Stocks were mixed last Tuesday to begin the holiday-shortened week. The Russell 2000 climbed 1.1%, the Global Dow added 0.6%, and the Dow eked out a 0.1% gain. The Nasdaq and the S&P 500 each dipped 0.1%. Yields on 10-year Treasuries, the dollar, and crude oil prices advanced. Energy gained nearly 4.0% as the OPEC+ alliance agreed to increase output in July. Real estate and materials also advanced more than 1.0%, while health care fell 1.6%. European markets closed higher for the fourth consecutive month as economies continue to show signs of recovery from the pandemic.

Stocks closed last Wednesday slightly higher as investors awaited the release of important employment data due later in the week. The energy sector continued to climb as crude oil prices jumped 1.5%, reaching $68.75 per barrel. Real estate, consumer staples, technology, utilities, and financials were the other market sectors to post gains. Materials dipped 0.9%. The Global Dow led the benchmark indexes, up 0.4%. The S&P 500, the Nasdaq, the Dow, and the Russell 2000 were little changed. Treasury yields fell, while the dollar was mixed.

The downward trend in unemployment claims wasn’t enough to spur the market last Thursday. Each of the benchmark indexes listed here lost value, with the Nasdaq (-1.0%) and the Russell 2000 (-0.8%) leading the decline. Treasury yields, the dollar, and crude oil prices advanced. The market sectors were mixed, with utilities, consumer staples, health care, energy, and financials gaining, while consumer discretionary, technology, and communication services dropped.

Stocks climbed higher last Friday on the heels of decreasing unemployment claims and increasing hires. Tech and communication services led the sectors. Each of the benchmark indexes listed here gained value by the close of trading last Friday, led by the Nasdaq (1.5%), and followed by the S&P 500 (0.9%), the Dow and the Global Dow (0.5%), and the Russell 2000 (0.3%). The yields on 10-year Treasuries dipped 4.0% and the dollar lost nearly 0.5%. Crude oil prices continued to rise, climbing 0.7% on the day.

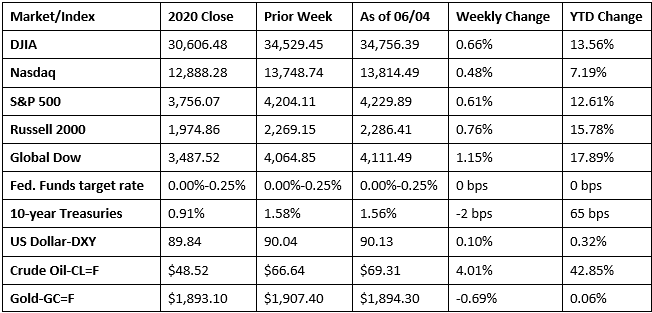

Last week ended with each of the benchmark indexes listed here scoring gains, led by the Global Dow, followed by the Russell 2000, the Dow, the S&P 500, and the Nasdaq. Favorable jobs data may have offset concerns of rising inflation for investors. Also of importance were reports that President Biden would accept a 15% floor on corporate taxes rather than raising the tax rate from 21% to 28%. The President also offered a $1 trillion infrastructure plan, down from $1.7 trillion originally proposed. Among the market sectors, energy again led the way, up 6.7% for the week, while consumer discretionary shares and health care fell. Crude oil prices have increased nearly 43.0% year to date.

The national average retail price for regular gasoline was $3.027 per gallon on May 31, $0.007 per gallon more than the prior week’s price and $1.053 higher than a year ago. U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ended May 28, which was 358,000 barrels per day more than the previous week’s average. Refineries operated at 88.7% of their operable capacity last week. Gasoline production decreased last week, averaging 9.6 million barrels per day, down from the prior week’s average of 9.7 million barrels per day.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The employment data for May was very encouraging. There were 559,000 new jobs added in May, the unemployment rate declined 0.3 percentage point to 5.8%, and the number of unemployed persons fell by 496,000 to 9.3 million. These measures are down considerably from their recent highs in April 2020 but remain well above their levels prior to the COVID-19 pandemic (3.5% and 5.7 million, respectively, in February 2020). Notable job gains occurred in leisure and hospitality, in public and private education, and in health care and social assistance. The number of those who permanently lost their jobs decreased by 295,000 to 3.2 million in May but is 1.9 million higher than in February 2020. The labor force participation rate dipped 0.1 percentage point to 61.6%, and the employment-population ratio rose by 0.1 percentage point to 58.0%. In May, 16.6% of employed persons teleworked because of the pandemic, down from 18.3% in the prior month. In May, 7.9 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic, down from 9.4 million in the previous month. Average hourly earnings increased by $0.15 to $30.33 in May, following an increase of $0.21 in April. Average hourly earnings are up 2.0% since May 2020. In May, the average workweek was 34.9 hours for the third month in a row.

- Purchasing managers were bullish on the state of manufacturing in May. The IHS Markit U.S. Manufacturing Purchasing Managers’ Index™ posted 62.1 in May, up from 60.5 in April — a new record high. Stronger client demand and a commensurate increase in new orders pushed output higher in May. Also, strong demand and supply constraints drove supplier prices higher, leading to the sharpest rise in cost burdens since July 2008. The rise in cost was passed on to customers, with the rate of charge inflation quickening to a record high.

- According to the latest report from IHS Markit, the services sector experienced its fastest rise since October 2009. The record expansion in output was driven by an increase in new business, particularly in new export orders. Employment in the services sector also expanded, although firms reported having difficulties filling vacancies. Input costs increased, prompting service providers to pass on their higher costs to clients, with the pace of inflation quickening at the steepest rate since the survey began.

- For the week ended May 29, there were 385,000 new claims for unemployment insurance, a decrease of 20,000 from the previous week’s level, which was revised down by 1,000. This is the lowest level for initial claims since March 14, 2020, when it was 256,000. According to the Department of Labor, the advance rate for insured unemployment claims was 2.7% for the week ended May 22, an increase of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended May 22 was 3,771,000, an increase of 169,000 from the prior week’s level, which was revised down by 40,000. For comparison, during the same period last year, there were 1,605,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 13.3%. During the last week of February 2020 (pre-pandemic), there were 219,000 initial claims for unemployment insurance, and the number of those receiving unemployment insurance benefits was 1,724,000. States and territories with the highest insured unemployment rates in the week ended May 15 were in Nevada (5.5%), Rhode Island (4.6%), Puerto Rico (4.5%), Connecticut (4.3%), Alaska (4.2%), New York (3.8%), Pennsylvania (3.8%), Illinois (3.6%), California (3.5%), and the District of Columbia (3.5%). The largest increases in initial claims for the week ended May 22 were in Delaware (+2,187), Illinois (+1,688), Pennsylvania (+1,347), California (+773), and Rhode Island (+644), while the largest decreases were in Washington (-8,020), New Jersey (-5,290), Florida (-4,679), Ohio (-3,844), and Michigan (-2,605).

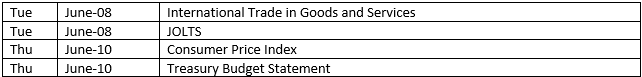

Eye on the Week Ahead

An important inflation indicator, the Consumer Price Index for May, is available this week. Consumer prices rose 0.8% in April and are up 4.2% since April 2020. Information provided in this report is very important for investors and will likely be a market mover following its release.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.