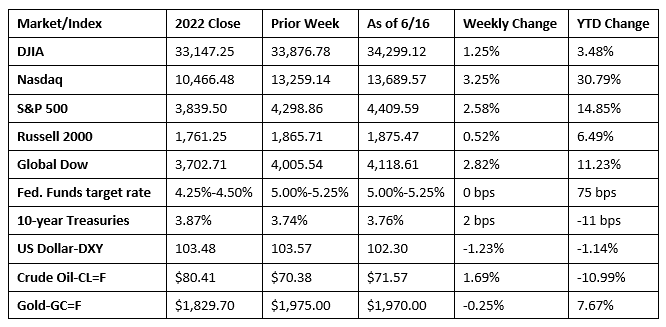

Stocks advanced for the third straight week, as each of the benchmark indexes listed here climbed higher. Inflationary pressures may finally be subsiding, according to the latest data (see below). In addition, the Federal Reserve held interest rates at their current range following their meeting last week, although there are indications that at least one, and possibly two more rate hikes are in store by the end of the year. With more interest rate hikes forecast, long- and short-term Treasury yields advanced. Despite a dip at the end of the week, the Nasdaq and the S&P 500 had their best week since March. Crude oil prices ebbed and flowed throughout much of the week, ultimately rallying to close higher. The dollar and gold prices declined.

Wall Street saw stocks rally last Monday ahead of inflation data and the Federal Reserve meeting. Traders may have acted based on the anticipation that the Fed would not hike interest rates. Information technology, consumer discretionary, and communication services led the market sectors. The Nasdaq gained 1.5%, the S&P 500 rose 0.9%, the Dow added 0.6%, the Russell 2000 advanced 0.4%, and the Global Dow increased 0.3%. Crude oil prices dropped 4.2%, settling at about $67.24 per barrel, the lowest price since December 2021. Ten-year Treasury yields inched up 2.0 basis points to 3.76%. The dollar climbed marginally higher, while gold prices dipped lower.

Stocks followed last Monday’s solid performance with another rally last Tuesday. The Russell 2000, which is generally sensitive to economic data, jumped 1.2% following last Tuesday’s Consumer Price Index (see below). The Global Dow rose 0.9%, the Nasdaq gained 0.8%, the S&P 500 advanced 0.7%, and the Dow edged up 0.4%. With the possibility that the Federal Reserve might pause interest rate increases, the dollar and gold prices slid lower. The yield on 10-year Treasuries rose 7.4 basis points to close at 3.83%. Crude oil prices jumped 3.1% to reach $69.20 per barrel.

Last Wednesday saw stocks end mixed, with the Dow sliding 0.7% and the Russell 2000 falling 1.2%, while the Global Dow (0.7%), the Nasdaq (0.4%), and the S&P 500 (0.1%) closed higher. The day began with a moderate selloff, only to pick up the pace following the Federal Reserve’s policy announcement (see below). The yield on 10-year Treasuries dipped 4.3 basis points to close at 3.79%. The dollar and gold prices declined. Crude oil prices gave back gains from the previous day after falling 1.1% to settle at about $68.68 per barrel.

Investors moved to equities last Thursday, driving each of the benchmark indexes listed here higher. Inflation indicators out last week showed price pressures may be cooling, although the Federal Reserve is suggesting more interest rate hikes are in the offing this year. The Dow led the indexes, climbing 1.3%, followed by the S&P 500 and the Nasdaq (1.2%), the Russell 2000 (0.9%), and the Global Dow (0.7%). In what is proving to be a volatile week, crude oil prices reversed the prior day’s trend, closing up 3.4% to about $70.58 per barrel. Ten-year Treasury yields fell 6.8 basis points, closing at 3.72%. The dollar fell, while gold prices inched higher.

Stocks slid lower to close out the week. Of the benchmark indexes listed here, only the Global Dow posted a gain, advancing 0.2% by the close of trading last Friday. The Russell 2000 (-0.8%), the Nasdaq (-0.7%), the S&P 500 (-0.4%), and the Dow (-0.3%) closed lower. Ten-year Treasury yields added 4.1 basis points to close at 3.76%. Crude oil prices rose for the second straight day, advancing $1.04, or 1.5%. The dollar inched higher, while gold prices dipped lower.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- In a move that was not totally unexpected, the Federal Open Market Committee decided to maintain the present target range for the federal funds rate at 5.00%-5.25%. The Committee noted that, while economic activity continued to expand and job growth was robust, inflation remained elevated. However, the FOMC proffered that it was unable to determine the effects that tighter credit conditions would have on households and businesses. To that extent, holding the target range steady allows the Committee to assess additional information and its implications for monetary policy. In determining the direction of its monetary policy going forward, the Committee will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

- The Consumer Price Index edged up 0.1% in May, slightly below most expectations and under the April increase of 0.4%. For the 12 months ended in May, the CPI rose 4.0%, the smallest 12-month increase since the period ended March 2021. The index for shelter (+0.6%) was the largest contributor to the monthly increase, followed by an increase in the index for used cars and trucks (+4.4%). The food index increased 0.2% in May after being unchanged in the previous two months. The energy index declined 3.6% in May. The CPI less food and energy rose 0.4% in May, the same increase as in April and March. This report might support a pause in interest rate increases by the Federal Reserve.

- Prices producers received for the sale of goods and services declined 0.3% in May after advancing 0.2% in April. For the 12 months ended in May, producer prices moved up 1.1%. The decrease in producer prices is attributable to a 1.6% drop in prices for goods, the largest decrease since July 2022. Prices for services increased 0.2% in May. Producer prices less foods, energy, and trade services were unchanged in May after inching up 0.1% in April. For the 12 months ended in May, prices less foods, energy, and trade services increased 2.8%. In May, prices for energy fell 6.8%, while prices for food decreased 1.3%.

- In yet another sign that inflation might be declining, May saw import prices fall 0.6% and export prices decline 1.9%, according to the latest report from the Bureau of Labor Statistics. Import prices fell 5.9% for the year ended in May, the largest 12-month decline since the comparable period ended May 2020. Import prices for fuel fell 6.4% in May after rising 4.1% in April. This is the largest one-month drop in import fuel prices since August 2022. Nonfuel import prices dipped 0.1% in May. Nonfuel import prices declined 1.6% since May 2022. The May decrease in export prices was the largest monthly decline since December 2022. In May, lower prices for nonagricultural exports and agricultural exports each contributed to the overall decrease in export prices. Export prices fell 10.1% for the year ended in May, the largest 12-month decline since the series was first published in September 1984.

- Sales at the retail level rose 0.3% in May and have increased 1.6% since May 2022. Retail trade sales also increased 0.3% in May. Nonstore retail sales were up 6.5% from last year, while sales at food services and drinking places were up 8.0% from May 2022.

- Industrial production declined 0.2% in May, following two consecutive monthly increases. Most of the major market groups declined in May, with final products and materials down 0.1% and 0.3%, respectively. Manufacturing edged up 0.1% in May, while the indexes for utilities and mining fell 1.8% and 0.4%, respectively. Despite the downturn in May, total industrial production was 0.2% above its year-earlier level.

- The government deficit for May was $240.0 billion, well above the May 2022 deficit of $66.2 billion. In May, government receipts were $307.5 billion and expenditures totaled $547.8 billion. Through the first eight months of the fiscal year, the government deficit sits at $1,164.9 trillion, significantly higher than the $426.2 billion deficit over the comparable period from the previous fiscal year.

- The national average retail price for regular gasoline was $3.595 per gallon on June 12, $0.054 per gallon higher than the prior week’s price but $1.411 less than a year ago. Also, as of June 12, the East Coast price increased $0.022 to $3.432 per gallon; the Midwest price rose $0.083 to $3.513 per gallon; the Gulf Coast price advanced $0.080 to $3.145 per gallon; the Rocky Mountain price increased $0.053 to $3.707 per gallon; and the West Coast price rose $0.061 to $4.584 per gallon.

- For the week ended June 10, there were 262,000 new claims for unemployment insurance, unchanged from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended June 3 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended June 3 was 1,775,000, an increase of 20,000 from the previous week’s level, which was revised down by 2,000. States and territories with the highest insured unemployment rates for the week ended May 27 were California (2.2%), New Jersey (2.1%), Massachusetts (1.9%), New York (1.6%), Oregon (1.6%), Puerto Rico (1.5%), Rhode Island (1.5%), Washington (1.5%), Alaska (1.4%), and Illinois (1.4%). The largest increases in initial claims for unemployment insurance for the week ended June 3 were in Ohio (+6,447), California (+4,103), Minnesota (+2,693), Pennsylvania (+2,069), and Tennessee (+732), while the largest decreases were in Connecticut (-2,544), New York (-1,325), Texas (-617), New Jersey (-560), and Oregon (-450).

Eye on the Week Ahead

This week focuses on the housing sector. The May figures on housing starts and building permits are out this week. In April, the number of issued building permits declined for all housing types, however building permits for single-family construction advanced over 3.0%. Housing starts increased for all housing types. The latest data on existing home sales is also available this week. Sales of existing homes declined in April, as total housing inventory sat at just below three months, while existing home prices increased.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.