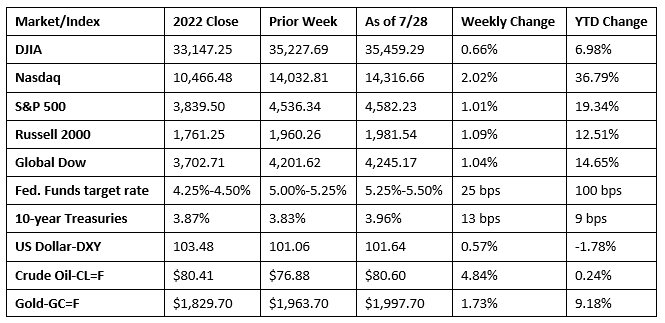

Stocks enjoyed a favorable week of returns, with each of the benchmark indexes listed here posting solid gains. The Dow and the S&P 500 notched their third straight week of gains. Inflation continued to cool in June, with the smallest 12-month rate increase since March 2021 (see below). So far, corporate earnings for the second quarter have been generally favorable, with some large tech companies beating expectations. Long-term bond prices fell, sending yields higher. Crude oil prices advanced, with global oil prices gaining more than 16.0% since late June. Rising oil prices have spurred an increase in gasoline prices. The dollar slipped lower last week, while gold prices climbed higher.

Wall Street began the week on a high note last Monday, with each of the benchmark indexes finishing the day up. The Dow gained 0.5% to extend its winning streak to 11 straight sessions. The S&P 500 added 0.4%, the Russell 2000 and the Global Dow each rose 0.3%, and the Nasdaq gained 0.2%. Ten-year Treasury yields inched up 2.0 basis points to close at 3.85%. Crude oil prices jumped 2.4%, settling at $78.92 per barrel. The dollar advanced 0.3%, while gold prices dipped 0.5%.

Stocks climbed higher last Tuesday, led by the Nasdaq (0.6%), while the Dow (0.1%) was able to eke out a gain to extend its streak to 12 days. The Global Dow and the S&P 500 added 0.3%, while the Russell 2000 closed the day essentially where it began. Crude oil prices rose 1.1% to hit $79.61 per barrel. The yield on 10-year Treasuries settled at 3.91%. The dollar dipped lower, while gold prices advanced 0.2%.

As expected, last Wednesday the Federal Reserve raised interest rates 25.0 basis points (see below) to the highest range since 2001. Stocks closed the day with mixed results. The Dow gained 0.2%, notching its 13th consecutive day of gains, which is the longest winning streak for the Dow since 1987. The Russell 2000 (0.7%) and the Global Dow (0.3%) also posted gains, while the Nasdaq slipped 0.1%. The S&P 500 ended the day flat. Bond prices jumped higher, pulling yields lower. Ten-year Treasury yields fell 6.1 basis points to 3.85%. Crude oil prices reversed a rally, declining 0.9% to $78.95 per barrel. The dollar slipped lower, while gold prices rose for the second straight day.

The Dow’s winning streak ended at 13 days following last Thursday’s negative performance. The Russell 2000 fell 1.3%, the largest decline among the benchmark indexes listed here. The Dow slipped 0.7%, the S&P 500 and the Nasdaq fell 0.6%, while the Global Dow dropped 0.2%. Bond prices plunged lower, hiking yields on 10-year Treasuries 16.1 basis points to close at 4.01%. Crude oil prices jumped 1.4% to $79.91 per barrel. The dollar rose nearly 1.0%. Gold prices ended a mini two-day winning streak, declining 1.4% by the close of trading.

Stocks ended last week on a high note, fueled by favorable technology earnings and positive inflation data. Each of the benchmark indexes listed here posted solid gains last Friday, led by the Nasdaq (1.9%), followed by the Russell 2000 (1.4%), the S&P 500 (1.0%), and the Dow and the Global Dow (0.5%). Ten-year Treasury yields slid lower to close the day and week at 3.96%. Crude oil prices continued to climb, with prices per barrel eclipsing the $80.00 threshold for the first time since April. The dollar lost ground, while gold prices rose 0.6%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Federal Reserve hiked the federal funds rate 25.0 basis points to 5.25%-5.50%. The statement released by the Fed contained virtually the same information as from its previous statement. Job gains have been robust, the economy has been expanding at a moderate pace, and inflation remains elevated. The Fed does not meet again until September.

- The economy accelerated at an annualized rate of 2.4% in the second quarter, according to the second estimate of gross domestic product. GDP increased 2.0% in the first quarter. Compared to the first quarter, the acceleration in GDP in the second quarter primarily reflected an upturn in private inventory investment and an acceleration in nonresidential (business) fixed investment. These movements were partly offset by a downturn in exports, and decelerations in consumer spending, federal government spending, and state and local government spending. Imports, which are a negative in the calculation of GDP, decreased. The personal consumption expenditures price index increased 2.6%, down from the 4.1% increase in the first quarter. Consumer spending rose 1.6% in the second quarter, following an increase of 4.2% in the first quarter.

- Consumer prices, as measured by the personal consumption expenditures price index, rose 0.2% in June. Prices less food and energy also increased 0.2% from May. Since June 2022, consumer prices are up 3.0%, the lowest yearly price increase since March 2021, when the advance was 2.5%. The PCE price index, the preferred measure of inflation for the Federal Reserve, is clearly ebbing but has yet to reach the 2.0% target rate of the Fed. Personal income and disposable personal income rose 0.3% last month. Consumer spending increased 0.5% in June.

- Durable goods orders rose 4.7% in June, marking the fourth straight month of increases. Transportation contributed to the increase in new orders for durable goods in June, increasing 12.1%. Also contributing to the June advance in new orders was nondefense aircraft and parts (69.4%), defense aircraft and parts (5.5%), and capital goods (11.2%). New orders for durable goods have increased 4.6% since June 2022.

- Sales of new single-family homes declined in June for the first time since February. According to the Census Bureau, new home sales dipped 2.5% last month, but were up 23.8% over June 2022. The median sales price in June was $415,400, while the average sales price was $494,700. Inventory for new single-family homes for sale sat at a 7.4-month supply, based on the current pace of sales.

- The advance report on the international trade in goods deficit was $87.8 billion in June, down $4.0 billion, or 4.4%, from May. Exports of goods for June were $0.4 billion, or 0.2%, more than May exports. Imports of goods for June were $3.6 billion, or 2.7%, less than May imports. Over the last 12 months, exports are down 9.3%, and imports have dropped 9.9%.

- The national average retail price for regular gasoline was $3.596 per gallon on July 24, $0.037 per gallon higher than the prior week’s price but $0.734 less than a year ago. Also, as of July 24, the East Coast price increased $0.066 to $3.488 per gallon; the Midwest price declined $0.009 to $3.404 per gallon; the Gulf Coast price rose $0.106 to $3.243 per gallon; the Rocky Mountain price decreased $0.010 to $3.755 per gallon; and the West Coast price declined $0.010 to $4.539 per gallon.

- For the week ended July 22, there were 221,000 new claims for unemployment insurance, a decrease of 7,000 from the previous week’s level. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended July 15 was 1.1%, a decrease of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended July 15 was 1,690,000, a decrease of 59,000 from the previous week’s level, which was revised down by 5,000. States and territories with the highest insured unemployment rates for the week ended July 8 were Connecticut (2.6%), New Jersey (2.5%), California (2.4%), Puerto Rico (2.4%), Rhode Island (2.2%), Massachusetts (2.0%), New York (1.9%), Oregon (1.9%), Minnesota (1.8%), and Pennsylvania (1.8%). The largest increases in initial claims for unemployment insurance for the week ended July 15 were in Georgia (+4,879), California (+3,875), South Carolina (+2,376), Oregon (+1,354), and Texas (+1,267), while the largest decreases were in Michigan (-3,620), Kentucky (-2,730), New Jersey (-2,036), New York (-1,917), and Indiana (-1,360).

Eye on the Week Ahead

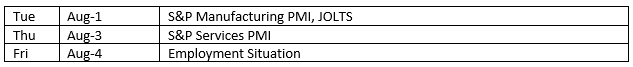

Manufacturing and labor are the focus of this week’s economic data. The manufacturing sector slowed in June for the second straight month, while services expanded. Employment remained relatively strong in June, although the number of new hires (209,000) was well below the 2023 monthly average of 273,000.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.