Stocks opened last week mixed, as cyclicals and value stocks advanced, while tech stocks plunged. The Dow (1.0%), the Global Dow (0.8%), and the Russell 2000 (0.5%) posted moderate gains. The S&P 500 fell 0.5%. The Nasdaq dove into correction territory after dropping 2.4% on the day and is down 11.0% from its all-time high. The Nasdaq sits at its lowest level since November 2020. Among the sectors, utilities, materials, financials, industrials, and real estate rose, while information technology and communication services sank. Treasury bond prices continued to slide last Monday, driving yields higher. Crude oil prices fell, while the dollar advanced.

The market saw a resurgence last Tuesday, particularly tech stocks. The Nasdaq, up 3.7% on the day, enjoyed its biggest rally since November. Treasury yields, which had been soaring, fell back, as did crude oil prices and the dollar. At least for the day, investors moved back to growth shares, possibly targeting stocks that had been avoided as overvalued. The Russell 2000 gained 1.9%, the S&P 500 advanced 1.4%, the Global Dow advanced 0.4%, and the Dow inched up 0.1%. Consumer discretionary (3.8%) and information technology (3.4%) led the sectors. Energy, which had been soaring, dropped 1.9%.

Stocks continued to surge last Wednesday following passage of a $1.9 trillion fiscal stimulus package, encouraging news on the vaccine front, and a lower-than-expected increase in the Consumer Price Index. Other than tech shares, which dipped, pulling the Nasdaq down 0.4%, the remaining benchmark indexes posted solid gains, led by the Russell 2000 (1.8%), followed by the Dow (1.5%), the Global Dow (0.8%), and the S&P 500 (0.6%). The yield on 10-year Treasuries dropped for the second consecutive day, the dollar weakened, while crude oil prices advanced. Energy, financials, industrials, materials, and consumer staples each advanced more than 1.0%.

Investors, spurred on by President Biden’s signing of the $1.9 trillion stimulus package, pushed both the S&P 500 and the Dow to record highs last Thursday. Tech shares rallied as the Nasdaq continued to rebound. Among the sectors, information technology climbed 2.1%, communication services advanced 1.8%, consumer discretionary jumped 1.6%, and real estate gained 1.5%. Treasury yields and crude oil prices rose, while the dollar fell.

Stocks closed generally higher last Friday as cyclicals and value stocks pushed higher, while tech shares regressed. The Dow advanced 0.9%, adding to its record high achieved earlier in the week. The Russell 2000 gained 0.6%, the Global Dow climbed 0.5%, and the S&P 500 eked out a 0.1% gain. The Nasdaq pulled back, falling 0.6% on the day. Advances in financials, industrials, and real estate offset downturns in communication services and information technology. The yield on 10-year Treasuries jumped 7.1% as bond prices sank. The dollar inched ahead, while crude oil prices dipped.

Investors generally preferred cyclicals and value stocks over tech shares last week. Nevertheless, stocks ended the week higher, with each of the benchmark indexes gaining at least 2.5%, led by the Russell 2000, followed by the Dow, the Global Dow, the Nasdaq, and the S&P 500. Year to date, the Russell 2000 is up nearly 20.0%, and the Global Dow is more than 10.0% ahead of its 2020 closing value. A sell-off of tech stocks has kept the Nasdaq somewhat in check. Among the sectors, real estate and consumer discretionary each gained 5.7% for the week, while both utilities and materials advanced 4.4%. Crude oil prices and the dollar pulled back a bit, while gold prices enjoyed a weekly advance for the first time in nearly a month.

The national average retail price for regular gasoline was $2.771 per gallon on March 8, $0.060 per gallon more than the prior week’s price and $0.396 higher than a year ago. During the week ended March 5, crude oil refinery inputs averaged 12.3 million barrels per day, which was 2.4 million barrels per day more than the previous week’s average. Refineries operated at 69.0% of their operable capacity last week, down from the prior week’s rate of 73.0%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Consumer prices increased 0.4% in February and have risen 1.7% over the last 12 months ended in February. Gasoline prices, which rose 6.4% last month, were a major contributor to the overall increase in prices. Food prices and shelter prices each inched up 0.2%. Prices for new vehicles were unchanged in February, although prices for used cars and trucks fell 0.9%. Consumer prices less food and energy crept ahead 0.1% in February and 1.3% over the last 12 months.

- Producer prices are advancing at a faster rate than prices at the consumer level. The Producer Price Index advanced 0.5% in February after climbing 1.3% in January. Over the 12 months ended in February, producer prices have increased 2.8%, the largest 12-month increase since rising 3.1% for the 12 months ended in October 2018. Prices for goods rose 1.4% in February, mostly driven by higher energy prices, which rose 6.0%. Nevertheless, producer prices less foods, energy, and trade services moved up 0.2% in February and have risen 2.2% over the 12 months ended in February. Producer prices for services inched up 0.1% last month.

- The February budget deficit was $310.9 billion, about 32% higher than the February 2020 budget deficit. Through the first five months of the fiscal year, the budget deficit is $1.05 billion, a 68% increase over the same period last fiscal year. Government outlays in February were $569.2 billion, 32% larger than outlays in February 2020. Receipts totaled $248.3 billion, also 32% greater than February 2020 receipts. Compared to the same period last fiscal year, outlays for income security for the current year are up 125%, commerce and housing credit increased 859%, and outlays for health increased 26%. Individual income tax receipts are up 5%, and corporate income taxes have increased 21%.

- In January, the number of job openings increased by about 150,000, the number of hires fell by nearly 100,000, and the number of separations dropped by 275,000, according to the latest Job Openings and Labor Turnover Summary. Job openings increased in state and local government education (56,000), educational services (21,000), and mining and logging (10,000). Hires increased in arts, entertainment, and recreation (59,000) and in educational services (25,000). Hires decreased in federal government (15,000). The number of layoffs and discharges decreased in accommodation and food services (209,000). The number of layoffs and discharges increased in transportation, warehousing, and utilities (113,000) and in federal government (5,000). Over the 12 months ended in January, hires totaled 72.4 million and separations totaled 81.2 million, yielding a net employment loss of 8.8 million.

- For the week ended March 6, there were 712,000 new claims for unemployment insurance, a decrease of 42,000 from the previous week’s level, which was revised up by 9,000. According to the Department of Labor, the advance rate for insured unemployment claims was 2.9% for the week ended February 27, a decrease of 0.2 percentage point from the previous week’s rate. For comparison, during the same period last year, there were 211,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended February 27 was 4,144,000, a decrease of 193,000 from the prior week’s level, which was revised up by 42,000. States and territories with the highest insured unemployment rates in the week ended February 20 were in Pennsylvania (6.2%), Alaska (5.9%), Nevada (5.5%), Connecticut (5.4%), Massachusetts (5.1%), New York (4.9%), Rhode Island (4.9%), the Virgin Islands (4.7%), California (4.5%), and Illinois (4.5%). The largest increases in initial claims for the week ended February 27 were in Texas (+19,897), Ohio (+18,644), New York (+12,316), Mississippi (+8,324), and West Virginia (+4,998), while the largest decreases were in Missouri (-9,878), Wisconsin (-2,940), Michigan (-2,879), Rhode Island (-2,473), and Minnesota (-2,003).

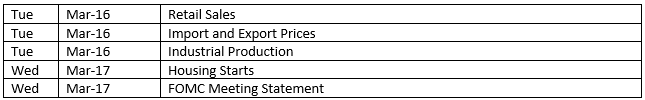

Eye on the Week Ahead

The Federal Open Market Committee meets this week. For the past several weeks, Committee Chair Jerome Powell and various Committee governors have indicated they have no intention of raising interest rates or scaling back accommodative measures already in place. Nevertheless, much attention will be paid to the announcement following this meeting to get a better gauge of actions to be taken by the Committee in the near term and over the mid-term.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.