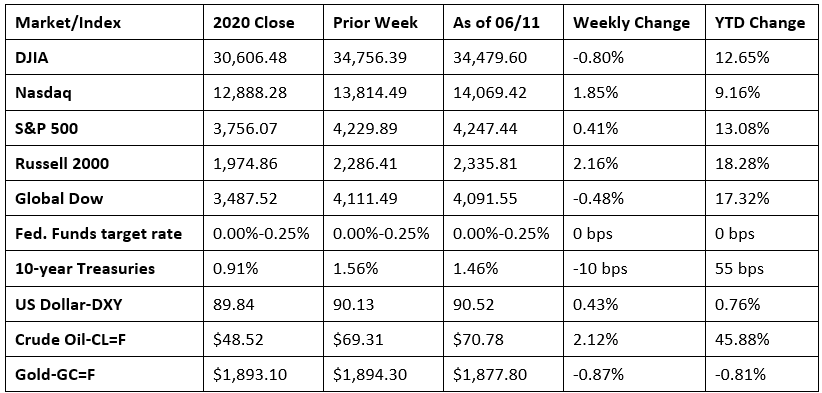

Stocks were mixed last Monday, with the Russell 2000 (1.4%) and the Nasdaq (0.5%) gaining, while the Dow fell 0.4% and the S&P 500 and the Global Dow closed the day essentially unchanged. Treasury yields, crude oil prices, and the dollar fell. Communication services, health care, and real estate advanced, while materials, industrials, and financials dipped lower.

Gains by cyclicals, energy, real estate, and meme stocks helped propel the Russell 2000 (1.1%) and the Nasdaq (0.3%) higher last Tuesday. The Dow, the Global Dow, and the S&P 500 were little changed for the second consecutive session. Treasury yields fell, while the dollar advanced. Crude oil prices climbed 1.4%, driving prices to over $70.00 per barrel — the highest price this year.

Last Wednesday saw stocks post gains early in the day, only to dip by the close of trading. Bond prices rose, pulling yields lower. The 10-year Treasury yield closed below 1.50% for the first time since the beginning of March. The dollar declined, while crude oil prices were little changed. Each of the benchmark indexes listed here lost value, with the Russell 2000 dropping nearly 0.75%, while the large caps of the Dow and the S&P 500 declined 0.4%. Among the market sectors, health care and utilities outperformed, while financials and industrials each fell nearly 1.0%.

Stocks closed last Thursday higher, with the S&P 500 reaching a record closing high. Investors apparently looked beyond another increase in consumer prices (the Consumer Price Index rose 0.6% in May), instead betting that the Federal Reserve will maintain its accommodative policies. Tech shares and megacaps advanced, helping to push the Nasdaq up 0.8%. The S&P 500 rose 0.5%, while the Global Dow and the Dow ticked up 0.1%. The small caps of the Russell 2000 fell 0.7%. Most of the market sectors advanced, led by health care, real estate, information technology, and communication services. Financials, industrials, materials, and energy lost ground. The yield on 10-year Treasuries continued to slip, falling to 1.46%, while crude oil prices rose. The dollar was mixed.

Last Friday saw stocks continue to tick higher following Thursday’s advance. The Russell 2000 reversed course from Thursday to post a solid 1.1% gain on Friday. The Nasdaq gained 0.4%, the S&P 500 edged up 0.2%, and both the Dow and the Global Dow inched up 0.1%. Treasury yields, crude oil prices and the dollar advanced. Financials, information technology, consumer discretionary, and materials led the sectors, while health care and real estate fell.

Stocks closed generally higher last week, with the Russell 2000 and the Nasdaq leading the benchmark indexes, followed by the S&P 500. Both the Dow and the Global Dow lost value. Among the market sectors, health care, real estate, consumer discretionary, utilities, and information technology notched weekly gains, while financials, industrials, and materials lost ground. The dollar rose moderately, Treasury yields dipped, and crude oil prices climbed again and have risen more than 45.0% year to date.

Prices at the pump continue to increase. The national average retail price for regular gasoline was $3.035 per gallon on June 7, $0.008 per gallon more than the prior week’s price and $0.999 higher than a year ago. U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ended June 4, which was 327,000 barrels per day more than the previous week’s average. For the week ended June 4, refineries operated at 91.3% of their operable capacity, up from the prior week’s level of 88.7%. Gasoline production decreased last week, averaging 9.4 million barrels per day, down from the prior week’s average of 9.6 million barrels per day.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Consumer prices rose 0.6% in May after climbing 0.8% in April. Over the last 12 months, the Consumer Price Index increased 5.0% — the largest 12-month increase since a 5.4% increase for the 12 months ended in August 2008. Prices for used cars and trucks continued to rise sharply, increasing 7.3% in May, which accounted for about one-third of last month’s overall CPI increase. Food prices rose 0.4% in May, while energy prices were essentially unchanged. Core prices less food and energy rose 0.7% in May and 3.8% over the last 12 months, which is the largest 12-month increase since the comparable period ended in June 1992. Over the last 12 months, energy prices have risen 28.5%, of which gasoline prices have risen 56.2%. Used car and truck prices have increased 29.7% since May 2020, while food prices are up 2.2% over the same period. This data will likely stoke the debate over whether inflationary pressures are temporary or long-lasting. On the one hand, the Federal Reserve has maintained that the rise in prices is due to transitory factors resulting from a broader reopening of the economy. Conversely, recent data showing labor shortages during a time of business reopenings may bolster concerns that rising inflation could have some staying power, which could lead to earlier-than-expected fiscal tightening by the Fed.

- The international trade in goods and services deficit was $68.9 billion in April, down $6.1 billion, or 8.2%, from the March deficit. April exports were $205.0 billion, $2.3 billion, or 1.1%, more than March exports. April imports were $273.9 billion, $3.8 billion, or 1.4%, less than March imports. Year to date, the goods and services deficit increased $94.5 billion, or 50.5%, from the same period in 2020. Exports increased $42.0 billion, or 5.6%. Imports increased $136.4 billion, or 14.6%.

- In April, there were 9.3 million job openings and the rate of job openings climbed to 6.0% — all-time highs since the Job Openings and Labor Turnover report began in December 2000. Job openings increased in accommodation and food services and in manufacturing. In April, the number of hires was little changed from the prior month, while the number of total separations increased by 324,000. Over the 12 months ended in April, hires totaled 75.4 million and separations totaled 64.0 million, yielding a net employment gain of 11.3 million.

- The federal budget deficit decreased for the third consecutive month in May. At $132.0 billion, the deficit was $93.6 billion less than the April deficit and 67% smaller than the May 2020 deficit. In May, government receipts increased 5.6% to $463.7 billion, while government expenditures decreased 11.6% to $595.7 billion. Through the first eight months of the fiscal year, the government deficit sits at $2.064 trillion, 9.8% higher than the deficit over the same period of the last fiscal year.

- The number of new claims for unemployment insurance benefits fell for the sixth consecutive time last week. For the week ended June 5, there were 376,000 new claims for unemployment insurance, a decrease of 9,000 from the previous week’s level. This is the lowest level for initial claims since March 14, 2020, when it was 256,000. According to the Department of Labor, the advance rate for insured unemployment claims was 2.5% for the week ended May 29, a decrease of 0.2 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended May 29 was 3,499,000, a decrease of 258,000 from the prior week’s level, which was revised down by 14,000. This is the lowest level for insured unemployment since March 21, 2020, when it was 3,094,000. For comparison, during the same period last year, there were 1,537,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 13.2%. During the last week of February 2020 (pre-pandemic), there were 219,000 initial claims for unemployment insurance, and the number of those receiving unemployment insurance benefits was 1,724,000. States and territories with the highest insured unemployment rates in the week ended May 22 were in Nevada (4.8%), Rhode Island (4.5%), Connecticut (4.2%), Puerto Rico (4.1%), California (4.0%), Alaska (3.9%), Pennsylvania (3.9%), New York (3.7%), Illinois (3.6%), and the District of Columbia (3.3%). The largest increases in initial claims for the week ended May 29 were in Pennsylvania (+7,064), Illinois (+4,298), Kentucky (+3,454), Missouri (+2,744), and Michigan (+1,664), while the largest decreases were in Texas (-3,114), Oregon (-1,822), Virginia (-1,753), Florida (-1,625), and Washington (-1,577).

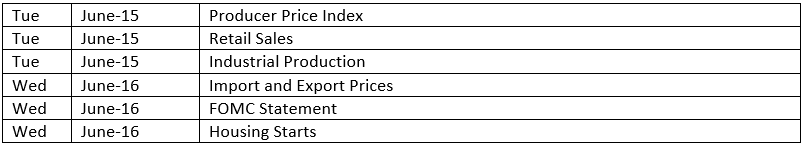

Eye on the Week Ahead

Several market-moving economic reports are out this week. Inflation is the focus with the Producer Price Index and prices for imports and exports. The Federal Reserve’s industrial production report for May is also available. Manufacturing has been picking up steam with the easing of pandemic-related restrictions. Investors seem to be waiting to see if the Group of Seven (G-7) agree to impose levies on big firms to help participating countries collect more taxes. Also, investors will be watching for signs from the Federal Open Market Committee, which meets this week, that fiscal stimulus will remain in place, despite rising inflationary pressures.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.