Last Friday’s rally helped drive stocks higher to end the first full week of January. Investors apparently saw a deceleration in November and December average hourly earnings (see jobs report below) as a sign that the aggressive monetary policy followed by the Federal Reserve may actually be slowing inflation. Traders will await this week’s consumer price index to get a better gauge on the direction of inflationary pressures. Nevertheless, stocks closed last week higher, led by the Global Dow. The large caps of the Dow and the S&P 500 boasted solid gains, as did the small caps of the Russell 2000. Ten-year Treasury yields fell on rising bond prices. Crude oil prices declined nearly $7.00 per barrel. The dollar rose marginally, while gold prices advanced.

Stocks finished the first trading session of 2023 lower. Wall Street was closed last Monday in observance of New Year’s day. However, investors weren’t in a spending mood last Tuesday, particularly with respect to megacap stocks. The Nasdaq continued its 2022 downward spiral, declining 0.8%. The Russell 2000 slid 0.6%, the S&P 500 lost 0.4%, while the Dow ended the day flat. The Global Dow was able to eke out a 0.2% gain. Bond prices rose, driving the yield on 10-year Treasuries down 8.6 basis points to 3.79%. The dollar advanced the most in nearly three weeks, while gold prices reached their highest values since mid-June. Crude oil prices lost nearly 4.0%, falling to $77.15 per barrel.

Wall Street snapped a two-day losing streak last Wednesday. The Global Dow led the benchmark indexes listed here, gaining 1.4%, followed by the S&P 500 (0.8%), the Nasdaq (0.7%), the Russell 2000 (0.6%), and the Dow (0.4%). Ten-year Treasury yields fell 8.4 basis points, closing at 3.70%, as long-term bond values rose for the second consecutive day. Weakening demand sent crude oil prices lower to $73.24 per barrel. The dollar slipped lower, while gold prices notched a second consecutive strong performance.

Stocks ended last Thursday’s session lower as investors grappled with the prospect of another strong labor report, due out the following day. The Federal Reserve has focused, in part, on the strength of the labor sector. A strong December jobs report would likely give the Fed room to keep up its aggressive policy aimed at stemming rising inflation. Among the indexes listed here, the Nasdaq fell the furthest, losing 1.5%, followed by the S&P 500 (-1.2%), the Russell 2000 (-1.1%), the Dow (-1.0%), and the Global Dow (-0.5%). Ten-year Treasury yields inched up to 3.72%. The dollar added nearly 0.9%, while gold prices fell 1.1%. Crude oil prices rose less than $1.00 to close at about $73.75 per barrel.

Wall Street enjoyed its first major rally of 2023 last Friday. Each of the benchmark indexes listed here gained more than 2.0%, led by the Nasdaq (2.6%), followed by the S&P 500 (2.3%), the Russell 2000 and the Global Dow (2.2%), and the Dow (2.1%). Bond prices jumped higher, pulling yields lower. Ten-year Treasury yields fell 15.1 basis points to close the week at 3.56%. Crude oil prices ended the day flat, remaining at $73.66 per barrel. The dollar dipped lower, while gold prices recouped the prior day’s losses after gaining 1.72%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Employment increased by 223,000 in December, according to the latest report from the Bureau of Labor Statistics. It is worth noting that employment gains in October and November were revised lower to 263,000 (from 284,000) and 256,000 (from 263,000), respectively. Notable job gains occurred in leisure and hospitality, health care, construction, and social assistance. Employment rose by 4.5 million in 2022 (an average monthly gain of 375,000), less than the increase of 6.7 million in 2021 (an average monthly gain of 562,000). The unemployment rate edged down 0.1 percentage point to 3.5%. The unemployment rate has remained within a range of 3.5%-3.7% since March. The number of unemployed persons decreased by 278,000 to 5.7 million. The employment-population ratio increased by 0.2 percentage point over the month to 60.1%. The labor force participation rate edged up 0.1 percentage point to 62.3%. Both measures have shown little net change since early 2022. In December, average hourly earnings rose by $0.09, or 0.3%, to $32.82. Over the past 12 months ended in December, average hourly earnings have increased by 4.6%, which is lower than the 12-month increase from November 2021 (5.1%). The average work week decreased by 0.1 hour in December to 34.3 hours. Wages have decelerated in November and December, which could be a sign that inflation is easing. However, statistically, there are nearly two available jobs for every unemployed person, so job growth is likely to continue.

- According to the latest information from the Census Bureau, the international trade in goods and services deficit was $61.5 billion in November, $16.3 billion less than the October deficit. The November trade deficit was the lowest since July 2020. November exports were $251.9 billion, $5.1 billion less than October exports. November imports were $313.4 billion, $21.5 billion less than October imports. Overall, the November decline in both imports and exports may indicate weakening domestic and foreign demand entering the holiday shopping season. Year to date, the goods and services deficit increased $120.1 billion, or 15.7%, from the same period in 2021. Exports increased $439.4 billion, or 18.9%. Imports increased $559.5 billion, or 18.1%.

- The number of job openings was little changed at 10.5 million on the last business day of November, according to the latest Job Openings and Labor Turnover report from the U.S. Bureau of Labor Statistics. Over the month, the number of hires and total separations changed little at 6.1 million and 5.9 million, respectively. Within separations, quits, layoffs, and discharges changed little.

- The results of the survey of purchasing managers revealed manufacturing declined at the fastest rate since May 2020, and was one of the sharpest reductions since 2009. The S&P Global US Manufacturing PMI™ was 46.2 in December, down from 47.7 in November. A reading of less than 50.0 indicates a decrease in manufacturing. Survey respondents indicated that the decline stemmed from weak client demand, which decreased new orders and output. Employment waned and backlogs of work fell sharply. Companies noted that weak client demand stemmed from economic uncertainty and inflationary pressures, leading to lower purchasing power among customers.

- Business suffered a sharp decline in the services sector in December, according to the latest survey of purchasing managers. The S&P Global US Services PMI Business Activity Index registered 44.7 in December, down from 46.2 in November. The rate of decline in services output accelerated for the third month running and was the second-fastest since May 2020. Lower business activity was attributed to a reduction in new orders, as client demand weakened due to the impact of higher interest rates and inflation on customer spending.

- Retail prices for regular gasoline rose for the first time in several weeks. According to the U.S. Energy Administration, the national average retail price for regular gasoline was $3.223 per gallon on January 2, $0.132 per gallon above the prior week’s price but $0.058 lower than a year ago. Also, as of January 2, the East Coast price increased $0.139 to $3.210 per gallon; the Gulf Coast price rose $0.207 to $2.891 per gallon; the Midwest price climbed $0.151 to $3.050 per gallon; the West Coast price increased $0.029 to $3.939 per gallon; and the Rocky Mountain price advanced $0.041 to $3.043 per gallon. Residential heating oil prices averaged $4.663 per gallon on January 2, $0.025 above the previous week’s price and $1.273 per gallon more than a year ago.

- For the week ended December 31, there were 204,000 new claims for unemployment insurance, a decrease of 19,000 from the previous week’s level, which was revised down by 2,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended December 24 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended December 24 was 1,694,000, a decrease of 24,000 from the previous week’s level, which was revised up by 8,000. States and territories with the highest insured unemployment rates for the week ended December 17 were Alaska (2.3%), New Jersey (2.1%), Minnesota (2.0%), California (1.9%), Puerto Rico (1.9%), Montana (1.8%), Massachusetts (1.8%), Rhode Island (1.8%), New York (1.7%), and Washington (1.6%). The largest increases in initial claims for unemployment insurance for the week ended December 24 were in Missouri (+4,974), Kentucky (+4,133), Washington (+2,197), New York (+2,097), and Ohio (+2,026), while the largest decreases were in California (-3,234), Georgia (-1,568), Texas (-1,455), Florida (-1,090), and North Carolina (-888).

Eye on the Week Ahead

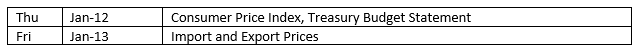

The first full week of 2023 kicks off with important inflationary data, with the release of the consumer price index and the report on import and export prices. Inflation may be showing signs that it has peaked. The CPI in November rose 0.1% and 7.1% from November 2021.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.