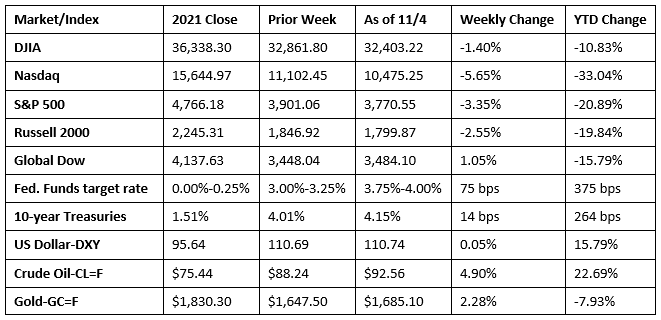

Despite a late-week rally, stocks closed lower last week. Investors continued to try to assess the plethora of mixed data and its impact on the economy. Inflation continued to rise, and the Federal Reserve hiked interest rates up another 75.0 basis points, yet the October job figures were above expectations — the result of which has been market volatility. For example, the S&P 500 has recorded five monthly moves of at least 7.0% either upward or downward. With the release of the consumer price index later this week, more volatility is likely. Nevertheless, each of the benchmark indexes listed here slid lower last week, led by the Nasdaq, which dropped nearly 6.0% as tech shares fell nearly 7.0%. Long-term bond prices also fell, pushing yields higher, with 10-year Treasury yields increasing 14.0 basis points. The dollar ended the week relatively flat, while gold prices advanced for the first time in a month. Crude oil prices finished at their highest price in a month, as the prospects of China’s relaxation of COVID restrictions likely will remove the lid on crude oil prices.

While October proved to be a very good month for stocks, the last day of the month ended on a rather sour note. Investors may have taken advantage of the opportunity to take some profits, as stocks dipped lower last Monday. Each of the benchmark indexes lost value, led by the Nasdaq (-1.0%) and followed by the S&P 500 (-0.8%), with the Dow and the Global Dow sliding -0.4%. The Russell 2000 ended the day flat. Ten-year Treasury yields were unchanged, remaining at 4.07%. Crude oil prices gained $1.08 to close at $87.61 per barrel. The dollar dipped lower, while gold prices advanced.

Stocks ended lower last Tuesday as investors awaited the outcome of last Wednesday’s Federal Open Market Committee meeting. The Russell 2000 (0.3%) and the Global Dow (0.8%) ended the day higher, while the Nasdaq (-0.9%), the S&P 500 (-0.4%), and the Dow (-0.2%) closed lower. Tech shares weighed on equities, while energy stocks performed better. Crude oil prices climbed higher for the second consecutive day, adding $1.76 to reach $88.29 per barrel. Ten-year Treasury yields dipped 2.5 basis points to 4.05%. The dollar was flat, while gold prices advanced for the second consecutive session.

Last Wednesday, investors reacted to the latest rate hike by the Federal Reserve (see below) by moving away from stocks. The Nasdaq and the Russell 2000 lost 3.4%, the S&P 500 slid 2.5%, the Dow dropped 1.6%, and the Global Dow fell 0.9%. The yield on 10-year Treasuries closed relatively flat, remaining at 4.05%. The dollar advanced, gold prices declined, and crude oil prices rose to $89.21 per barrel. Many had hoped that the Fed would slow its aggressive interest-rate hike policy. However, Federal Reserve Chair Jerome Powell remained hawkish in his post-meeting news conference, indicating that we’re a long way from ending rate hikes. Nevertheless, while a pause is not likely, a reduction in the amount of future interest-rate increases is possible.

Wall Street continued to reel last Thursday following the hawkish rhetoric emanating from the Federal Reserve. Short-term bond prices plunged, sending yields soaring, with two-year Treasury yields climbing 19.0 basis points. Stocks also dropped, with tech shares falling the furthest, followed by communication services, heath care, and finance. The Nasdaq fell 1.7%, followed by the S&P 500 (-1.1%), the Global Dow (-1.0%), and the Russell 2000 and the Dow (-0.5%). Ten-year Treasury yields rose 6.5 basis points to 4.12%. The dollar was flat, while gold prices climbed higher. Crude oil prices dipped, closing at $88.04 per barrel.

Stocks halted a four-day slide last Friday as investors tried to gauge the latest data and its impact on whether the Federal Reserve might slow the pace of interest-rate increases. By the close of trading last Friday, the Global Dow soared up 2.4%, followed by the S&P 500 (1.4%), the Nasdaq and the Dow (1.3%), and the Russell 2000 (1.0%). Ten-year Treasury yields added 3.2 basis points to close the week at 4.15%. Crude oil prices jumped about $4.50 to hit $92.63 per barrel. The dollar slid lower, while gold prices added nearly $54.00 per ounce.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- As expected, the Federal Open Market Committee increased the target range for the federal funds rate 75 basis points to 3.75%-4.00%. In support of its decision, the Committee noted that inflation remains elevated due to supply and demand imbalances related to the pandemic, higher food and energy prices, broader price pressures, and the ongoing Russia/Ukraine war. In addition, the Committee indirectly suggested that the economy has thus far weathered the aggressive monetary policies, noting that there has been modest growth in spending and production, while job gains have been robust in recent months. Nevertheless, the FOMC made it clear that it is “strongly committed to returning inflation to its 2.0% objective.” As to the pace of future increases in the target range, “the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

- Employment added 261,000 new jobs in October, according to the latest data from the Bureau of Labor Statistics. This follows an upwardly revised September total of 315,000 (+52,000). Monthly job growth has averaged 407,000 thus far in 2022, compared with 562,000 per month in 2021. In October, notable job gains occurred in health care, professional and technical services, and manufacturing. The unemployment rate rose 0.2 percentage point to 3.7% in October, while the number of unemployed persons rose by 306,000 to 6.1 million. The labor force participation rate, at 62.2%, and the employment-population ratio, at 60.0%, were unchanged in October and have shown little net change since early this year, although these measures are 1.2 percentage point below their February 2020 values prior to the pandemic. In October, average hourly earnings rose by $0.12, or 0.4%, to $32.58. Over the past 12 months, average hourly earnings have increased by 4.7%. In October, the average work week was 34.5 hours for the fifth month in a row. Overall, the relative strength of this latest employment data supports more interest-rate hikes.

- According to the latest purchasing managers’ report from S&P Global, manufacturing slowed in October, with the Purchasing Managers’ Index (PMI™) registering 50.4, down from September’s 52.0. A reading over 50.0 indicates growth, thus manufacturing expanded in October, but at a slower pace than in September. According to respondents, firms experienced a decline in new orders, which were linked to greater buyer hesitancy, leading to the slowest increase in employment in over two years.

- The S&P Global US Services PMI Business Activity Index registered 47.8 in October, down from 49.3 in September. The latest survey of purchasing managers showed business activity in the services sector contracted sharply to begin the fourth quarter. New orders and client demand weakened, largely due to inflation and the strength of the dollar, which dampened foreign demand.

- The latest Job Openings and Labor Turnover Summary for September revealed that the number of job openings increased by 147,000 to 10.7 million, offsetting a sharp decline in August. In September, the largest increases in job openings were in accommodation and food services (+215,000); health care and social assistance (+115,000); and transportation, warehousing, and utilities (+111,000). The number of job openings decreased in wholesale trade (-104,000) and in finance and insurance (-83,000). The number of hires fell by 282,000 to 6.1 million. Total separations, which includes quits, layoffs, and discharges, decreased by 370,000 to 5.7 million.

- The latest data on international trade in goods and services shows that the trade deficit increased 11.6% in September to $73.3 billion. Exports decreased 1.1% in September, while imports increased 1.5%. Year to date, the goods and services deficit increased by $125.6 billion, or 20.2%, from the same period in 2021. Exports increased by $378.1 billion, or 20.2%. Imports increased $503.6 billion, or 20.2%.

- According to the U.S. Energy Administration, the national average retail price for regular gasoline was $3.742 per gallon on October 31, $0.027 per gallon below the prior week’s price but $0.352 higher than a year ago. Also as of October 31, the East Coast price increased $0.041 to $3.522 per gallon; the Gulf Coast price fell $0.041 to $3.177 per gallon; the Midwest price dropped $0.047 to $3.641 per gallon; the West Coast price decreased $0.151 to $5.028 per gallon; and the Rocky Mountain price decreased $0.056 to $3.789 per gallon. Residential heating oil prices averaged $5.832 per gallon on October 31, $0.133 above the previous week’s price and $2.437 per gallon more than a year ago.

- For the week ended October 29, there were 217,000 new claims for unemployment insurance, a decrease of 1,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended October 22 remained 1.0%. The advance number of those receiving unemployment insurance benefits during the week ended October 22 was 1,485,000, an increase of 47,000 from the previous week’s level. States and territories with the highest insured unemployment rates for the week ended October 15 were Puerto Rico (2.1%), New Jersey (1.8%), California (1.7%), Alaska (1.5%), New York (1.3%), Rhode Island (1.2%), Massachusetts (1.2%), Nevada (1.1%), and Oregon (1.1%). The largest increases in initial claims for unemployment insurance for the week ended October 22 were in New York (+1,726), Georgia (+1,301), New Jersey (+1.100), Pennsylvania (+1,062), and Illinois (+1,016), while the largest decreases were in Missouri (-2,213), Florida (-2,004), Michigan (-804), Tennessee (-628), and Puerto Rico (-510).

Eye on the Week Ahead

There is not much in terms of economic data released this week. However, one important inflation indicator is available, the consumer price index for October. September saw prices increase 0.4%, while year-over-year prices advanced 8.2%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.