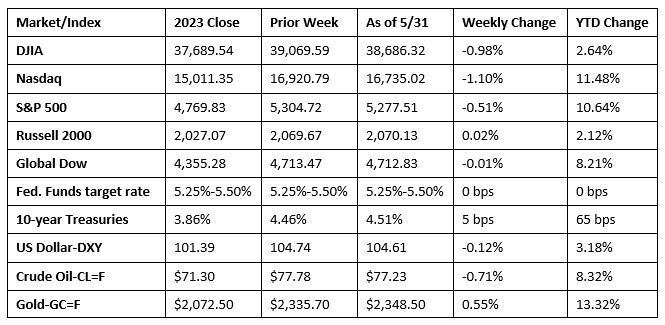

Equities generally closed lower by the end of the week with, the Nasdaq and the Dow falling furthest among the benchmark indexes listed here. The Russell 2000 and the Global Dow were flat. Investors spent the week assessing the first-quarter gross domestic product, jobless claims, and corporate earnings data. Ten-year Treasury yields rose as bond prices dipped, on hawkish comments from Federal Reserve officials and a weaker Treasury auction. Crude oil prices dipped and prices at the pump dipped lower. Utilities led the market sectors, with energy and real estate outperforming. Health care, industrials, and information technology closed in the red.

Stocks opened mixed to begin the holiday-shortened week. The Nasdaq reached another record high after gaining 0.6%, while the S&P 500 ticked up less than 0.1%. The Dow fell 0.6%, the Global Dow lost 0.2%, and the Russell 2000 dipped 0.1%. Ten-year Treasury yields rose 7.5 basis points to 4.54%. Investors reacted to Federal Reserve officials who maintained a hawkish stance and would not rule out another rate hike if inflationary pressures accelerated. Ten-year bond yields jumped following weak Treasury auctions of two- and five-year notes. A surge in stock values of a major chip maker helped drive up the Nasdaq. Crude oil prices climbed $2.45 to $80.17 per barrel amid speculation that OPEC+ would extend output cuts into the second half of the year. The dollar was flat, while gold prices rose 1.1%.

Wall Street endured another rough day last Wednesday as rising bond yields continued to cut into a preference for stocks. The small caps of the Russell 2000 lost 1.5%, the Global Dow dropped 1.4%, the Dow fell 1.1%, the S&P 500 declined 0.7%, and the Nasdaq fell 0.6%. On the other hand, 10-year bond yields climbed to 4.62%, reflective of a disappointing government debt auction. Crude oil prices fell to $79.00 per barrel. The dollar gained 0.5%, while gold prices fell 0.8%.

The markets closed last Thursday mostly lower, with the Nasdaq (-1.1%), the Dow (-0.87%), and the S&P 500 (-0.6%) losing value, while the Russell 2000 (+1.0%) and the Global Dow (+0.3%) advanced. Ten-year Treasury yields ended a streak of gains, falling 7.0 basis points to 4.55%. Crude oil prices fell to $77.93 per barrel. The dollar declined 0.3%, and gold prices dipped 0.1%. Tech and consumer shares led the overall market downturn after the first-quarter GDP was revised down to 1.3% (see below).

Stocks rebounded last Friday, led by the Dow, which advanced 1.5%. The S&P 500 and the Global Dow rose 0.8%, the Russell 2000 advanced 0.7%, while the Nasdaq was unchanged. Ten-year Treasury yields fell 4.0 basis points to 4.51%. Crude oil prices decreased about $0.70 per barrel. The dollar lost 0.1%, while gold prices fell 0.7%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Gross domestic product increased at an annual rate of 1.3% in the first quarter of 2024, according to the second estimate from the Bureau of Economic analysis. In the fourth quarter, GDP rose 3.4%. April’s initial, or advance, estimate showed first-quarter GDP rose 1.6%. A downward revision to consumer spending largely accounted for the decrease. Compared to the fourth quarter, the personal consumption expenditures (PCE) price index increased 3.3%, a downward revision of 0.1 percentage point. Excluding food and energy prices, the PCE price index increased 3.6%, a downward revision of 0.1 percentage point. In the first quarter, consumer spending rose 2.0%, nonresidential fixed investment advanced 3.3%, and residential fixed investment climbed 15.4%. Exports increased 1.2%, while imports, which are a negative in the calculation of GDP, increased 7.7%.

- Personal income advanced 0.3% in April, while disposable (after-tax) income rose 0.2%. Consumer spending slowed significantly in April, falling from 0.7% in both February and March, to 0.2% in April. Consumer prices for goods and services increased 0.3% in April for the third consecutive month. Excluding food and energy, prices rose 0.2%. Since April 2023, consumer prices advanced 2.7%, unchanged from the previous 12-month period. Prices less food and energy climbed 2.8%.

- The international trade in goods deficit was $99.4 billion in April, up $7.1 billion from $92.3 billion in March. Exports of goods for April were $169.9 billion, $0.9 billion more than March exports. Imports of goods for April were $269.3 billion, $8.0 billion more than March imports.

- The national average retail price for regular gasoline was $3.577 per gallon on May 27, $0.007 per gallon below the prior week’s price but $0.006 per gallon more than a year ago. Also, as of May 27, the East Coast price rose $0.010 to $3.485 per gallon; the Midwest price increased $0.027 to $3.459 per gallon; the Gulf Coast price decreased $0.001 to $3.112 per gallon; the Rocky Mountain price decreased $0.076 to $3.354 per gallon; and the West Coast price declined $0.053 to $4.571 per gallon.

- For the week ended May 25, there were 219,000 new claims for unemployment insurance, an increase of 3,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended May 18 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended May 18 was 1,791,000, an increase of 4,000 from the previous week’s level, which was revised down by 7,000. States and territories with the highest insured unemployment rates for the week ended May 11 were New Jersey (2.3%), California (2.2%), Illinois (1.6%), Massachusetts (1.6%), Nevada (1.6%), New York (1.6%), Rhode Island (1.6%), Washington (1.6%), Alaska (1.5%), and Pennsylvania (1.4%). The largest increases in initial claims for unemployment insurance for the week ended May 18 were in Texas (+798), Michigan (+775), Missouri (+461), Oklahoma (+334), and New Jersey (+310), while the largest decreases were in California (-2,460), Indiana (-1,105), New York (-626), Florida (-612), and Minnesota (-522).

Eye on the Week Ahead

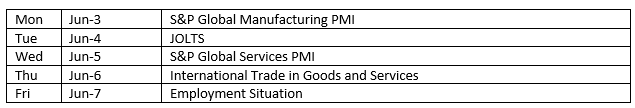

The manufacturing and services surveys for May are out this week. April saw growth in both sectors slow. The employment figures for May are also available this week. April saw a significant downturn in the number of new jobs added, leading to guarded optimism that the Fed may be more inclined to lower interest rates.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.