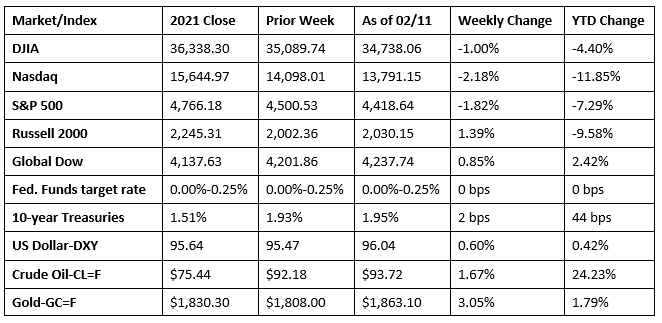

The major benchmark indexes closed last week lower. Rising tensions over the Russia-Ukraine situation coupled with rising inflation made investors a bit skittish towards stocks. A higher-than-expected jump in the Consumer Price Index added to jitters over an accelerated tightening of the Federal Reserve’s monetary policy. The Nasdaq, the S&P 500, and the Dow lost value last week, while the Russell 2000 and the Global Dow advanced. As of late Friday afternoon, concerns increased that Russia could invade Ukraine “any day now.” An invasion would likely spur sanctions against Russia’s exports of oil and gas, causing supply to decrease and prices to rise. Crude oil prices rose nearly 1.7% last week following Friday’s 4.0% jump in the price per barrel. Ten-year Treasury yields were volatile last week, reaching 2.0%, only to drop back down to 1.95% by the end of the week. Gold prices rose for the second consecutive week. Meanwhile, fourth-quarter earnings data continued to be mainly positive, with 78% of the S&P 500 companies exceeding earnings estimates.

Last Monday saw Wall Street end lower as stocks gave back gains from earlier in the day. The Nasdaq fell 0.6%, while declines in communication services and information technology dragged the S&P 500 (-0.4%) lower. The Dow was flat, while the small caps of the Russell 2000 and the Global Dow each advanced 0.5%. Crude oil prices extended a streak of six consecutive session advances after climbing 1.83% to $91.92 per barrel. Gold prices also continued to advance, while the dollar and 10-year Treasury yields declined.

Stocks rose last Tuesday, even as bond yields approached their highest levels since November 2019. Ten-year Treasuries jumped 4 basis points to close at 1.95%. Information technology, financials, industrials, and materials each increased by at least 1.0%, helping to push up the benchmark indexes listed here. The Russell 2000 gained for the second consecutive session after advancing 1.6%. The Nasdaq rose 1.3%. The Dow climbed 1.1%. The S&P 500 climbed 0.8% and the Global Dow added 0.7%. Crude oil prices declined, falling to $89.78 per barrel. The dollar inched higher.

Tech shares led a broad-based stock market rally last Wednesday. Megacaps helped drive the Nasdaq up 2.1% while the S&P 500 advanced 1.5% as both indexes posted their biggest daily gains this month. The Russell 2000 continued its upward trend after adding 1.9% last Wednesday. The Global Dow gained 1.0%. Ten-year Treasury yields retreated from the prior day’s advance, closing at 1.92%. The dollar was flat, while crude oil prices rose about $0.19 to $89.97 per barrel.

Each of the benchmark indexes listed here lost ground last Thursday on the heels of the largest annual increase in the Consumer Price Index (7.5%) since February 1982. The noteworthy jump in price inflation adds to the likelihood that the Federal Reserve will be more aggressive in pushing the federal funds rate higher beginning in March. The Nasdaq fell 2.1%, the S&P 500 lost 1.8%, the Russell 2000 slid 1.6%, the Dow dropped 1.5%, and the Global Dow dipped 0.6%. Ten-year Treasury yields jumped 11 basis points to 2.03%. Crude oil prices climbed to $90.02 per barrel. The dollar also advanced.

Stocks closed sharply lower last Friday amid rising Russia-Ukraine tensions. Information technology slumped over 3.0% on the day, pulling the Nasdaq down 2.8%. Energy climbed higher, although the remaining market sectors slid lower. The S&P 500 fell 1.9%. The Dow dropped 1.4%, while both the Russell 2000 and the Global Dow slipped 1.0%. Ten-year Treasury yields continued to bounce up and down, falling to 1.95%. Crude oil prices reached $93.72 per barrel. The dollar advanced.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Consumer Price Index rose 0.6% in January from the previous month and is up 7.5% year over year. Price increases were wide spread last month. In January, increases in prices for food, electricity, and shelter were the largest contributors to the CPI increase. Food prices rose 0.9% in January following a 0.5% increase in December. Energy prices also increased 0.9% over the month, with an increase in prices for electricity being partially offset by declines in gasoline prices. Also of note were price gains in household furnishings and operations, used cars and trucks, medical care, and apparel. Core prices, less food and energy, also rose 0.6% in January and are up 6.0% over the past 12 months, the largest 12-month increase since the period ended in August 1982.

- The Treasury budget for January posted a surplus of $118.7 billion, the first monthly surplus since September 2019. The January 2021 budget ran at a deficit of $162.8 billion. Compared to January 2021, budget expenditures for January 2022 were down 37.0%, while government receipts were up 21.0%. Through the first four months of the fiscal year, the budget deficit is $259.0 billion, 65.0% lower than the deficit over the same four months of the previous fiscal year, as government expenditures fell 8.0% while receipts rose 28.0%. Over the first four months of this fiscal year compared to the same period for fiscal 2021, individual income tax receipts are up 43.0% and corporate tax receipts increased 32.0%.

- The goods and services trade deficit was $80.7 billion in December 2021, $1.4 billion, or 1.8%, above the November deficit. In December, exports rose 1.5% and imports increased 1.6%. For 2021, the goods and services deficit increased $182.4 billion, or 27.0%, from 2020. Exports increased $394.1 billion, or 18.5%. Imports increased $576.5 billion, or 20.5%. Of particular note in December, the U.S. trade deficit with China increased by $6.0 billion, the trade deficit with South Korea increased by $1.4 billion, while the trade deficit with the European Union decreased $3.0 billion.

- The national average retail price for regular gasoline was $3.444 per gallon on February 7, $0.076 per gallon more than the prior week’s price and $0.983 higher than a year ago. The Midwest price increased more than $0.10 to $3.29 per gallon, the Gulf Coast price increased more than $0.09 to $3.12 per gallon, the East Coast price increased nearly $0.08 to $3.39 per gallon, and the West Coast price increased more than $0.02 to $4.18 per gallon. The Rocky Mountain price remained unchanged at $3.33 per gallon. As of February 7, 2022, residential heating oil prices averaged nearly $3.89 per gallon, $0.11 per gallon above the prior week’s price and nearly $1.22 per gallon higher than last year’s price at this time. Residential propane prices averaged nearly $2.83 per gallon, almost $0.045 per gallon above last week’s price and more than $0.60 per gallon above last year’s price.

- Weekly claims for unemployment insurance benefits continue to decline. For the week ended February 5, there were 223,000 new claims for unemployment insurance, a decrease of 16,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended January 29 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended January 29 was 1,621,000, unchanged from the previous week’s level, which was revised down by 7,000. States and territories with the highest insured unemployment rates for the week ended January 22 were Alaska (2.9%), California (2.7%), Illinois (2.5%), Minnesota (2.5%), New Jersey (2.5%), Rhode Island (2.5%), the Virgin Islands (2.5%), New York (2.4%), Massachusetts (2.3%), and Puerto Rico (2.1%). The largest increases in initial claims for the week ended January 29 were in Pennsylvania (+2,735), Georgia (+1,551), Michigan (+1,238), Indiana (+939), and Texas (+785), while the largest decreases were in Ohio (-4,847), California (-2,595), Kentucky (-2,318), Utah (-1,870), and Alabama (-1,343).

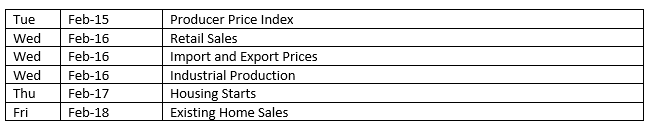

Eye on the Week Ahead

Inflation and housing information take the stage this week. Inflationary indicators available this week include the latest Producer Price Index, import and export prices, and the retail sales report. Producer prices slowed in December, increasing only 0.2%. However, since December 2020, producer prices rose nearly 10.0%. Both import and export prices have also been on the rise. For the 12 months ended in December 2021, import prices climbed 10.4% and export prices advanced 14.7%. Sales at the retail level actually receded in November and December 2021. However, retail sales increased 19.3% in 2021. The housing sector has been a mixed bag of late, with existing home sales falling 4.6% in December, while new home sales rose. That trend is likely to continue as December saw building permits (+9.1%) and housing starts (+1.4%) increase, which should increase the inventory of new homes for sale.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.