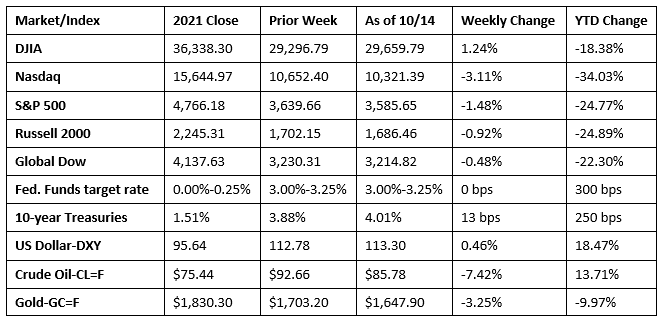

Wall Street closed generally lower last week, with only the Dow able to garner a gain. The latest data showed inflation is stubbornly rising, which could lead to more hawkish rate hikes from the Federal Reserve. While some big financial institutions reported solid third-quarter earnings, a few major banks’ earnings were not so positive. Long-term bond prices slid lower, driving yields higher. The dollar continued to strengthen against a basket of currencies. Crude oil prices dipped lower as falling demand more than offset receding output.

Stocks underperformed for the fourth consecutive session last Monday, kicking off the week on a sour note. The Nasdaq ended the day with its lowest close since July 2020 after falling 1.0%. The S&P 500 slid 0.8%, the Dow dipped 0.3%, the Russell 2000 declined 0.6%, and the Global Dow lost 0.7%. The dollar rose against most other major currencies. Ten-year Treasury yields ended the day where they began, at 3.88%. Crude oil prices fell for the first time in several days, slipping to $90.80 per barrel. Gold lost its momentum from the previous week after falling $33.90 to $1,675.40 per ounce. Investor trepidation was driven by the impact of rising interest rates, the escalation of the Russia/Ukraine war, and restrictions placed on China’s access to U.S. technology, which could slow chip demand worldwide.

Investors fled risk last Tuesday after Bank of England Governor Andrew Bailey reiterated that the central bank’s quantitative easing would end by the end of the week. Tech shares took the brunt of the losses, with the Nasdaq losing 1.1% and the S&P 500 falling 0.7%. The Global Dow dipped 0.8%, while the Russell 2000 and the Dow made minimal gains. Bond prices slid lower, pushing yields up, with 10-year Treasury yields climbing 5.1 basis points to 3.93%. Crude oil prices fell for the second consecutive day, down $2.55 to $88.58 per barrel. The dollar advanced marginally, while gold prices declined.

Equities continued to slide lower last Wednesday. The Global Dow fell 0.5%, followed by the S&P 500, which lost 0.3% to land at its lowest level since November 2020. Stocks rallied earlier in the day but faded by the end of the session. The yield on 10-year Treasuries dipped to 3.90%, the dollar edged higher, while gold prices declined $6.40 to $1,679.60 per ounce.

Stocks surged higher last Thursday despite inflation data that’s bound to support further interest-rate hikes. In what may have been driven by dip buyers and put options, each of the benchmark indexes listed here posted solid gains, led by the Dow (2.8%), followed by the S&P 500 (2.6%), the Russell 2000 (2.4%), the Nasdaq (2.2%), and the Global Dow (2.0%). Ten-year Treasury yields rose 5.0 basis points to 3.95%. Crude oil prices jumped $1.88 to $89.15 per barrel. The dollar and gold prices slid lower.

Last Thursday’s rally was short-lived as stocks dipped lower on Friday to end last week. Mixed third-quarter corporate earnings data from several banks pulled financials lower. Energy stocks also declined on the heels of falling crude oil prices. Overall, each of the benchmark indexes listed here lost value last Friday, with the tech-heavy Nasdaq falling more than 3.0%. The Russell 2000 and the S&P 500 dropped more than 2.3%, while the Dow slid 1.3%. The Global Dow lost 0.6%. As stocks declined, bond yields rose. Ten-year Treasury yields rose 5.8 basis points to hit 4.01%, the first time yields eclipsed 4.0% this year. Crude oil and gold prices fell, while the dollar advanced.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- In what will certainly support further interest-rate hikes by the Federal Reserve, the Consumer Price Index rose 0.4% in September and 8.2% since September 2021. Prices less food and energy increased 0.6% last month. The September CPI was driven by price increases in shelter (0.7%), food (0.8%), and medical care (1.0%). Price hikes also occurred in transportation (1.9%) and new vehicles (0.7%), Gasoline prices slid 4.9%, contributing to a 2.1% decline in overall energy prices.

- In September, the prices producers received for their goods and services rose 0.4%, following decreases of 0.2% in August and 0.4% in July. For the 12 months ended in September, producer prices have risen 8.5%, down from 8.7% for the 12 months ended in August 2022. Prices for both services and goods advanced 0.4% last month. Prices less foods, energy, and trade services also rose 0.4% in September, the largest monthly increase since May 2022.

- While prices for domestic goods and services rose in September, import and export prices fell for the third consecutive month. According to the latest data from the Bureau of Labor Statistics, import prices, reflecting the strength of the dollar, decreased 1.2% in September after declining 1.1% in August. Export prices fell 0.8% last month following a 1.7% drop in August. Since September 2021, import prices have risen 6.0%, while export prices have increased 9.5%. Import fuel prices fell 7.5% for the second month in a row, although import fuel prices have risen 32.3% from September 2021. Nonfuel import prices declined 0.4% in September. A drop in prices for industrial supplies and materials more than offset higher prices for foods, feeds, and beverages. On the export side of the ledger, prices for both agricultural and nonagricultural exports fell in September.

- Retail sales were virtually unchanged in September from August, but have risen 8.2% for the 12 months ended in September. Retail trade sales slipped 0.1% last month, but are up 7.8% since September 2021. Several retailers saw sales decrease in September, including motor vehicle and parts dealers (-0.4%); furniture and home furnishing stores (-0.7%); electronics and appliance stores (-0.8%); building material and garden equipment and supplies dealers (-0.4%); gasoline stations (-1.4%); sporting goods, book stores, and related retailers (-0.7%); and miscellaneous store retailers (-2.5%). Several retailers saw sales increase in September including food and beverage stores (0.4%); health and personal care stores (0.5%); clothing and clothing accessories stores (0.5%); general merchandise stores, including department stores (0.7%); nonstore, or online, retailers (0.5%); and food services and drinking places (0.5%).

- Gasoline prices continued to increase last week. According to the U.S. Energy Administration, the national average retail price for regular gasoline was $3.912 per gallon on October 10, $0.130 per gallon above the prior week’s price and $0.645 higher than a year ago. Also as of October 10, the East Coast price increased $0.143 to $3.479 per gallon; the Gulf Coast price rose $0.213 to $3.294 per gallon; the Midwest price advanced $0.159 to $3.881 per gallon; the West Coast price decreased $0.014 to $5.673 per gallon; and the Rocky Mountain price increased $0.073 to $3.974 per gallon. Residential heating oil prices averaged $5.332 per gallon on October 10, $0627 above the previous week’s price and $2.048 per gallon more than a year ago. Also, EIA reported that households using heating oil as their primary fuel for space heating will spend 27.0% more this winter than last winter due to higher prices for heating oil, increased heating demand, and colder temperatures.

- For the week ended October 8, there were 228,000 new claims for unemployment insurance, an increase of 9,000 from the previous week’s level. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended October 1 was 1.0%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended October 1 was 1,368,000, an increase of 3,000 from the previous week’s level, which was revised up by 4,000. States and territories with the highest insured unemployment rates for the week ended September 24 were Puerto Rico (2.0%), California (1.8%), New Jersey (1.7%), New York (1.4%), Alaska (1.2%), Massachusetts (1.2%), Rhode Island (1.2%), Connecticut (1.1%), and Nevada (1.1%). The largest increases in initial claims for the week ended October 1 were in Puerto Rico (+3,966), Missouri (+3,830), Massachusetts (+2,245), North Carolina (+1,651), and California (+1,253), while the largest decreases were in Florida (-1,203), Ohio (-754), Georgia (-684), Virginia (-343), and New York (-335).

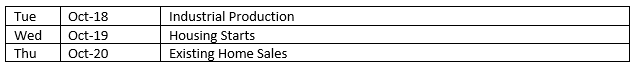

Eye on the Week Ahead

The Federal Reserve’s September report on industrial production is out this week. August saw production slip 0.2%, although manufacturing output inched 0.1% higher. The housing sector is also front and center this week with the release of the September reports on housing starts and existing home sales. Housing starts rose 12.2% in August, due primarily to a rise in construction of multi-unit properties. Building permits slid 10.0%. Sales of existing homes also fell in August, down 0.4% for the month and 19.9% since August 2021.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.