Stocks rebounded in a big way last Monday. Investors may be picking low-hanging fruit following the prior week’s depressed values, or they may have regained confidence in the market despite higher Treasury yields. In any case, each of the benchmark indexes listed here posted sizable gains, led by the Russell 2000 (3.4%), followed by the Nasdaq (3.0%), the S&P 500 (2.4%), the Dow (2.0%), and the Global Dow (1.6%). Yields on 10-year Treasuries dipped, as did the price of crude oil. The dollar inched up 0.2%. The market sectors enjoyed a resurgence as well, with information technology and financials each climbing more than 3.0%.

Monday’s profit-taking market surge was short-lived, as stocks plummeted last Tuesday. Tech shares led the losses, pulling the Nasdaq down 1.7%. The Russell 2000 fell 1.9%, the S&P 500 dropped 0.8%, the Dow lost 0.5%, and the Global Dow dipped 0.1%. Treasury yields fell, as prices climbed on increased demand. Crude oil prices also plunged, and the dollar inched down. Only materials posted a gain among the sectors, while information technology (-1.6%) and consumer discretionary (-1.3%) tumbled.

Last Wednesday marked another rough day for equities. The Nasdaq dropped 2.7%, sinking to a two-month low. The yield on 10-year Treasuries jumped 6 basis points to 1.47%, as investors may be retreating from stocks perceived as overvalued. The S&P 500 declined 1.3%, while the Russell 2000 (-1.1%) and the Dow (-0.4%) also fell. The Global Dow picked up 0.6%. Crude oil prices reversed course from the past few days, surging to over $61.00 per barrel. The dollar gained as well. Among the sectors, energy and financials advanced. Information technology and consumer discretionary each lost more than 2.4%.

Last Thursday, Federal Reserve Chair Jerome Powell did not offer any consolation or planned intervention relative to the volatility in both the equity and the bond markets. Investors, fearing overinflated stock values and potential inflationary pressures, sold equities and bonds, pulling stock prices lower and sending bond yields higher. The Russell 2000 led the dive, falling 2.8%, followed by the Nasdaq (-2.1%), the S&P 500 (-1.3%), the Global Dow (-1.3%), and the Dow (-1.1%). The yield on 10-year Treasuries passed 1.50%, as bond prices plunged. Crude oil prices rose past $64.00 per barrel on word that oil-producing nations had no intention of increasing output. The dollar advanced against a basket of currencies. Among the sectors, energy vaulted up 2.5%, and communication services inched up less than 0.1%. The remaining market sectors declined, with information technology, materials, and consumer discretionary all falling more than 2.0%.

Stocks rebounded last Friday, largely driven by dip buyers, although a favorable jobs report certainly helped. Nevertheless, each of the benchmark indexes posted solid gains, with the Russell 2000 leading the way after climbing 2.1%, followed by the S&P 500 (2.0%), the Dow (1.9%), the Nasdaq (1.6%), and the Global Dow (0.5%). Treasury yields continued to spike, as did crude oil prices and the dollar. Each of the market sectors advanced, led by energy, industrials, communication services, materials, consumer staples, and health care, which all gained more than 2.0%.

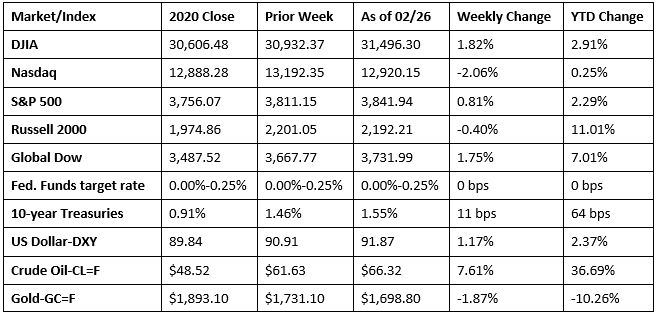

Investors looking for low-hanging values drove stocks higher last Monday and Friday — enough to push a few of the indexes into the black by the end of the week. Posting weekly gains were the Dow, the Global Dow, and the S&P 500. The Nasdaq and the Russell 2000 could not recover from mid-week sell-offs, ending the week in the red. Treasury yields continued to surge, driven by concerns that inflationary pressures are about to rise. Crude oil prices advanced past $66.00 per barrel and have risen nearly 37.0% this year. By comparison, crude oil prices were $45.90 this date last year. The dollar continued to climb, while gold prices continued to fall. Several of the market sectors gained ground last week. Energy was the major climber, advancing 10.1%, followed by financials (4.3%), industrials (3.1%), and communication services (2.4%). Utilities (-10.7%) and consumer discretionary (-2.8%) fell the most. Year to date, each of the indexes continued to remain ahead of their respective 2020 closing values, led by the small caps of the Russell 2000, followed by the Global Dow, the Dow, the S&P 500, and the Nasdaq.

The national average retail price for regular gasoline was $2.711 per gallon on March 1, $0.078 per gallon over the prior week’s price and $0.288 higher than a year ago. During the week ended February 26, crude oil refinery inputs averaged 9.9 million barrels per day, which was 2.3 million barrels per day less than the previous week’s average. Refineries operated at 56.0% of their operable capacity last week, down from the prior week’s rate of 68.6%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Employment advanced by a robust 379,000 in February after adding 166,000 new jobs the prior month. In February, most of the job gains occurred in leisure and hospitality, with smaller gains in temporary help services, health care and social assistance, retail trade, and manufacturing. Employment declined in state and local government education, construction, and mining. Last month, the unemployment rate dipped by 0.1 percentage point to 6.2%, and the number of unemployed fell by 158,000 to 10.0 million. Although both measures are much lower than their April 2020 highs, they remain well above their pre-pandemic levels in February 2020 (3.5% and 5.7 million, respectively). The employment-population ratio inched up 0.1 percentage point to 57.6, and the labor participation rate was unchanged at 61.4%. The number of persons on temporary layoff fell by 517,000 in February to 2.2 million (1.5 million higher than a year earlier). There were 3.5 million workers who permanently lost their jobs — 2.2 million higher than in February 2020. Also last month, 22.7% of employed persons teleworked because of the coronavirus pandemic, down from 23.2% in January. In February, 13.3 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic. In February, average hourly earnings increased by $0.07 to $30.01. Average hourly earnings have increased 5.3% over the 12 months ended in February. Average weekly hours were 34.6 last month, down from 34.9 in January but up from 34.4 in February 2020.

- According to the IHS Markit final U.S. Manufacturing Purchasing Managers’ Index™ (PMI™), manufacturing growth slipped a bit in February from January, but continued on an upward trend. The purchasing managers’ index registered 58.6 in February, down from 59.2 in January. According to the report, the rates of growth for both production and new orders were among the fastest in several years.

- The services sector also expanded in February, according to the IHS Markit US Services PMI™. The services purchasing managers’ index registered 59.8 in February, up from 58.3 in January — the sharpest increase in over six-and-a-half years. Stronger client demand helped drive business and new sales.

- The international trade in goods and services deficit for January, out March 5, was $68.2 billion, 1.9% higher than the December 2020 deficit. January imports were $260.2 billion, $3.1 billion, or 1.2%, more than December imports. January exports were $191.9 billion, $1.8 billion, or 1.0%, more than December exports. Year over year, the goods and services deficit increased $23.8 billion, or 53.7%, from January 2020. Exports decreased $15.7 billion, or 7.6%. Imports increased $8.1 billion, or 3.2%.

- For the week ended February 27, there were 745,000 new claims for unemployment insurance, an increase of 9,000 from the previous week’s level, which was revised up by 6,000. According to the Department of Labor, the advance rate for insured unemployment claims was 3.0% for the week ended February 20, a decrease of 0.1 percentage point from the previous week’s rate. For comparison, during the same period last year, there were 217,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended February 20 was 4,295,000, a decrease of 124,000 from the prior week’s level. States and territories with the highest insured unemployment rates in the week ended February 13 were in Pennsylvania (6.3%), Alaska (5.7%), Nevada (5.4%), Rhode Island (5.1%), Connecticut (4.9%), New York (4.9%), the Virgin Islands (4.9%), California (4.7%), Illinois (4.7%), and New Mexico (4.6%). The largest increases in initial claims for the week ended February 20 were in Illinois (+6,014), Missouri (+5,624), Tennessee (+3,987), Mississippi (+3,266), and Colorado (+2,842), while the largest decreases were in California (-49,138), Ohio (-45,189), New York (-9,117), Idaho (-5,111), and Michigan (-3,942).

Eye on the Week Ahead

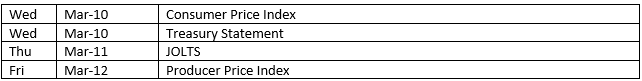

Inflation indicators are in the news this week with the February release of the Consumer Price Index and the Producer Price Index. The CPI advanced 0.3% in January and was up 1.4% year-over-year. Producer prices surged in January, climbing 1.3% for the month and were up 1.7% over the past 12 months ended in January.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.