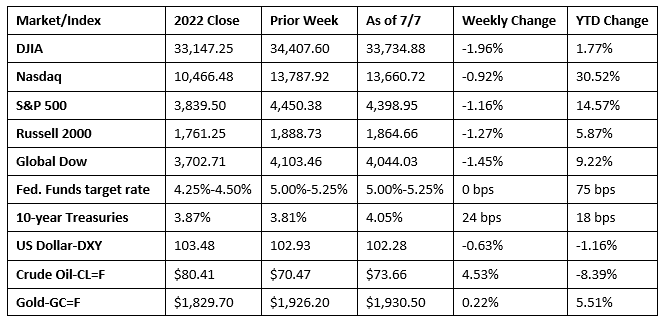

Stocks fell for the second straight week, with each of the benchmark indexes losing ground. The Dow led the declines, followed by the Global Dow, the Russell 2000, the S&P 500, and the Nasdaq. Although the employment report for June (see below) showed a moderate decline in the number of new jobs added, wages continued to track higher, which could support further interest rate hikes by the Federal Reserve. The Fed meets next on July 26, and the latest employment data makes another pause in rate increases highly unlikely. Whether the rate hike is 25.0 basis points or 50.0 basis points is open to conjecture. Crude oil prices advanced for the second straight week as export cuts by Saudi Arabia and Russia began to impact prices. Ten-year Treasury yields increased by 24.0 basis points, impacted by the weakest number of new job hires in three years and rising wages.

As expected, trading was light last Monday before the fourth of July holiday. Nevertheless, stocks managed to post moderate gains, with each of the benchmark indexes listed here adding value, led by the Global Dow (0.5%), followed by the Russell 2000 (0.4%), the Nasdaq (0.2%), and the S&P 500 (0.1%). The Dow closed the session where it began. Ten-year Treasury yields inched up to 3.85% after adding 3.9 basis points. Crude oil prices fell 1.2% to $69.79 per barrel, despite fresh production cuts by Saudi Arabia and Russia. The dollar and gold prices edged higher.

Stocks declined last Wednesday as investors digested the minutes from the Federal Reserve’s June meeting and a sharp decline in services activity in China. The Russell 2000 slid 1.3%, followed by the Global Dow (-0.6%), and the Dow (-0.4%). The S&P 500 and the Nasdaq dipped 0.2%. Crude oil prices jumped 3.0%, settling at $71.88 per barrel. The dollar edged higher, while gold prices declined. Ten-year Treasury yields rose 8.7 basis points to 3.94%.

Equities got off to a slow start last Thursday. The Fed got more ammunition to continue to hike interest rates, following a better-than-expected ADP employment report. The Russell 2000 and the Global Dow fell 1.6%, the Dow dropped 1.1%, while the Nasdaq and the S&P 500 slid 0.8%. Ten-year Treasury yields gained 9.6 basis points, closing at 4.04%. Crude oil prices were flat, while the dollar and gold prices slid lower.

Last Friday saw stocks close mostly lower, with only the Russell 2000 (1.22%) and the Global Dow (0.40%) ending the session higher. The Dow lost 0.6%, the S&P 500 fell 0.3%, and the Nasdaq dipped 0.1%. Crude oil prices jumped 2.6% to close at $73.66 per barrel. The dollar slid lower, while gold prices advanced 0.8%. Ten-year Treasury yields were flat on the day.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Employment slowed somewhat in June. There were 209,000 new jobs added last month, down from the 2023 average of 278,000 per month, and well off the monthly average of 399,000 since May 2022. In May, employment continued to trend up in government, health care, social assistance, and construction. Both the unemployment rate, at 3.6%, and the number of unemployed persons, at 6.0 million, changed little in June. The unemployment rate has ranged from 3.4% to 3.7% since March 2022. The labor force participation rate, at 62.6%, and the employment-population ratio, at 60.3%, were unchanged in May from the previous month. In June, average hourly earnings rose by $0.12, or 0.4%, to $33.58. Over the past 12 months, average hourly earnings have increased by 4.4%. The average workweek edged up by 0.1 hour to 34.4 hours in June.

- According to the latest Job Openings and Labor Turnover Summary (JOLTS), the number of job openings fell 496,000 to 9.8 million in May. In May, the largest decreases in job openings were in health care and social assistance (-285,000), finance and insurance (-139,000), and other services (-78,000). Job openings increased in educational services (+45,000), state and local government education (+37,000), and federal government (+24,000). The number of hires increased by 107,000 in May, with hires in durable goods manufacturing increasing by 41,000. Total separations include quits, layoffs and discharges, and other separations. Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. The number of total separations increased 211,000 in May. The number of quits increased 250,000 to 4.0 million.

- Manufacturing contracted for the second straight month in June, according to the latest survey from S&P Global. The S&P Global US Manufacturing Purchasing Managers’ Index™ posted 46.3 in June, down from 48.4 in May. Manufacturing has declined in seven of the last eight months. A sharper decline in new orders caused manufacturing output to decrease. Survey respondents generally attributed the decline in demand to inflationary pressure and higher interest rates.

- Unlike the manufacturing sector, services expanded in June. According to the latest purchasing managers’ index from S&P Global, new orders increased for the fourth straight month. The June PMI™, at 54.4, rose at the second-fastest pace in over a year. Survey respondents were more upbeat in their expectations for the remainder of the year and sought to expand employment accordingly. Even with the expansion, higher interest rates and increased wage demands pushed cost burdens higher for service providers. Nevertheless, in an attempt to remain competitive, selling prices increased at the slowest rate since February.

- The goods and services trade deficit decreased by $5.5 billion to $69.0 billion in April. Exports fell 0.8%, while imports declined 2.3%. Year to date, the goods and services deficit decreased $101.7 billion, or 22.8%, from the same period in 2022. Exports increased $48.0 billion, or 3.9%. Imports decreased $53.7 billion, or 3.2%.

- The national average retail price for regular gasoline was $3.527 per gallon on July 3, $0.044 per gallon lower than the prior week’s price and $1.244 less than a year ago. Also, as of July 3, the East Coast price decreased $0.033 to $3.372 per gallon; the Midwest price fell $0.063 to $3.389 per gallon; the Gulf Coast price decreased $0.082 to $3.108 per gallon; the Rocky Mountain price rose $0.056 to $3.790 per gallon; and the West Coast price dipped $0.023 to $4.533 per gallon.

- For the week ended July 1, there were 248,000 new claims for unemployment insurance, an increase of 12,000 from the previous week’s level, which was revised down by 3,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended June 24 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended June 24 was 1,720,000, a decrease of 13,000 from the previous week’s level, which was revised down by 9,000. States and territories with the highest insured unemployment rates for the week ended June 17 were California (2.2%), New Jersey (2.1%), Puerto Rico (2.1%), Massachusetts (1.8%), New York (1.6%), Oregon (1.6%), Pennsylvania (1.6%), Illinois (1.5%), Minnesota (1.5%), and Rhode Island (1.5%). The largest increases in initial claims for unemployment insurance for the week ended June 24 were in New Jersey (+5,306), Ohio (+2,359), Connecticut (+2,096), Rhode Island (+927), and Oregon (+711), while the largest decreases were in California (-10,956), Texas (-8,962), Pennsylvania (-3,199), Minnesota (-2,490), and Puerto Rico (-1,280).

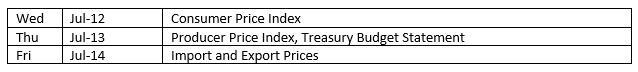

Eye on the Week Ahead

Quite a bit of attention will be focused on the Consumer Price Index and the Producer Price Index, which are released this week. The CPI inched up 0.1% in May and 4.0% for the year. The PPI declined 0.3% in May and was up only 1.1% for the 12 months ended in May.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.