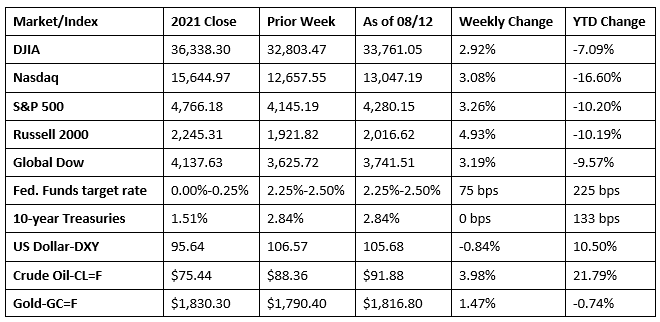

The stock market posted its fourth straight weekly advance, the longest consecutive weekly rally of 2022. Investors turned to stocks on the premise that the Federal Reserve may reduce the pace of its economic tightening campaign after three major indicators showed that inflation subsided in July. With this week’s performance, the S&P 500 has recouped half of its losses from the beginning of the year. The Nasdaq has risen over 20.0% from its low in June. With corporate earnings season about finished, traders are now assessing the direction of the economy. Even if the Fed continues its hawkish push to get inflation down to the 2.0% target, the economy has thus far been resilient, with the labor market continuing to show strength while corporate earnings have been generally positive. Crude oil prices have remained under $100.00 per barrel for three weeks, gold prices have nearly recovered all their losses from the beginning of the year, and consumer sentiment is on the rise. By the end of last week, each of the benchmark indexes listed here climbed by at least 2.9%, led by the Russell 2000, which rose nearly 5.0%. Ten-year Treasury yields broke even, crude oil prices increased nearly 4.0%, gold prices advanced about 1.5%, and the dollar slipped marginally.

Wall Street began last week with mixed returns. Monday saw the Dow (0.1%), the Russell 2000 (1.0%), and the Global Dow (0.6%) post modest gains, while the Nasdaq and the S&P 500 dipped 0.1%. Ten-year Treasury yields slid 7.5 basis points, falling to 2.76%. Crude oil climbed to $90.49 per barrel. The dollar fell, while gold prices surged $13.50 to $1,786.40 per ounce.

Stocks extended their losses last Tuesday ahead of the release of the July Consumer Price Index. The Nasdaq slumped 1.2% after a large computer chip manufacturer warned that its fourth-quarter revenue may not be as robust as forecast. The Russell 2000 fell 1.5%, the S&P 500 dipped 0.4%, the Dow and the Global Dow slid 0.2%. Ten-year Treasury yields increased to 2.79%. Crude oil prices changed minimally. The dollar declined, while gold prices continued to rally, adding another $5.90 to reach $1,811.10 per ounce.

Last Wednesday saw stocks climb and the dollar fall after a slower-than-expected inflation report. Investors may view the latest Consumer Price Index (see below) as supporting the notion that the Federal Reserve will ease its tightening and interest-rate hikes. The Russell 2000 (3.0%) and the Nasdaq (2.9%) led the benchmark indexes listed here, followed by the S&P 500 (2.1%), the Dow (1.6%), and the Global Dow (1.5%). Yields on 10-year Treasuries slipped minimally to 2.78%. The dollar fell over 1.0%. The rally in gold ended with prices falling $5.10 per ounce. Crude oil prices increased $1.06 to hit $91.56 per barrel.

Bond prices slid lower last Thursday, sending yields higher. Ten-year Treasury yields rose 10.2 basis points to reach 2.88%. Stocks ended the day mixed, with the Dow (0.1%), the Russell 2000 (0.3%), and the Global Dow (0.3%) gaining ground, while the Nasdaq (-0.6%) and the S&P 500 (-0.1%) declined as tech shares underperformed. Crude oil prices continued to move higher, closing at $94.14 per barrel. The dollar and gold prices dipped lower.

Stocks closed higher last Friday after another inflation indicator slid lower. Each of the benchmark indexes listed here added value, led by the Russell 2000 and the Nasdaq, which rose 2.1%. The S&P 500 advanced 1.7%, the Dow climbed 1.3%, and the Global Dow gained 0.6%. Crude oil prices ended lower for the first time last week, falling $2.46 to end the day at $91.88 per barrel. Gold prices gained $9.60, climbing to $1,816.80 per ounce. Ten-year Treasury yields slipped 3.9 basis points to 2.84%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Inflation slowed more than expected as the Consumer Price Index was flat in July after increasing 1.3% in June. The CPI is up 8.5% since July 2021, down from 9.1% for the 12-month period ended in June. Gasoline prices fell 7.7% in July, offsetting price increases in food and shelter. Food prices rose 1.1% with food prices at home climbing 1.3%. Prices for shelter increased 0.5% and prices for medical care services rose 0.4%. Prices for new vehicles advanced 0.6%, while prices for used vehicles dropped 0.4%. Prices for apparel dipped 0.1%, and prices for transportation services decreased 0.5%. Prices for medical care commodities increased 0.6%.

- The Producer Price Index for July fell 0.5% after advancing 1.0% in June. For the 12 months ended in July, producer prices are up 9.8%. Last month, prices for goods declined 1.8%, the largest decline since moving down 2.7% in April 2020. The July decrease can be traced to a 9.0% drop in prices for energy. On the other hand, prices for foods increased 1.0%. Prices for services rose 0.1%, the third consecutive monthly increase. Leading the July advance, margins for trade services rose 0.3% (trade indexes measure margins received by wholesalers and retailers).

- Import prices slid 1.4% in July after advancing 0.3% in June. Export prices also declined in July, dropping 3.3% following a 0.7% increase in June. With only the personal consumption expenditures price index left to be released later this month, the other primary inflationary indicators have each shown waning inflationary price pressures in July. As to import prices, the July decline was the first monthly decrease since December 2021 and the largest drop since April 2020. Import prices rose 8.8% over the 12 months ended in July, the smallest year-over-year increase since the index advanced 7.1% for the 12 months ended in March 2021. Fuel import prices fell 7.5% last month. Import prices excluding fuel decreased for the third consecutive month after dipping 0.5% in July. The July decrease in export prices was the largest one-month decline since April 2020. Prices for exports rose 13.1% over the past year, the lowest 12-month advance since the index increased 9.6% for the 12 months ended in March 2021.

- The Treasury deficit for July increased to $211.1 billion, up from the June deficit of $88.8 billion but lower than the $302.1 billion deficit in July 2021. Through the first 10 months of the fiscal year, the deficit sits at $732.5 billion. Over the same period last fiscal year, the deficit was $2.540 trillion.

- The national average retail price for regular gasoline was $4.038 per gallon on August 8, $0.154 per gallon below the prior week’s price but $0.866 higher than a year ago. Also as of August 8, the East Coast price decreased $0.127 to $3.967 per gallon; the Gulf Coast price fell $0.158 to $3.535 per gallon; the Midwest price dropped $0.185 to $3.851 per gallon; the West Coast price slid $0.160 to $4.999 per gallon; and the Rocky Mountain price fell $0.158 to $4.353 per gallon. Residential heating oil prices averaged $3.216 per gallon on August 5, about $0.409 per gallon less than the prior week’s price. According to the U.S. Energy Information Administration, gasoline production increased during the week of August 5, averaging 10.2 million barrels per day. Also, U.S. crude oil imports averaged 6.2 million barrels per day, a decrease of 1.2 million barrels per day from the previous week.

- For the week ended August 6, there were 262,000 new claims for unemployment insurance, an increase of 14,000 from the previous week’s level, which was revised down by 12,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended July 30 was 1.0%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended July 30 was 1,428,000, an increase of 8,000 from the previous week’s level, which was revised up by 4,000. States and territories with the highest insured unemployment rates for the week ended July 23 were Connecticut (2.3%), New Jersey (2.1%), Puerto Rico (2.0%), California (1.9%), Rhode Island (1.8%), Massachusetts (1.7%), New York (1.6%), Pennsylvania (1.5%), Alaska (1.2%), Illinois (1.2%), and Nevada (1.2%). The largest increases in initial claims for the week ended July 30 were in Connecticut (+4,790), Oklahoma (+997), North Carolina (+547), Washington (+372), and Nevada (+177), while the largest decreases were in Massachusetts (-14,256), Kentucky (-2,201), Ohio (-1,640), Michigan (-1,425), and Illinois (-1,033).

Eye on the Week Ahead

Housing data for July is out this week. Rising mortgage rates and overall inflationary pressure have subdued the housing sector. Housing starts for new home construction were down 6.3% from June 2021, with starts for single family homes down 15.7%. Sales of existing homes have fallen, down 14.2% over the last 12 months. The Federal Reserve’s industrial production report for July is also available this week. Overall production fell 0.2% in June, with manufacturing down 0.5%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.