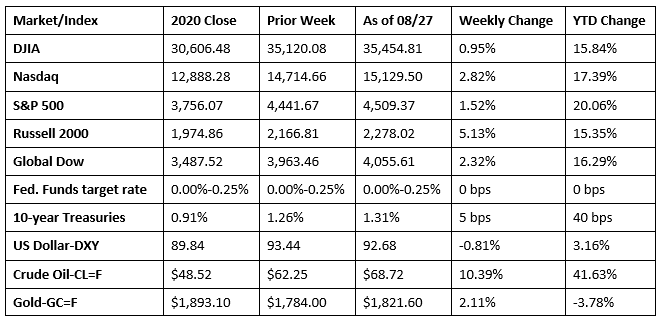

The S&P 500 and the Nasdaq recorded multiple record highs last week. Each of the benchmark indexes listed here posted solid gains, led by the small caps of the Russell 2000, which climbed more than 5.0%. Following the conclusion of the Federal Reserve’s much-anticipated Jackson Hole symposium, Fed Chair Jerome Powell reiterated the message that tapering bond purchases would likely begin this year, while interest rates would remain in place for some time. The market sectors generally advanced, with energy climbing 7.4% and financials adding 3.5%. Ten-year Treasury yields rose 5 basis points to 1.31%. Crude oil prices rebounded from the prior week’s dip, rising over 10.0% to $68.72 per barrel. The dollar slid against a basket of currencies, while gold prices advanced for the second consecutive week.

Wall Street rallied to open the week last Monday, as sentiment was bolstered by the Food and Drug Administration approval of the Pfizer COVID-19 vaccine. The Nasdaq closed at a record high after advancing 1.6%. The Russell 2000 climbed 1.9%, the Global Dow rose 1.2%, the S&P 500 gained 0.9%, and the Dow added 0.6%. Energy led the market sectors as growing demand sent crude oil prices up 5.3% to $65.46 per barrel. Treasury yields and the dollar slipped.

Stocks continued to push higher last Tuesday. The S&P 500 reached its 50th record high this year, while the Nasdaq finished above the 15,000 mark for the first time in its history. The Russell 2000 advanced 1.0%, the Global Dow climbed 0.7%, and the Dow inched ahead 0.1%. The energy sector jumped 1.6% to lead the market sectors. Ten-year Treasury yields closed at 1.29%, up 4 basis points from the previous day’s figure. Crude oil prices rose to $67.70 per barrel, while the dollar dipped lower.

Wall Street closed higher for the third consecutive session last Wednesday as the Nasdaq and the S&P 500 reached fresh records. Once again, the Russell 2000 led the market indexes after gaining 0.5%, followed by the Global Dow, the S&P 500, the Nasdaq, and the Dow. The yield on 10-year Treasuries added 5 basis points to reach 1.34%, crude oil prices rose higher, while the dollar dipped lower. Financials, energy, and industrials led the market sectors, which were otherwise mixed.

Stocks reversed course last Thursday with the S&P 500 ending a streak of five straight sessions of gains. Concerns about the attacks in Afghanistan may have prompted the market sell-off. In addition, investors awaited the start of the Federal Reserve’s Jackson Hole symposium, with the expectation that it might shed more light on the time line for the Fed’s tapering of the pandemic-related asset purchase program. The Russell 2000, which had been soaring, lost 1.1%, followed by the Nasdaq, the S&P 500, and the Global Dow, which lost 0.6%. The Dow slipped 0.5%. Treasury yields were unchanged from the day before, crude oil prices fell, while the dollar gained. Each of the market sectors fell, with energy declining 1.5%.

Equities closed higher last Friday with the S&P 500 and the Nasdaq reaching record highs. Treasury yields and the dollar fell, while crude oil prices advanced. Several of the market sectors posted gains, led by energy (2.6%) and communication services (1.6%).

The national average retail price for regular gasoline was $3.145 per gallon on August 23, $0.029 per gallon less than the prior week’s price but $0.963 higher than a year ago. Gasoline production increased during the week ended August 20, averaging 10.2 million barrels per day. U.S. crude oil refinery inputs averaged 16.1 million barrels per day during the week ended August 20; this was 193,000 barrels per day less than the previous week’s average. For the week ended August 20, refineries operated at 92.4% of their operable capacity, up from the prior week’s level of 92.2%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The economy expanded at an annualized rate of 6.6% in the second quarter, according to the second estimate of gross domestic product. GDP increased 6.3% in the first quarter. Consumer spending, as measured by personal consumption expenditures, increased 11.9% to drive much of the overall GDP growth. Fixed investment rose 3.4% and exports increased 6.6%. Imports, which are a negative in the calculation of GDP, increased 6.7%. Consumer prices (a measure of inflation) climbed 6.5%, while prices less food and energy advanced 6.1%. Profits of domestic financial corporations increased $53.7 billion in the second quarter, compared with an increase of $1.3 billion in the first quarter.

- Personal income and disposable (after-tax) personal income rose 1.1% in July. Consumer spending increased 0.3% last month after climbing 1.1% in June. The personal consumption expenditures price index, a measure of inflation favored by the Federal Reserve, rose 0.4% in July after increasing 0.5% in June. Excluding food and energy, prices climbed 0.3% in July following a 0.5% jump in June. Prices for consumer goods and services have risen 4.2% since July 2020.

- Sales of existing homes rose 2.0% in July. Sales increased 1.5% from a year ago. Inventory of available houses for sale jumped 7.3% last month, helping to drive sales higher. Unsold inventory sits at a 2.6-month supply at the present sales pace, up slightly from the 2.5-month figure recorded in June but down from 3.1 months in July 2020. The median existing-home price in July was $359,900, down from the June price of $363,300 but above the July 2020 price of $305,600. Sales of existing single-family homes increased 2.7% in July, although they are down 0.8% from July 2020. The median existing single-family home price was $367,000 in July, down from the June price of $370,600.

- Sales of new single-family homes increased 1.0% in July after falling in each of the previous three months. The median price for new single-family homes in July was $390,500 ($370,200 in June). The average sales price was $446,000 ($429,600 in June). While new home sales advanced last month, they were 27.2% below the July 2020 pace. The estimate for new houses for sale at the end of July was 367,000, which represents a supply of 6.2 months at the current sales pace.

- According to the latest report from the Census Bureau, new orders for durable goods slid 0.1% in July after increasing 0.8% the previous month. Transportation equipment drove the decrease, down 2.2% following two consecutive monthly increases. Excluding transportation, new orders increased 0.7%. Contributing to the decrease in transportation equipment was a 48.9% decrease in new orders for nondefense aircraft and parts. In July, shipments of durable goods rose 2.2%, unfilled orders increased 0.3%, and inventories advanced 0.6%.

- The advance report on international trade in goods revealed the trade deficit was $86.4 billion in July, down $5.7 billion, or 6.2%, from the June figure. Exports of goods for July were $147.6 billion, $2.2 billion, or 1.5%, more than June exports. Imports of goods for July were $233.9 billion, $3.4 billion, or 1.4%, less than June imports.

- For the week ended August 21, there were 353,000 new claims for unemployment insurance, an increase of 4,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended August 14 was 2.1%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended August 14 was 2,862,000, a decrease of 3,000 from the prior week’s level, which was revised up by 45,000. This is the lowest level for insured unemployment since March 14, 2020, when it was 1,770,000. For comparison, during the same period last year, there were 872,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 9.5%. During the last week of February 2020 (pre-pandemic), there were 219,000 initial claims for unemployment insurance, and the number of those receiving unemployment insurance benefits was 1,724,000. States and territories with the highest insured unemployment rates for the week ended August 7 were Puerto Rico (4.9%), Illinois (3.7%), New Jersey (3.7%), California (3.4%), the District of Columbia (3.2%), New York (3.1%), Connecticut (3.1%), Rhode Island (3.0%), Nevada (2.7%), and the Virgin Islands (2.7%). States and territories with the largest increases in initial claims for the week ended August 14 were Virginia (+6,367), New Mexico (+2,872), the District of Columbia (+757), Georgia (+374), and Nevada (+288), while the largest decreases were in Texas (-7,667), Illinois (-3,023), Kentucky (-2,236), Michigan (-2,026), and Massachusetts (-1,146).

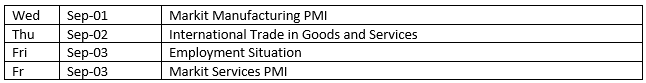

Eye on the Week Ahead

The July employment figures are out this week. Nearly 1.0 million new jobs were added in June, while the unemployment rate fell to 5.4%. July’s figures are not expected to be quite as robust but should be favorable nonetheless.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.