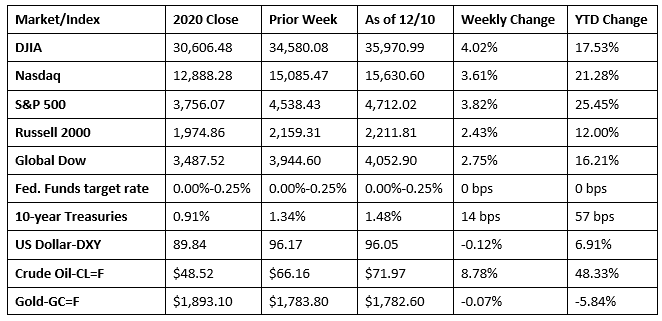

Stocks closed last week higher for the first time in three weeks. The S&P 500 enjoyed its best weekly gain since February. Fears over the effects of the Omicron variant on economic growth seemed to subside somewhat as each of the benchmark indexes recorded notable gains. Information technology drove much of the rally, advancing 6.0% last week. Markets also seemed to react to favorable economic news. Weekly unemployment claims were the lowest since 1969, while the number of new jobs available rose to 11.0 million. Inflation rose again, but in line with expectations, reinforcing the premise that the Federal Reserve will accelerate the tapering of its bond purchases. The Dow posted the largest weekly gain, followed by the S&P 500, the Nasdaq, the Global Dow, and the Russell 2000. Treasury yields and crude oil prices advanced, while the dollar and gold prices dipped.

Investors turned more bullish last Monday following a stretch of volatility sparked by concerns over the spread of the Omicron variant. Each of the benchmark indexes listed here posted gains, led by the Russell 2000 (2.1%), followed by the Dow (1.9%), the Global Dow (1.3%), the S&P 500 (1.2%), and the Nasdaq (0.9%). Yields on 10-year Treasuries jumped 678 basis points to 1.43%. Crude oil prices climbed to $69.95 per barrel, while the dollar was mixed.

Last Tuesday, Wall Street staged the biggest rally since March on hopes that the Omicron variant won’t weaken the economy. Tech stocks, which had been floundering, led the charge, pushing the Nasdaq up 3.0%, followed by the Russell 2000 (2.3%), the S&P 500 (2.1%), the Global Dow (1.6%), and the Dow (1.4%). Each of the market sectors advanced, led by information technology, consumer discretionary, and energy. Ten-year Treasury yields climbed to 1.48%. Crude oil prices rose to $71.54 per barrel. The dollar was unchanged.

Stocks continued to push higher last Wednesday as the S&P 500 and the Nasdaq inched toward record highs. The small caps of the Russell 2000 led the indexes, gaining 0.8%, ahead of the Nasdaq (0.6%), the S&P 500 (0.3%), the Global Dow (0.3%), and the Dow (0.1%). Yields on 10-year Treasuries rose again, reaching 1.5% at the close of trading. The dollar fell, while crude oil prices advanced for the third consecutive day, hitting $72.62 per barrel. Among the market sectors, communication services (0.8%) and health care (0.7%) climbed higher, while financials (-0.5%) and consumer staples (-0.4%) fell.

The three-day stock market rally ended last Thursday as losses in consumer discretionary, information technology, and real estate led the market lower. The volatile Russell 2000 dropped the furthest, down 2.3%, followed by the Nasdaq (-1.7%), the S&P 500 (-0.7%), and the Global Dow (-0.4). The Dow was little changed. Bond prices rose, pulling yields lower. Crude oil prices fell to $70.49 per barrel. The dollar inched higher. Among the market sectors, only health care and consumer staples posted gains.

Equities closed out the week on a high note last Friday. Several of the benchmark indexes listed here posted solid gains, led by the S&P 500 (1.0%), followed by the Nasdaq (0.7%), the Dow (0.6%), and the Global Dow (0.3%). The Russell 2000 dipped 0.4%. Ten-year Treasury yields inched higher, while crude oil prices rose 1.5% to $71.97 per barrel. The dollar slipped lower. Many market sectors rose, with information technology, consumer staples, and energy leading the way.

The national average retail price for regular gasoline was $3.341 per gallon on December 6, $0.039 per gallon less than the prior week’s price but $1.185 higher than a year ago. Gasoline production decreased during the week ended December 3, averaging 9.6 million barrels per day. U.S. crude oil refinery inputs averaged 15.8 million barrels per day during the week ended December 3 — 153,000 barrels per day more than the previous week’s average. Refineries operated at 89.8% of their operable capacity, up from the prior week’s level of 88.8%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Inflationary pressures are showing no signs of moderating following the latest Consumer Price Index report. Prices rose 0.8% in November after advancing 0.9% in October. Over the last 12 months, the CPI has risen 6.8%, the largest 12-month increase since the period ended June 1982. The November price hike was the result of broad increases in most component indexes, similar to the previous month. The indexes for gasoline (6.1%), shelter (0.5%), food (0.7%), used cars and trucks (2.5%), and new vehicles (1.1%) were among the larger contributors. The energy index rose 3.5% in November. The fuel oil index increased 3.5%. Within the food index, the index for food at home rose 0.8%. The apparel index climbed 1.3%.

- The international trade in goods and services deficit was $67.1 billion in October, down $14.3 billion, or 17.6%, from $81.4 billion in September. October exports were $223.6 billion, $16.8 billion, or 8.1%, more than September exports. October imports were $290.7 billion, $2.5 billion, or 0.9%, more than September imports. Year to date, the goods and services deficit increased $161.7 billion, or 29.7%, from the same period in 2020. Exports increased $315.1 billion, or 17.9%. Imports increased $476.8 billion, or 20.7%. Of particular note in October relative to the trade in goods (excluding services), the deficit with China decreased $3.2 billion to $28.3 billion; the deficit with the European Union decreased $2.1 billion to $16.6 billion; the deficit with Mexico increased $0.8 billion to $9.7 billion. On the other hand, the October figures show trade in goods surpluses, in billions of dollars, with South and Central America ($4.5), Hong Kong ($2.6), Brazil ($1.3), the United Kingdom ($1.0), and Singapore ($0.5).

- November, the second month of fiscal year 2022, saw the budget deficit grow to $191.3 billion. The October deficit was $165.1 billion. In November, government receipts were little changed at $281.2 billion. Government outlays increased by $23.5 billion to $472.5 billion in November. For the first two months of the fiscal year, the government deficit sits at $356.4 billion, $73.0 billion less than the same period in the previous fiscal year.

- The number of job openings increased in October, according to the latest Job Openings and Labor Turnover Summary. Job openings increased to 11.0 million (+431,000) and the job openings rate inched up 0.2 percentage point to 6.9%. Job openings increased in several industries with the largest increases in accommodation and food services (+254,000); nondurable goods manufacturing (+45,000); and educational services (+42,000). Job openings decreased in state and local government, excluding education (-115,000). The number of hires, at 6.5 million, was little changed from September. Total separations edged down to 5.9 million (-255,000). Within separations, the number of quits decreased 205,000 to 4.2 million, while the number of layoffs and discharges was little changed at 1.4 million. Over the 12 months ended in October, hires totaled 73.8 million and separations totaled 68.1 million, yielding a net employment gain of 5.7 million.

- For the week ended December 4, there were 184,000 new claims for unemployment insurance, a decrease of 43,000 from the previous week’s level, which was revised up by 5,000. This is the lowest level for initial claims since September 6, 1969, when it was 182,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended November 27 was 1.5%, an increase of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended November 27 was 1,992,000, an increase of 38,000 from the prior week’s level, which was revised down by 2,000. For comparison, last year at this time there were 853,000 initial claims for unemployment insurance, and the rate for unemployment claims was 4.0%. During the last week of February 2020 (pre-pandemic), there were 219,000 initial claims for unemployment insurance, and the number of those receiving unemployment insurance benefits was 1,724,000. States and territories with the highest insured unemployment rates for the week ended November 20 were Alaska (2.9%), the District of Columbia (2.8%), New Jersey (2.3%), Puerto Rico (2.3%), California (2.1%), Hawaii (1.8%), Minnesota (1.8%), Nevada (1.8%), Illinois (1.7%), and Massachusetts (1.7%). The largest increases in initial claims for the week ended November 27 were in North Carolina (+2,461), Wisconsin (+1,081), Ohio (+300), Connecticut (+251), and Idaho (+249), while the largest decreases were in Virginia (-6,548), California (-5,613), Texas (-5,447), Michigan (-2,640), and New Jersey (-2,371).

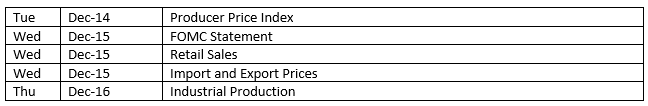

Eye on the Week Ahead

The Federal Open Market Committee meets this week. Based on “hawkish” statements from Fed Chair Jerome Powell and other members, it is likely the Committee will further accelerate the tapering of its asset purchases. It is also possible that the timetable for raising interest rates could be moved up to mid-2022.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.