Stocks closed generally higher last week on continued hopes that the Federal Reserve is done raising interest rates despite more hawkish comments from Fed Chair Jerome Powell. Tech and growth stocks carried the market for much of the week as investors looked ahead to this week’s inflation reports. Ten-year Treasury yields eased somewhat from recent 16-year highs. Crude oil prices fell for the third straight week. The dollar edged higher, while gold prices couldn’t maintain momentum, declining nearly 3.0% last week.

Last Monday saw stocks close moderately higher to extend the prior week’s winning streak. Each of the benchmark indexes posted gains, with the exception of the small caps of the Russell 2000, which fell 1.3%. The Nasdaq gained 0.3%, the S&P 500 advanced 0.2%, while the Dow and the Global Dow edged up 0.1%. Stocks began the day on an upswing, only to be dragged lower after a rebound in 10-year Treasury yields, which closed the session at 4.66%, up 10.4 basis points. Crude oil prices (0.5%) and the dollar (0.2%) ended the day up, while gold prices slid 0.7%.

The three major benchmark indexes, the Nasdaq (0.9%), the S&P 500 (0.3%), and the Dow (0.2%), extended their rally last Tuesday, while the Global Dow (-0.5%) and the Russell 2000 (-0.3%) declined. Bond prices advanced with yields on 10-year Treasuries falling 9.1 basis points to 4.57%. Crude oil prices fell 4.2% to $77.45 per barrel, marking the lowest closing price since August. China, the world’s largest consumer of oil, saw it’s exports fall for the sixth straight month in October, highlighting a slowdown in global demand. The dollar inched up 0.3%, while gold prices fell 0.7%.

The Nasdaq and the S&P 500 ticked up 0.1% last Wednesday, barely enough to keep their respective winning streaks alive. The Global Dow fell 0.2%, while the Dow and the Russell 2000 dipped 0.1%. Yields on 10-year Treasuries continued to slide, falling 4.8 basis points to 4.52%. Crude oil prices slumped to $75.46 per barrel, the lowest price since July. The dollar was unchanged, while gold prices declined 0.9%.

Stocks lost value last Thursday, ending the longest winning streak since 2021. Each of the benchmark indexes listed here declined, led by the Russell 2000 (-1.6%), followed by the Nasdaq (-0.9%), the S&P 500 (-0.8%), the Dow (-0.7%), and the Global Dow (-0.4%). Yields for 10-year Treasuries jumped 10.7 basis points to 4.63%. Crude oil prices inched up 0.3%, closing at about $75.54 per barrel. Both the dollar and gold prices edged up 0.3%.

Wall Street saw stocks rebound last Friday, with each of the benchmark indexes closing the session up. The Nasdaq jumped 2.1% as large tech companies pushed that index higher. The S&P 500 hit its highest value since September after gaining 1.6%. The Dow rose 1.2%, the Russell 2000 advanced 1.1%, and the Global Dow gained 0.1%. Among the market sectors, information technology (2.5%), consumer discretionary (1.5%), and communication services (1.4%) performed the best. Ten-year Treasury yields slipped 0.2 basis points, while the dollar and gold prices fell. Crude oil prices rose 2.0%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- According to the latest report from the Bureau of Economic Analysis, the goods and services trade deficit for September was $61.5 billion, $2.9 billion, or 4.9%, above the August deficit. September exports were $261.1 billion, $5.7 billion, or 2.2%, more than August exports. September imports were $322.7 billion, $8.6 billion, or 2.7%, more than August imports. Year to date, the goods and services deficit decreased $147.4 billion, or 20.0%, from the same period in 2022. Exports increased $22.7 billion, or 1.0%. Imports decreased $124.8 billion, or 4.2%.

- Information on prices for regular gasoline is limited as the U.S. Energy Information Administration delayed its scheduled data releases to complete a planned systems upgrade. It will resume its regular publishing schedule on November 13. In lieu thereof, the national average retail price for regular gasoline was $3.396 per gallon on November 6, $0.077 per gallon lower than the prior week’s price and $0.400 less than a year ago.

- For the week ended November 4, there were 217,000 new claims for unemployment insurance, a decrease of 3,000 from the previous week’s level, which was revised up by 3,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended October 28 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended October 28 was 1,834,000, an increase of 22,000 from the previous week’s level, which was revised down by 6,000. States and territories with the highest insured unemployment rates for the week ended October 21 were California (2.0%), Hawaii (2.0%), New Jersey (2.0%), Puerto Rico (1.9%), New York (1.6%), Oregon (1.6%), Alaska (1.5%), Massachusetts (1.5%), Rhode Island (1.5%), and Washington (1.5%). The largest increases in initial claims for unemployment insurance for the week ended October 28 were in Michigan (+2,227), North Carolina (+1,303), California (+842), Minnesota (+767), and Iowa (+613), while the largest decreases were in New York (-1,942), Oregon (-405), Georgia (-348), Florida (-302), and Ohio (-299).

Eye on the Week Ahead

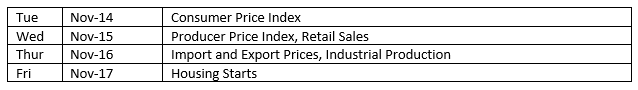

The focus is on inflation this week. The latest data of the Consumer Price Index for October is available. September saw consumer prices increase by 0.4% and 3.7% for the 12 months ended in September. Producer prices also edged higher in September, climbing 0.5%. However, import prices slowed more than anticipated in September after ticking up 0.1%. Conversely, export prices beat expectations, climbing 0.7%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.