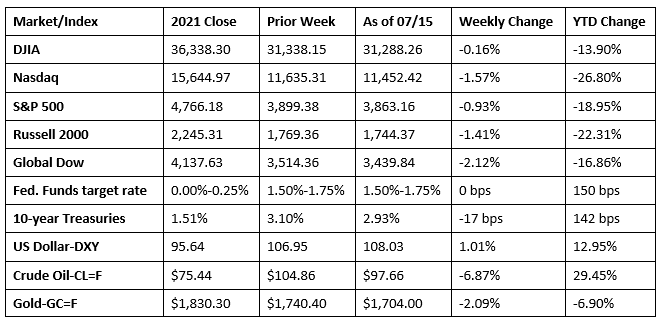

Despite a late-week rally, stocks ended last week lower. A strong retail sales report for June showed continued economic strength, even in the face of rising inflation and concerns over an economic recession. Investors still aren’t totally sold on risk, however. Each of the benchmark indexes listed here ended last week lower, led by the Global Dow, which fell more than 2.0%. Year to date, the Nasdaq is nearing a 30.0% downturn from its value at the end of 2021. Crude oil prices fell by nearly $7.00 to end the week below $100 per barrel. The dollar continued to rise, while gold prices faltered. Fed rate hikes and fears of a recession have sent the dollar to the highest level since March 2020.

Monday saw stocks slump, as trading volume was at its lowest pace in 2022. Tech shares led the sell-off, pulling the Nasdaq down 2.3%. The Russell 2000 also dipped a little more than 2.00%, followed by the Global Dow and the S&P 500, which slid 1.2%. The Dow lost 0.5%. Ten-year Treasury yields tumbled 11.0 basis points to close at 2.99%. Crude oil prices dropped $1.20 to sit at $103.50 per barrel. The dollar advanced, while gold prices declined. Traders may have pulled back from stocks as they awaited inflation data with the release of the June Consumer Price Index on Wednesday.

Stocks tumbled lower for the second consecutive day last Tuesday. Once again, the Nasdaq led the downturn, giving back 1.0%, followed by the S&P 500 (-0.9%), the Dow (-0.6%), the Global Dow (-0.4%), and the Russell 2000 (-0.2%). The yield on 10-year Treasuries dipped lower last Tuesday and is about 12.0 basis points below the two-year rate. This so-called “inversion curve” is often a sign of a contracting economy. Crude oil prices fell $8.40 to hit $95.68 per barrel. The dollar rose against a basket of currencies, while gold prices lagged.

Wall Street saw equities slide last Wednesday as investors retreated from risk following a greater-than-expected jump in the latest Consumer Price Index. Both the Dow and the Global Dow fell 0.7%, while the S&P 500 dropped 0.5%. The Nasdaq dipped 0.2%, while the Russell 2000 broke even on the day. Ten-year Treasury yields fell 5.4 basis points, settling at 2.90%, while the two-year rate rose to 3.14%, deepening the “inversion” of the yield curve. Crude oil prices and the dollar were relatively unchanged, while gold prices reversed course, gaining $6.30 to reach $1,731.10 per ounce.

Last Thursday, traders spent most of the day retreating from stocks, worried that recent inflation data would prompt a 100-basis point rate hike at the end of the month. However, Wall Street recovered somewhat after Federal Reserve officials seemed to quel those concerns. Nevertheless, the Global Dow (-1.6%), the Russell 2000 (-1.1%), the Dow (-0.5%), and the S&P 500 (-0.3%) still ended the day in the red. The Nasdaq ended the day flat. Crude oil prices and the dollar advanced marginally, while gold prices slid lower. The yield on 10-year Treasuries climbed to 2.96%, up 5.6 basis points. Two-year Treasury yields dipped lower, but not enough to make a dent in the inverted yield curve. Disappointing quarterly results from some major financial firms pulled the financial sector lower and added to the concern that an economic downturn is coming.

Stocks rallied last Friday to end a topsy-turvy week of trading. It’s possible that some investors were buoyed by a solid retail sales report, while other traders may have been taking advantage of some possible low-hanging bargains. In any case, each of the benchmark indexes listed here posted solid gains, led by the Russell 2000 and the Dow, which advanced 2.2%. The S&P 500 climbed 1.9%, the Nasdaq added 1.8%, and the Global Dow gained 1.7%. Long-term bond prices advanced, dragging the yield on 10-year Treasuries down marginally to 2.93%. Crude oil prices rose to $97.66 per barrel. The dollar and gold prices dipped lower.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Consumer Price Index rose 1.3% in June and is up 9.1% over the past 12 months. This is the largest 12-month increase in the CPI since 1981. Both the monthly and 12-month rates were greater than expected and will almost certainly prompt the Federal Reserve to raise interest rates by at least 75.0 basis points following its next meeting at the end of July. The June increase was broad-based, with gasoline, shelter, and food being the largest contributors. The energy index rose 7.5% and contributed nearly half of the overall increase, with the gasoline index rising 11.2%. The food index rose 1.0% in June, while the shelter index increased 0.6%. Since June 2021, the food index has risen 10.4%, the energy index has advanced 41.6% (gasoline is up 59.9% and fuel oil has risen 98.5%), and prices for shelter have increased 5.6%.

- Producer prices climbed higher in June. The Producer Price Index advanced 1.1% last month after increasing 0.9% in May. Over the past 12 months, the PPI has risen 11.3%, the largest increase since a record 11.6% increase in March 2022. In June, prices for goods rose 2.4%, while prices for services increased 0.4%. A 10.0% increase in energy prices accounted for 90% of the increase in prices for goods. Prices for goods less foods and energy advanced 0.5%. Gasoline prices jumped 18.5% in June, while prices for foods ticked up 0.1%.

- Sales of food services and retail items rose 1.0% in June over the previous month. Retail and food services sales are up 8.4% since June 2021. In many cases, the increase in June retail sales is attributable to higher prices and not necessarily greater demand. Excluding gasoline sales, retail sales rose 0.7% in June. Sales from gasoline stations increased 3.6% in June and were up 49.1% from June 2021, while food services and drinking places sales advanced 1.0% last month and 13.4% from last year. On the other hand, department store sales dropped 2.6% in June, while clothing and clothing accessories sales dipped 0.4%. Retail trade sales were up 1.0% from May and have increased 7.7% over the last 12 months.

- Prices for imports rose 0.2% in June over May. Export prices rose 0.7% last month. Import prices have risen 10.7% over the last 12 months, while export prices increased 18.2%. Import fuel prices rose 5.7% last month and 73.9% for the year ended in June, which is the largest 12-month increase since November 2021. Excluding fuel, import prices declined for the second consecutive month, decreasing 0.5% in June. The June decline in nonfuel imports was the largest one-month decrease since April 2020. In June, lower prices for nonfuel industrial supplies and materials; consumer goods; and foods, feeds, and beverages more than offset higher capital goods prices. On the other side of the ledger, agricultural export prices dipped 0.3% in June, falling for the first time since September 2021. Nonagricultural export prices increased 0.9% last month and have not decreased since December 2021.

- The monthly Treasury statement for June showed a budget deficit of $88.8 billion, up from May’s $66.2 billion but well below the June 2021 deficit of $174.2 billion. Through the first nine months of the fiscal year, the government budget deficit sits at $515.1 billion, nearly $1.8 billion less than the deficit over the same period in the previous fiscal year. Individual income taxes are up $544.8 billion in the current fiscal year, while corporate income taxes are up $40.9 billion.

- In June, total industrial production fell 0.2% and has not increased since April 2022. Manufacturing output declined 0.5% for the second consecutive month in June. Mining rose 1.7%, although utilities fell 1.4%. Despite the downturn, total industrial production was 4.2% above its level in June 2021. The June decrease in production was widespread, with durable and nondurable consumer good falling 1.0% and 0.7%, respectively. Last month, the appliance, furniture, and carpeting category posted the largest loss among the components of consumer goods (-3.3%), while only home electronics, miscellaneous goods, and clothing recorded gains.

- The national average retail price for regular gasoline was $4.646 per gallon on July 11, $0.125 per gallon below the prior week’s price but $1.513 higher than a year ago. Also as of July 11, the East Coast price decreased $0.119 to $4.472 per gallon; the Gulf Coast price fell $0.161 to $4.190 per gallon; the Midwest price dropped $0.130 to $4.599 per gallon; the West Coast price slid $0.123 to $5.571 per gallon; and the Rocky Mountain price fell $0.054 to $4.947 per gallon. Residential heating oil prices averaged $3.673 per gallon on July 8, about $0.266 per gallon less than the prior week’s price. According to the U.S. Energy Information Administration report of July 13, gasoline production decreased, averaging 5.1 million barrels per day. Refineries operated at 94.9% of their capacity. 53 U.S. exploration and production (E&P) companies reported higher revenue in the first quarter of 2022, passing some of those profits on to shareholders in the form of dividends. In addition, as crude oil prices and returns on investment rise, the valuation of these companies has increased to just below the previous five-year high.

- For the week ended July 9, there were 244,000 new claims for unemployment insurance, an increase of 9,000 from the previous week’s level. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended July 2 was 0.9%, a decrease of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended July 2 was 1,331,000, a decrease of 41,000 from the previous week’s level, which was revised down by 3,000. States and territories with the highest insured unemployment rates for the week ended June 25 were New Jersey (2.0%), Puerto Rico (1.9%), California (1.9%), Rhode Island (1.6%), Pennsylvania (1.5%), Massachusetts (1.4%), New York (1.4%), Alaska (1.3%), and Georgia (1.3%). The largest increases in initial claims for the week ended July 2 were in New York (+5,165), Michigan (+5,104), Georgia (+2,935), California (+2,823), and Mississippi (+1,364), while the largest decreases were in Illinois (-1,508), Kentucky (-1,232), Missouri (-1,061), Ohio (-998), and Pennsylvania (-971).

Eye on the Week Ahead

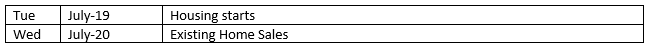

The latest data on the housing market for June is out this week with reports on housing starts and existing home sales. The housing market has definitely slowed in 2022 after setting a torrid pace the previous year. In May, residential building permits and housing starts fell, while sales of existing homes dipped for the fourth consecutive month.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.