The Trust Company of Kansas (TCK) today announced that Angela Malley has been named Chief Investment Officer (CIO), effective January 1.

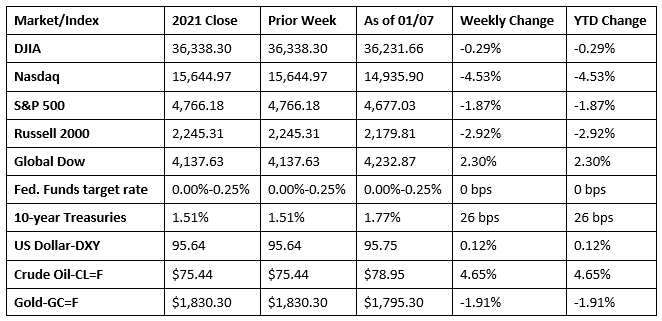

After beginning the week on a high note, stocks couldn’t maintain that momentum, ending the week in the red. Following a record close on Monday, the S&P 500 ended the week down 1.9%, the worst start to a year since 2016. Some investors may be concerned that the Federal Reserve will raise interest rates faster than had been anticipated. The Nasdaq fell 4.5%, its worst week since February 2021. Treasury yields continued to mount in anticipation of higher interest rates. While the December employment report showed a slightly underwhelming 199,000 new jobs added, the unemployment rate fell to a pandemic-era low of 3.9%, possibly adding further fodder for the Fed to continue its hawkish bent.

Wall Street kicked off the start of 2022 in fine fashion, recording record highs last Monday. The Nasdaq and the Russell 2000 climbed 1.2%. The large caps of the Dow (0.7%) and the S&P 500 (0.6%) advanced, while the Global Dow added 0.6%. Bond prices dipped, possibly in anticipation of rising interest rates, sending 10-year Treasury yields up to 1.62%. Crude oil prices rose $76.07 per barrel, while the dollar gained 0.7%. Energy (3.1%) and consumer discretionary (2.8%) led the market sectors, while materials, real estate, and health care fell. The risk rally sent gold prices down nearly 1.5% to $1,801.90 per ounce.

Stocks were mixed last Tuesday, with the Dow reaching its second record high in 2022, while a tech rout pulled the Nasdaq down 1.3%. The Russell 2000 and the Global Dow each gained more than 1.0% on the day, while the S&P 500 was little changed. Ten-year Treasury yields jumped to 1.66%, crude oil prices rose for the second consecutive day to close at $77.00 per barrel, while the dollar stalemated. Energy, financials, and industrials climbed higher, while information technology and health care trended lower.

Equities fell last Wednesday following the release of the minutes from the Federal Reserve meeting, raising the prospect for multiple interest-rate hikes beginning in the near term. The Nasdaq and the Russell 2000 each dropped 3.3%. The S&P 500 fell 1.9%. The Dow dipped 1.1%. Ten-year Treasury yields continued to rise, closing at 1.7% as bond prices fell. Crude oil prices rose marginally to close at $77.19 per barrel. The dollar was little changed. Each of the market sectors lost value, with the biggest declines hitting information technology, real estate, communication services, and consumer discretionary.

Stocks continued to trend lower last Thursday, with only the Russell 2000 advancing by the close of trading. The Dow fell 0.5% and the Global Dow dipped 0.4%. The Nasdaq and the S&P 500 were flat. Ten-year Treasury yields rose again, climbing to 1.73%. Crude oil prices were approaching $80.00 per barrel, while the dollar was unchanged. Energy and financials advanced, while health care and materials declined.

Equities couldn’t reverse course last Friday, closing the day in the red. The Russell 2000 fell 1.1%, followed by the Nasdaq (-1.0%), and the S&P 500 (-0.4%). The Dow was flat, while the Global Dow gained 0.7%. The dollar and crude oil prices fell, while 10-year Treasury yields continued to climb higher, jumping 3.8 basis points. Among the market sectors, energy, financials, and utilities advanced, while information technology and consumer discretionary fell more than 1.0%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- December saw 199,000 new jobs added, and the unemployment rate fell 0.3 percentage point to 3.9%. The total number of unemployed persons declined by 483,000 to 6.3 million. For comparison, in February 2020, the unemployment rate was 3.5% and there were 5.7 million unemployed persons. Employment has increased by 18.8 million since April 2020 but is down by 3.6 million, or 2.3%, from its pre-pandemic level in February 2020. In December, the number of workers who permanently lost jobs dipped by 202,000 to 1.8 million. The labor force participation rate was unchanged at 61.9% in December but remains 1.5 percentage point lower than in February 2020. The employment-population ratio increased by 0.2 percentage point to 59.5% in December but is 1.7 percentage point below its February 2020 level. In December, there were 5.7 million people not in the labor force who wanted a job. This total fell by 1.6 million over the year, but is 717,000 higher than in February 2020. In December, the share of employed persons who teleworked because of the coronavirus was 11.1%, little changed from November. In December, 3.1 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic. This level is down from 3.6 million in November. In December, average hourly earnings increased by $0.19 to $31.31. Over the past 12 months, average hourly earnings have increased by 4.7%. The average work week in December was unchanged at 34.7 hours.

- According to the latest report from IHS Markit, the U.S. Purchasing Managers’ Index for December dipped to 57.7, down from 58.3 in November. Since a reading above 50 indicates growth in the manufacturing sector, survey respondents noted growth in December, but at a slower pace than in November. With the exception of October and November, the pace of output growth in December was the slowest since October 2020 as material shortages and supplier delays continued to drag production lower. On the plus side, supply-chain bottlenecks eased as did client demand.

- The services sector enjoyed a strong December, posting an IHS Markit U.S. Services PMI Business Activity Index of 57.6. While the rise in services activity was the slowest in the past three months, the decrease was marginal and was supported by a sharp increase in new business, as the rise in new orders was the fastest in the last five months. Although firms sought to increase their workforces to tackle strong growth in backlogs of work, labor shortages and challenges retaining staff hampered progress. Meanwhile, soaring wage bills and greater supplier prices led to the steepest increase in cost burdens on record.

- According to the latest Job Openings and Labor Turnover Summary, November saw the number and rate of job openings decrease to 10.6 million (-529,000) and 6.6%, respectively. Job openings declined in several industries, with the largest decreases in accommodation and food services (-261,000), construction (-110,000), and nondurable goods manufacturing (-66,000). Job openings increased in finance and insurance (+83,000) and in federal government (+25,000). Over the 12 months ended in November 2021, hires totaled 74.5 million and separations totaled 68.7 million, yielding a net employment gain of 5.9 million. While the number of hires was little changed in November from the previous month, the number of total separations increased by 382,000 to 6.3 million. The number of workers who quit their respective jobs increased in November to a series high of 4.5 million, while the quits rate jumped to 3.0%.

- The latest data shows that the goods and services trade deficit for November was $80.2 billion, up $13.0 billion from October. November exports were $224.2 billion, $0.4 billion more than October exports. November imports were $304.4 billion, $13.4 billion more than October imports. Year to date, the goods and services deficit increased $174.6 billion, or 28.6%, from the same period in 2020. Exports increased $354.4 billion, or 18.2%. Imports increased $529.0 billion, or 20.7%.

- The national average retail price for regular gasoline was $3.281 per gallon on January 3, $0.006 per gallon more than the prior week’s price and $1.032 higher than a year ago. Gasoline production decreased during the week ended December 31, averaging 8.5 million barrels per day. U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ended December 31 — 163,000 barrels per day more than the previous week’s average. Refineries operated at 89.8% of their operable capacity.

- Not unexpectedly, claims for unemployment insurance rose during the holiday period of Christmas through New Year’s Day. For the week ended January 1, there were 207,000 new claims for unemployment insurance, an increase of 7,000 from the previous week’s level, which was revised up by 2,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended December 25 was 1.3%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended December 25 was 1,754,000, an increase of 36,000 from the prior week’s level, which was revised up by 2,000. Unemployment insurance claims are in line with pre-pandemic totals. During the last week of February 2020 (pre-pandemic), there were 219,000 initial claims for unemployment insurance, and the number of those receiving unemployment insurance benefits was 1,724,000. States and territories with the highest insured unemployment rates for the week ended December 18, 2021 were Alaska (3.1%), the Virgin Islands (2.6%), New Jersey (2.3%), California (2.2%), Minnesota (2.2%), Puerto Rico (2.0%), Illinois (1.9%), Massachusetts (1.9%), New York (1.8%), and Rhode Island (1.8%). The largest increases in initial claims for the week ended December 25 were in New Jersey (+4,660), Pennsylvania (+3,320), Ohio (+2,615), Michigan (+2,440), and New York (+2,287), while the largest decreases were in California (-7,320), Texas (-3,955), Virginia (-2,183), Alabama (-1,293), and Wisconsin (-1,181).

Eye on the Week Ahead

Inflation data for December is available this week with the release of the Consumer Price Index and the Producer Price Index. The CPI rose 6.8% through November, while the PPI vaulted 9.6%. Neither index is projected to decrease based on December’s figures.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.