 0.8% from October, but 7.1% above last year. Nonstore (online) retailers were up 0.2% in November and are 29.2% ahead of November 2019. While overall sales at the retail level have been impacted by the pandemic, particularly hard hit were sales at food services and drinking places (-4.0%), clothing and clothing accessories stores (-6.8%), motor vehicle and parts dealers (-1.7%), electronics and appliance stores (-3.5%), and gasoline stations (-2.4%).

- Industrial production continued to accelerate in November, increasing 0.4% from October. After falling 16.5% between February and April, industrial production has risen to within 5% of its pre-pandemic (February) level. In November, manufacturing output advanced 0.8% for its seventh consecutive monthly gain. Manufacturing of motor vehicles and parts increased 5.3% last month, contributing significantly to the gain in factory production. The output of utilities declined 4.3% as warmer-than-usual temperatures reduced the demand for heating. Mining production increased 2.3% after decreasing 0.7% in October. Overall, total industrial production was 5.5% lower in November than it was a year earlier.

- The housing sector continued to show strength in November. The number of residential building permits issued grew by 6.2% over October’s rate. Single-family authorizations in November were 1.3% above the October figure. Housing starts increased 1.2% in November over October. Single-family housing starts in November were 0.4% above the October number. Privately-owned housing completions in November were 12.1% below the October estimate. Single-family housing completions in November were 0.6% below the October rate.

- For the week ended December 12, there were 885,000 new claims for unemployment insurance, an increase of 23,000 from the previous week’s level, which was revised up by 9,000. According to the Department of Labor, the advance rate for insured unemployment claims was 3.8% for the week ended December 5, a decrease of 0.1 percentage point from the prior week’s rate. For comparison, during the same period last year, there were 229,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended December 5 was 5,508,000, a decrease of 273,000 from the prior week’s level, which was revised up by 24,000. States and territories with the highest insured unemployment rates in the week ended November 28 were California (7.0%), New Mexico (6.7%), Alaska (6.6%), Hawaii (6.5%), Nevada (6.1%), Illinois (5.6%), Puerto Rico (5.6%), Pennsylvania (5.5%), Massachusetts (5.4%), and the Virgin Islands (5.4%). The largest increases in initial claims for the week ended December 5 were in California (+48,341), Illinois (+33,485), Texas (+22,729), Pennsylvania (+16,955), and New York (+16,814), while the largest decreases were in Louisiana (-2,666), Kentucky (-1,151), New Mexico (-378), and North Dakota (96).

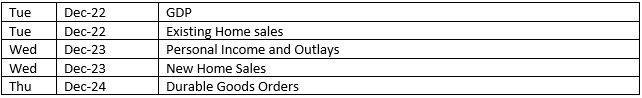

Eye on the Week Ahead

Christmas week brings with it plenty of economic reports. The final estimate of the third-quarter gross domestic product is available. The second estimate showed that the economy advanced at an annual rate of 33.1% in the third quarter. That figure is not likely to change in the third and last estimate. Also out this week is the November report on personal income and spending. Personal income fell 0.7% in October, while consumer spending increased 0.5%. Prices for consumer goods and services were unchanged in October and have risen only 1.2% over the last 12 months, indicative of muted inflationary trends.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2020 Broadridge Financial Solutions, Inc. All Rights Reserved.