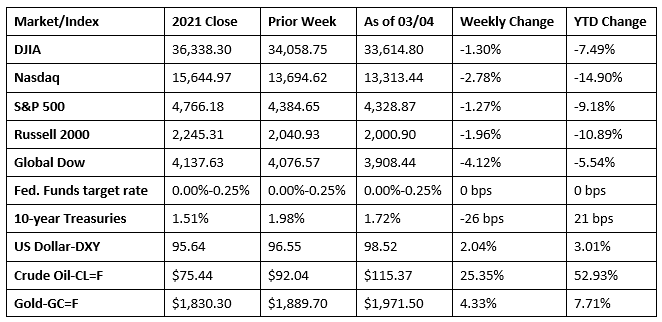

Wall Street was hit hard last week as traders moved from stocks to bonds and gold. Each of the benchmark indexes listed here lost value, with the Global Dow dropping more than 4.0% and the Nasdaq declining nearly 3.0%. The Russian escalation of the war in Ukraine eclipsed strong economic data at home, including a solid jobs report. The crisis in Ukraine has boosted commodities, particularly crude oil prices, which rose more than 25.0% last week. Federal Reserve Chairman Jerome Powell said he would support a 25-basis point interest rate increase in March as inflation has continued to soar.

Stocks closed mixed last Monday as investors considered more sanctions against Russia, which responded by putting its nuclear forces on high alert. The large caps of the Dow and the S&P 500 fell 0.5% and 0.2%, respectively, while the Nasdaq (0.4%) and the Russell 2000 (0.4%) added value. The Global Dow dipped 0.6%. Ten-year Treasury yields fell 15 basis points to 1.83%. The dollar inched higher, while domestic crude oil prices jumped nearly 5.0%, reaching $95.91 per barrel. Gold prices also rose, climbing to $1,910.50 per ounce. The Russian central bank raised interest rates to 20.0% as the ruble plunged following additional sanctions imposed by Western countries. The United States, the European Union, the United Kingdom, and Canada pledged to exclude certain large Russian banks from the SWIFT interbank messaging network. Talks between representatives of Russia and Ukraine ended with no deal on a potential cease-fire as the conflict intensified throughout the day.

Domestic crude oil prices vaulted past $105.00 per barrel last Tuesday, sending domestic and global stocks tumbling. Ten-year Treasury yields slid to 1.70%, marking their worst four-day drop since last December. Investors could view surging oil prices, rising inflation, and the intensifying Russia-Ukraine crisis as threats to economic growth. That, coupled with the prospect of higher interest rates, may be moving investors away from stocks. By the close of trading last Tuesday, each of the benchmark indexes listed here declined, with the Global Dow (-2.0%) and the Russell 2000 (-1.9%) falling the furthest, followed by the Dow (-1.8%), the Nasdaq (-1.6%), and the S&P 500 (-1.5%). The dollar and gold prices traded higher. Among the market sectors, financials and materials were hit the hardest, while energy rose 1.0%.

Crude oil prices, Treasury yields, and stocks climbed higher last Wednesday. The Russell 2000 jumped 2.5%, the S&P 500 rose 1.9%, the Dow gained 1.8%, and the Nasdaq added 1.6%. The Global Dow increased 1.0%. Ten-year Treasury yields advanced nearly 16 basis points to 1.87%. Domestic crude oil prices climbed nearly 8.0% to $111.51 per barrel, while the dollar and gold prices retreated. Commodity markets around the globe rose to multi-year highs last Wednesday. In addition to rising oil prices, aluminum jumped to an all-time high and wheat climbed to its highest price since 2008.

Last Thursday, stocks erased most of the gains from the previous day. A decline in tech shares dragged down the equity market, with the Nasdaq falling 1.6% and the Russell 2000 dropping 1.3%. Ten-year Treasury yields slid to 1.84%. The dollar and gold advanced, while crude oil prices retreated to $108.36 per barrel. With prices increasing at the fastest rate since 1982, Federal Reserve Chairman Jerome Powell told the Senate Banking Committee that the central bank should have cut stimulus sooner in an attempt to slow burgeoning inflation.

Despite a strong labor report (see below), stocks continued to slide last Friday. The Russell 2000 and the Global Dow dropped nearly 2.0%, the Nasdaq fell 1.7%, the S&P 500 lost 0.8%, and the Dow slipped 0.5%. Crude oil prices jumped nearly $8.00 to $115.37 per barrel. The dollar and gold prices rose, while 10-year Treasury yields fell 12 basis points to 1.72%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Employment rose by 678,000 in February, according to the latest information from the Bureau of Labor Statistics. While new jobs continue to be added on a monthly basis, total employment remains 2.1 million, or 1.4%, below its pre-pandemic level in February 2020. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, health care, and construction. In February, the unemployment rate edged down 0.2 percentage point to 3.8%, and the total number of unemployed dipped by 243,000 to 6.3 million. The labor force participation rate ticked up 0.1 percentage point to 62.3%, and the employment-population ratio rose 0.2 percentage point to 59.9%. The number of those who permanently lost jobs fell marginally to 1.6 million. The number of persons not in the labor force who currently want a job declined by 349,000 to 5.4 million. In February, 13.0% of employed persons teleworked because of the coronavirus pandemic, down from 15.4% in the prior month. In February, 4.2 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic, down from 6.0 million in the previous month. Average hourly earnings in February were $31.58, up $0.01 from January’s figure. Since February 2021, average hourly earnings have increased 5.1%. The average work week rose by 0.1 hour to 34.7 hours in February.

- The international trade in goods deficit widened in January as exports of goods dipped 1.8%, while imports increased 1.7%. The deficit for January was $107.6 billion, up $7.2 billion, or 7.1%, from the December deficit. Exports fell $2.8 billion from December, while imports increased $4.4 billion. Exports of consumer goods slipped $2.7 billion in January, accounting for most of the decrease in overall exports.

- According to the latest PMI™ data from IHS Markit, in February the manufacturing sector registered a stronger improvement in operating conditions amid signs of easing supply-chain disruptions and a sharp expansion in new orders. Stronger new sales growth spurred manufacturers to increase staffing numbers and boost stocks of products. Although input costs increased at the slowest pace in nine months, selling prices rose at the sharpest rate since last November.

- Business activity across the services sector rose sharply in February, according to the latest IHS Markit US Services PMI Business Activity survey. Sales grew at the fastest rate in the last seven months, aided by an increase in foreign client demand. To keep pace, businesses increased their workforce numbers at the fastest pace since May 2021. Inflationary pressures continued to increase, as a marked rise in input costs prompted firms to hike their selling prices at the fastest rate on record.

- The national average retail price for regular gasoline was $3.608 per gallon on February 28, $0.078 per gallon more than the prior week’s price and $0.897 higher than a year ago. The East Coast price increased $0.06 to $3.56 per gallon; the Gulf Coast price rose $0.07 to $3.31 per gallon; the Midwest price increased $0.11 to $3.47 per gallon; the West Coast price increased $0.08 to $4.31 per gallon; and the Rocky Mountain price increased $0.03 to $3.37 per gallon. As of February 28, residential heating oil prices averaged $4.04 per gallon, more than $0.09 per gallon above the prior week’s price and almost $1.19 per gallon higher than last year’s price at this time. Residential propane prices averaged nearly $2.90 per gallon, up $0.05 per gallon above last week’s price and $0.39 per gallon above last year’s price.

- For the week ended February 26, there were 215,000 new claims for unemployment insurance, a decrease of 18,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended February 19 was 1.1%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended February 19 was 1,476,000, an increase of 2,000 from the previous week’s level, which was revised down by 2,000. States and territories with the highest insured unemployment rates for the week ended February 12 were California (2.6%), Alaska (2.6%), New Jersey (2.5%), Rhode Island (2.4%), Massachusetts (2.3%), Minnesota (2.3%), New York (2.2%), Illinois (2.1%), Connecticut (2.0%), Montana (1.9%), and Pennsylvania (1.9%). The largest increases in initial claims for the week ended February 19 were in Michigan (+3,500), Kansas (+724), Utah (+454), Connecticut (+349), and the District of Columbia (+239), while the largest decreases were in Missouri (-6,949), New York (-3,037), Ohio (-2,212), California (-2,182), and Tennessee (-1,959).

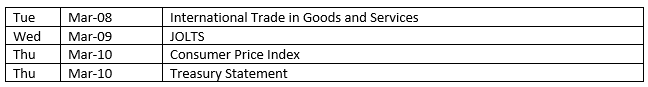

Eye on the Week Ahead

The economic impact of the Eastern European conflict will continue to be felt here and globally. Not only are traders paying close attention to the economic outlook resulting from the war, but they must also keep an eye on the upcoming Federal Reserve meeting, particularly in light of the latest developments in Ukraine.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.