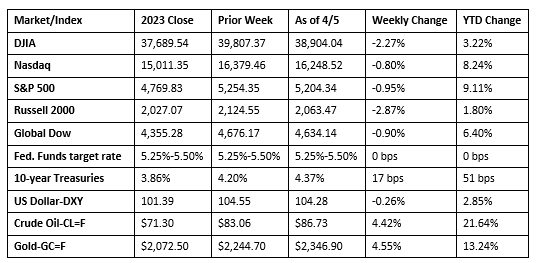

Despite a late-week surge, stocks closed lower last week. Investors saw the continued strength of the labor market (see below) as increasing the chances of a soft landing for the economy, while potentially delaying the Federal Reserve from cutting interest rates. Each of the benchmark indexes listed here lost value, with the Russell 2000 and the Dow falling more than 2.0%. Ten-year Treasury yields rose as bond prices slid. Communication services, energy, and materials were the only market sectors to end the week ahead. Gold prices continued to surge, while crude oil prices rose by over 4.4%. Rising inflation, increased travel, a reduction in production, and the ongoing conflicts in the Middle East have contributed to the rise in crude oil prices.

Stocks opened last week mixed on the first day of trading for the second quarter of the year. The Russell 2000 fell 1.0%, the Dow and the Global Dow dipped 0.6%, while the S&P 500 declined 0.2%. The Nasdaq eked out a 0.1% gain. Long-term bond prices fell, as yields rose 12.3 basis points on 10-year Treasuries, which closed the session at 4.32%. Crude oil prices rose $0.71 to reach about $83.88 per barrel. The dollar gained 0.4%, while gold prices jumped 1.4%.

Last Tuesday saw stocks slide as bond yields and crude oil prices vaulted higher. Each of the benchmark indexes listed here closed in the red, with the small caps of the Russell 2000 losing 1.8%. The Dow and the Nasdaq fell 1.0%, the S&P 500 dipped 0.7%, and the Global Dow declined 0.3%. Bond values continued to struggle as yields on 10-year Treasuries closed at 4.36%, nearing their highest levels in 2024. Crude oil prices rose to a nearly six-month high after settling at about $85.10 per barrel. The dollar lost 0.2%, while gold prices reached an all-time high after gaining 1.81% to close at $2,296.90 per ounce.

The Dow ticked down 0.1% to extend its losing streak to three days last Wednesday. The remaining benchmark indexes listed here posted gains, led by the Russell 2000 (0.5%), followed by the Global Dow (0.3%), the Nasdaq (0.2%), and the S&P 500 (0.1%). Investors paid particular attention to Federal Reserve Chair Jerome Powell’s comments that the Fed will not lower interest rates unless there is sustained evidence of decreasing inflation. He also mentioned that the Fed has been successful in navigating a soft landing despite the impact of higher rates on the economy. Ten-year Treasury yields inched down to 4.35%. Crude oil prices rose again, settling at about $85.66 per barrel. The dollar fell 0.5%, while gold prices rose 1.7%.

Wall Street closed notably in the red last Thursday as each of the benchmark indexes listed here lost value. The Dow dropped 1.4%, marking the largest single-day decline since March 2023. The Nasdaq fell 1.4%, the S&P 500 declined 1.2%, the Russell 2000 lost 1.1%, and the Global Dow dipped 0.3%. Bond prices rose higher as yields on 10-year Treasuries fell 4.6 basis points to 4.30%. Crude oil prices gained 1.5% to reach $86.69 per barrel. The dollar was flat, while the rally for gold prices ended as they fell 0.4%.

Stocks rebounded to close out the week last Friday. The Nasdaq led the benchmark indexes listed here, gaining 1.2%, followed by the S&P 500 (1.1%), the Dow (0.8%), and the Russell 2000 (0.5%). The Global Dow edged 0.1% lower. Ten-year Treasury yields gained 6.9 basis points to end the week at 4.37%. Crude oil prices ticked up minimally. The dollar rose 0.2%, while gold prices gained 1.5%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- March saw 303,000 new jobs added, well above expectations. In March, job gains occurred in health care, government, and construction. According to the latest information from the Bureau of Labor Statistics, the unemployment rate dipped 0.1 percentage point to 3.8%. The labor force participation rate rose from 62.5% to 62.7%. The employment-population ratio increased 0.2 percentage point to 60.3%. The total number of unemployed was little changed at 6.4 million, while the number of long-term unemployed (those jobless for 27 weeks or more), at 1.2 million, was little changed in March. The long-term unemployed accounted for 19.5% of all unemployed people. In March, average hourly earnings increased by $0.12, or 0.3%, to $34.69. Over the past 12 months, average hourly earnings have increased by 4.1%. While the pace of wage growth remained above the inflation rate, the latest year-over-year gain is the lowest since June of 2021. Last month, the average workweek edged up by 0.1 hour to 34.4 hours.

- Manufacturing production expanded in March, hitting a 22-month high, according to the S&P Global Manufacturing PMI®. Survey respondents noted the rate of job creation quickened, while new orders slowed somewhat, allowing firms to draw down inventories. Inflationary pressures drove up input costs and output prices.

- The S&P Global US Services PMI® Business Activity Index ticked down to a three-month low of 51.7 in March from 52.3 in February. That said, the index remained above the 50.0 mark, indicating a rise in business activity, albeit at a slower pace. The pace of growth of new orders was the slowest since November. With the slowdown in new orders, firms were able to reduce backlogs of work, which prompted service providers to expand their staffing.

- According to the Job Openings and Labor Turnover Survey, the number of job openings, at 8.8 million, was little changed in February from the prior month. The number of hires, at 5.8 million, increased by less than 200,000, while the number of separations advanced by slightly more than 100,000 to 5.6 million.

- The international trade in goods and services deficit increased in February by 1.9% to $68.9 billion. Exports rose by 2.3% and imports increased 2.2%. Year to date, the goods and services deficit decreased $3.9 billion, or 2.8%, from the same period in 2023. Exports increased $9.3 billion, or 1.8%. Imports increased $5.4 billion, or 0.8%.

- The national average retail price for regular gasoline was $3.517 per gallon on April 1, $0.006 per gallon less than the prior week’s price but $0.020 per gallon more than a year ago. Also, as of April 1, the East Coast price decreased $0.006 to $3.382 per gallon; the Midwest price fell $0.040 to $3.366 per gallon; the Gulf Coast price declined $0.060 to $3.116 per gallon; the Rocky Mountain price rose $0.059 to $3.351 per gallon; and the West Coast price increased $0.096 to $4.556 per gallon.

- For the week ended March 30, there were 221,000 new claims for unemployment insurance, an increase of 9,000 from the previous week’s level, which was revised up by 2,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended March 23 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended March 23 was 1,791,000, a decrease of 19,000 from the previous week’s level, which was revised down by 9,000. States and territories with the highest insured unemployment rates for the week ended March 16 were New Jersey (2.8%), California (2.5%), Rhode Island (2.5%), Massachusetts (2.3%), Minnesota (2.3%), Illinois (2.1%), New York (1.9%), Alaska (1.8%), Connecticut (1.8%), Montana (1.8%), Pennsylvania (1.8%), and Washington (1.8%). The largest increases in initial claims for unemployment insurance for the week ended March 23 were in Texas (+2,274), Missouri (+1,312), Oregon (+940), Illinois (+788), and Ohio (+785), while the largest decreases were in Michigan (-1,322), California (-538), Mississippi (-443), Connecticut (-440), and Iowa (-423).

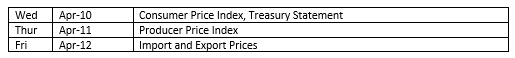

Eye on the Week Ahead

Inflation data is available this week with the release of the March Consumer Price Index. The CPI has been trending higher on a monthly basis since the beginning of the year. Another increase may prompt a more hawkish response from the Federal Reserve as to the timing of a reduction in interest rates.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.