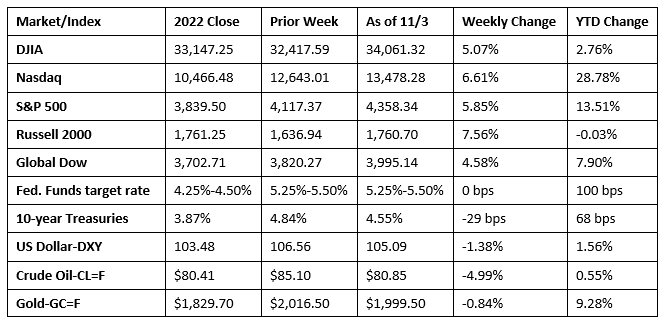

Wall Street ended a two-week bear run as stocks enjoyed their best week of the year. Each of the benchmark indexes listed here posted solid gains, while bond yields declined, dragged lower by escalating bond prices. Investors may have seen slowing job growth (see below) as more reason for the Federal Reserve to maintain, if not lower, interest rates in the near future. The Fed kept interest rates at their current levels following last week’s meeting (see below). Third-quarter corporate earnings have been mixed, with about 49% of the companies of the S&P 500 reporting earnings that are 7.7% above estimates, which is below the five-year average of 8.5% but above the 10-year average of 6.6%. Crude oil prices fell for the second straight week as supply concerns driven by tensions in the Middle East waned. The dollar declined to a six-week low, while gold prices advanced.

Stocks rallied last Monday as investors awaited the outcome of Wednesday’s Federal Reserve meeting. The S&P 500 and the Nasdaq, both in correction territory, gained 1.2%. The Dow rose 1.6%, while the Global Dow and the Russell 2000 advanced 0.7% and 0.6%, respectively. Crude oil prices dropped 3.6% to $82.47, as Israel’s measured approach to its war in Gaza eased concerns of that other countries, particularly oil-producing nations, would get involved and use oil as a tool of retaliation. Ten-year Treasury yields inched up 3.0 basis points to 4.87%. The dollar fell 0.4%, while gold prices rose 0.4%.

Wall Street continued to trend higher on Tuesday to salvage the final day of October. Investors continued to look ahead to the Fed’s interest rate decision on Wednesday and Apple’s earnings report on Thursday. The Russell 2000 led the benchmark indexes, gaining 0.9%, followed by the S&P 500 (0.7%), the Nasdaq (0.5%), the Dow (0.4%), and the Global Dow (-0.1%). Ten-year Treasury yields ended the session unchanged from the prior day’s value. Crude oil prices fell 1.3% to $81.28 per barrel. The dollar rose 0.5%, while gold prices slipped below $2,000.00 per ounce after declining 0.6%.

Stocks trended higher last Wednesday, helped by a drop in bond yields. The Federal Reserve left interest rates unchanged, as expected. Fed Chair Jerome Powell noted that the surge in bond yields has had a tightening effect on financial conditions. Ten-year Treasury yields fell 8.6 basis points to settle at 4.78%. While each of the S&P 500 market sectors ended the day up, information technology was the best performing, which helped drive the Nasdaq up 1.6%. The S&P 500 gained 1.1%, the Global Dow rose 0.8%, the Dow advanced 0.7%, and the Russell 2000 climbed 0.5%. Crude oil prices slipped 0.2% to $80.90 per barrel. The dollar was unchanged, while gold prices fell 0.4%.

The markets continued to move upward last Thursday as investors may have seen the latest policy announcement from the Federal Reserve as an indication that no more interest rate hikes are likely. Bond prices also advanced, dragging yields on 10-year Treasuries down 12.0 basis points to 4.66%. The Russell 2000 vaulted 2.7%, followed by the S&P 500 and the Global Dow, which advanced 1.9%. The Nasdaq rose 1.8% and the Dow climbed 1.7%. Crude oil prices inched up 0.2%, settling at $82.63 per barrel. Both the dollar and gold prices closed in the red.

Stocks closed higher last Friday, while bond yields fell as recent economic data reinforced the idea that the Fed policy of interest rate hikes may be over. The Russell 2000 capped a banner week after gaining 2.7% for the second straight day. The Nasdaq added 1.4%, the Global Dow advanced 1.1%, the S&P 500 climbed 0.9%, and the Dow increased 0.7%. Ten-year Treasury yields dropped 11.1 basis points to 4.55%. Crude oil prices dipped 1.8%. The dollar lost 1.0%, while gold prices rose 0.3%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Employment cooled in October, according to the latest report from the Bureau of Labor Statistics. There were 150,000 new jobs added last month, well below the average monthly gain of 258,000. Job gains occurred in health care, government, and social assistance. Employment in manufacturing declined due to strike activity. The number of unemployed persons increased by 146,000 to 6.5 million, and the unemployment rate ticked up 0.1 percentage point to 3.9%. Since April, the unemployment rate and the number of unemployed persons are up 0.5 percentage point and 849,000, respectively. Both the labor force participation rate, at 62.7%, and the employment-population ratio, at 60.2%, edged up 0.2 percentage point from the previous month. In October, average hourly earnings rose by $0.07, or 0.2%, to $34.00. Over the past 12 months, average hourly earnings have increased by 4.1%. The average workweek edged down by 0.1 hour to 34.3 hours. According to the report, the change in employment for August was revised down by 62,000, and the change for September was revised down by 39,000. With these revisions, employment in August and September combined was 101,000 lower than previously reported.

- Last week, the Federal Open Market Committee voted unanimously to keep the Federal Funds target rate at its current range of 5.25%-5.50%. The Committee noted that economic activity expanded at a strong pace in the third quarter and, while job gains moderated since earlier in the year, they remained strong. Inflation continued to be elevated. Moving forward, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals (full employment and inflation at a rate of 2.0% over the longer run). Following the meeting, Federal Reserve Chair Jerome Powell maintained a hawkish tone, noting that further policy tightening may be necessary despite signs that price pressures may be waning. Powell stated that, “a few months of good data are only the beginning to build confidence that inflation is moving sustainably to our goal,”

- According to the latest Job Openings and Labor Turnover survey, there were 9.6 million job openings in September, an increase of less than 57,000 from the previous month’s total. Job openings increased in accommodation and food services (+141,000) and in arts, entertainment, and recreation (+39,000). Job openings decreased in other services (-124,000), federal government (-43,000), and information (-41,000). The number of hires was essentially unchanged at 5.9 million. Total separations, which include quits, layoffs and discharges, and other separations, decreased by about 150,000 to 5.5 million. Within separations, the number of quits (voluntary separations) was unchanged at 3.7 million.

- Manufacturing expanded in October, ending a five-month period of declines. The S&P Global US Manufacturing Purchasing Managers’ Index™ rose to 50.0, up from September’s 49.8, driven by an increase in new orders. All the news was not favorable, however, as survey respondents noted that inflationary pressures picked up, pushing input costs and output charges higher at the fastest rate since April.

- October saw growth in the services sector as business activity rose marginally. Despite a decline in new orders, survey respondents noted a slower rise in costs. The S&P Global US Services PMI Business Activity Index posted 50.6 in October, up from 50.1 in September, signaling expansion in output in the services sector.

- The national average retail price for regular gasoline was $3.473 per gallon on October 30, $0.060 per gallon lower than the prior week’s price and $0.269 less than a year ago. Also, as of October 30, the East Coast price decreased $0.021 to $3.327 per gallon; the Midwest price fell $0.062 to $3.253 per gallon; the Gulf Coast price declined $0.076 to $2.965 per gallon; the Rocky Mountain price dropped $0.112 to $3.579 per gallon; and the West Coast price decreased $0.135 to $4.723 per gallon.

- For the week ended October 28, there were 217,000 new claims for unemployment insurance, an increase of 5,000 from the previous week’s level, which was revised up by 2,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended October 21 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended October 21 was 1,818,000, an increase of 35,000 from the previous week’s level, which was revised down by 7,000. States and territories with the highest insured unemployment rates for the week ended October 14 were Hawaii (2.1%), New Jersey (2.1%), California (2.0%), Puerto Rico (1.9%), New York (1.6%), Massachusetts (1.5%), Oregon (1.5%), Rhode Island (1.5%), and Washington (1.5%). The largest increases in initial claims for unemployment insurance for the week ended October 21 were in Oregon (+3,797), New York (+1,969), Pennsylvania (+1,293), Georgia (+1,252), and Texas (+1,144), while the largest decreases were in Tennessee (-1,092), Michigan (-740), North Carolina (-487), Mississippi (-199), and Arkansas (-174).

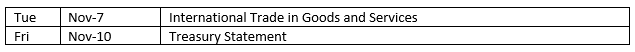

Eye on the Week Ahead

This week is a very slow one for economic data. The trade in goods and services deficit report out this week is for September. The Treasury statement is for October, the first month of fiscal year 2024.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.