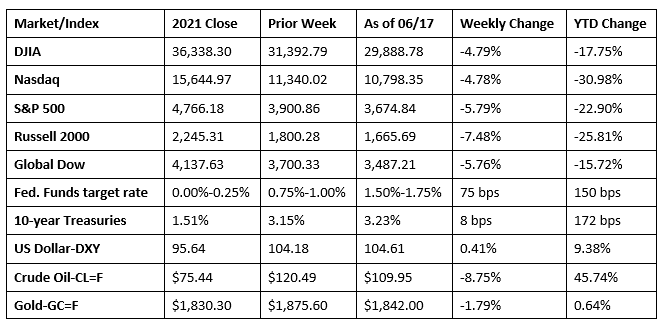

Last week was marked by volatility. Stocks experienced brief rallies throughout the week, but not enough to overcome corresponding troughs that ultimately dragged the major benchmark indexes lower. The Federal Reserve’s intent to bring inflation down to 2.0% through tighter monetary policy has investors concerned about the impact on the economy in general and corporate valuations in particular. That is partially reflected in the stock market, as the S&P 500 is firmly in bear territory, down more than 20.0% from its all-time high. Despite a late Friday rally, stocks ended last week down. The Russell 2000 dropped nearly 7.5% for the week and is down 25.81% for the year. The Nasdaq gave back 5.80%, followed by the Global Dow, the Dow, and the S&P 500. Crude oil prices fell over $10.00 to end the week at roughly $109.95 per barrel. The dollar inched higher, while gold prices slid.

Last Monday saw a wave of sell-offs for stocks with each of the benchmark indexes listed here falling notably. The Russell 2000 and the Nasdaq lost 4.8% and 4.7%, respectively. The S&P 500 dropped 3.9%, the Global Dow slid 3.2%, and the Dow declined 2.8%. Ten-year Treasury yields jumped 21 basis points to reach 3.36%. Investors may have lost confidence that inflation had peaked following the somewhat unexpected jump in the latest Consumer Price Index. The move from stocks could be in anticipation of more aggressive interest-rate hikes from the Federal Reserve that could push the economy into a recession. Crude oil prices inched higher. The dollar advanced, while gold prices slid lower.

Stocks closed generally lower last Tuesday, with only the Nasdaq eking out a 0.2% gain, likely the result of dip buyers seeking some low-hanging fruit. The S&P 500 declined 0.4%, falling for the fifth consecutive session, its longest slide since January. The Dow dipped 0.5%, the Russell 2000 declined 0.4%, and the Global Dow dropped 0.8%. Yields on 10-year Treasuries rose over 11 basis points to close at 3.48%. Crude oil prices fell $2.50 to $118.41 per barrel. The dollar climbed for the second consecutive day. Gold prices lost nearly $23.00, falling to $1,809.20 per ounce.

Despite a larger-than-expected interest-rate hike from the Federal Reserve, stocks rallied last Wednesday, ending a five-day tailspin. The Nasdaq led the indexes, climbing 2.5%, followed by the S&P 500 (1.5%) and the Russell 2000 (1.4%). The Dow and the Global Dow advanced 1.0%. Ten-year Treasury yields fell 8.8 basis points to close at 3.39%. Crude oil prices rose to $116.02 per barrel. The dollar dipped lower, while gold prices jumped more than $17.00 to $1,836.80 per ounce.

Stocks finished last Thursday sharply lower, giving back gains from the previous session and dragging the Dow below 30,000 for the first time since early in 2021. Investors are likely eying a prolonged period of global monetary tightening as the Bank of England and the Swiss National Bank followed the Federal Reserve with rate hikes. The Nasdaq dropped over 4.0%, while the Russell 2000 fell 4.7%. The Dow (-2.4%), the S&P 500 (-3.3%), and the Global Dow (-1.7%) also slid lower. Each of the S&P 500 market sectors ended the day in the red, with energy declining 5.6%, consumer discretionary decreasing 4.8%, and information technology losing 4.1%. Yields on 10-year Treasuries ended the day at 3.30% after falling 8.8 basis points. Crude oil prices rose $1.70 to $117.03 per barrel. The dollar fell for the second consecutive session, while gold prices advanced for the second straight day.

Last Friday saw the Nasdaq, the S&P 500, and the Russell 2000 post gains, while the Dow and the Global Dow slid lower. Ten-year Treasury yields dipped to 3.23% after declining 6.8 basis points. Crude oil prices dropped to around $109.95 per barrel. The dollar rose, while gold prices fell.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Federal Open Market Committee hiked the target range for the federal funds rate 75 basis points to 1.50%-1.75%. The increase is more than the anticipated 50-basis-point advance and is the biggest rate hike since November 1994. The Committee chose a more aggressive path after noting that inflation remained elevated due to supply-and-demand imbalances related to the pandemic, higher energy prices, and broader price pressures. The invasion of Ukraine by Russia created additional upward pressure on inflation and has weighed on global economic activity. Further, COVID-related lockdowns in China are likely to exacerbate supply-chain disruptions. In addition to ongoing increases in the target range, the Committee will continue reducing its holdings of Treasury securities, agency debt, and agency mortgage-backed securities. Following last week’s meeting, Federal Reserve Chair Jerome Powell indicated that a 50-to-75 basis-point rate increase is likely in July, when the Committee meets next.

- Prices at the producer level increased 0.8% in May, following advances of 0.4% in April and 1.6% in March. Producer prices increased 10.8% for the 12 months ended in May. Last month, prices for goods advanced 1.4%, while prices for services rose 0.4%. Prices less foods, energy, and trade services moved up 0.5% in May after increasing 0.4% in April. For the 12 months ended in May, the index less foods, energy, and trade services rose 6.8%. Driving the May increase in prices for goods was a 5.0% increase in energy prices, of which prices for gasoline advanced 8.4%. Energy prices are up 45.3% since May 2021. Over half of the increase in prices for services was attributable to a 2.9% increase in prices for transportation and warehousing services.

- In May, retail and food services sales fell 0.3% from the previous month, but are 8.1% above sales in May 2021. Retail trade sales also declined, dropping 0.4% for the month, but are up 6.9% over the 12 months ended in May. Gasoline station sales were up 4.0% in May and 43.2% from May 2021, while sales for food services and drinking places were up 0.7% last month and 17.5% from last year. Food and beverage store sales rose 1.2% in May and 7.9% over May 2021. The data for May seems to indicate that consumers are scaling back on discretionary spending, possibly evidenced by declining sales for motor vehicle and parts dealers (-3.5%), furniture and home furnishing stores (-0.9%), and electronics and appliance stores (-1.3%). Online retail sales also dipped 1.0% in May.

- U.S. import prices rose 0.6% in May and 11.7% for the 12 months ended in May. Import fuel prices rose 7.5% last months and 73.5% since May 2021, the largest 12-month increase since advancing 87.0% in November 2021. Nonfuel imports actually declined 0.3% in May, the first monthly decrease since decreasing 0.2% in November 2020. Exports increased 2.8%. Higher prices for both nonagricultural and agricultural exports contributed to the U.S. export price rise in May. Exports has risen 18.9% since May 2021, the largest annual increase since the index was first published in September 1984.

- New home construction slowed in May. The number of issued building permits fell 7.0% from the prior month and is only 0.2% above the total for May 2021. The number of housing starts in May was 14.4% lower than the April estimate and 3.5% below the May 2021 rate. Housing completions increased 9.1% in May and are up 9.3% from a year earlier. For single-family construction in May, issued building permits fell 5.5%, housing starts were down 9.2%, while completions rose 2.8%.

- Total industrial production inched higher in May, advancing 0.2% from the previous month. Industrial production has increased in every month of the year so far, with an average monthly gain of nearly 0.8%. Total industrial production in May was 5.8% above its year-earlier level. In May, manufacturing output declined 0.1%, following three months when growth averaged nearly 1%. The indexes for utilities and mining rose 1.0% and 1.3%, respectively.

- The national average retail price for regular gasoline was $5.006 per gallon on June 13, $0.130 per gallon above the prior week’s price and $1.937 higher than a year ago. Also as of June 13, the East Coast price increased $0.13 to $4.85 per gallon; the Gulf Coast price rose $0.08 to $4.63 per gallon; the Midwest price climbed $0.16 to $4.97 per gallon; the West Coast price increased $0.12 to $5.87 per gallon; and the Rocky Mountain price increased $0.21 to $4.92 per gallon. Residential heating oil prices averaged $4.37 per gallon on June 10, about $0.09 per gallon more than the prior week’s price. According to the U.S. Energy Information Administration, U.S. exports of crude oil and petroleum products reached a record of 9.8 million barrels per day during the week of May 27. In addition to high exports, movements from the Gulf Coast to the East Coast via pipeline, tanker, and barge are near historic high annual levels for both motor gasoline and distillate. Despite this supply, low product inventories in the Northeast are likely to continue, driven by a confluence of factors, including transportation constraints, increasing demand, and low regional refinery production.

- For the week ended June 11, there were 229,000 new claims for unemployment insurance, a decrease of 3,000 from the previous week’s level, which was revised up by 3,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended June 4 was 0.9%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended June 4 was 1,312,000, an increase of 3,000 from the previous week’s level, which was revised up by 3,000. States and territories with the highest insured unemployment rates for the week ended May 28 were California (1.8%), New Jersey (1.8%), Alaska (1.5%), New York (1.4%), Pennsylvania (1.3%), Puerto Rico (1.3%), Massachusetts (1.2%), Rhode Island (1.2%), Georgia (1.1%), Hawaii (1.1%), Illinois (1.1%), and Oregon (1.1%). The largest increases in initial claims for the week ended June 4 were in Florida (+2,098), Georgia (+2,060), Pennsylvania (+1,134), Missouri (+1,053), and Illinois (+827), while the largest decreases were in Michigan (-2,131), Mississippi (-1,723), New York (-631), Oklahoma (-598), and New Jersey (-440).

Eye on the Week Ahead

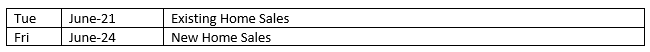

The real estate sector is front and center this week with the release of the latest data on sales of both new and existing homes. The housing market slowed notably in April and if the latest data on housing starts is any indication, May will not show much improvement.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.