Every May, interest rates on federal student loans are reset for the upcoming school year. The rates are calculated by combining the yield on the 10-year U.S. Treasury note with an extra fixed amount set by Congress.

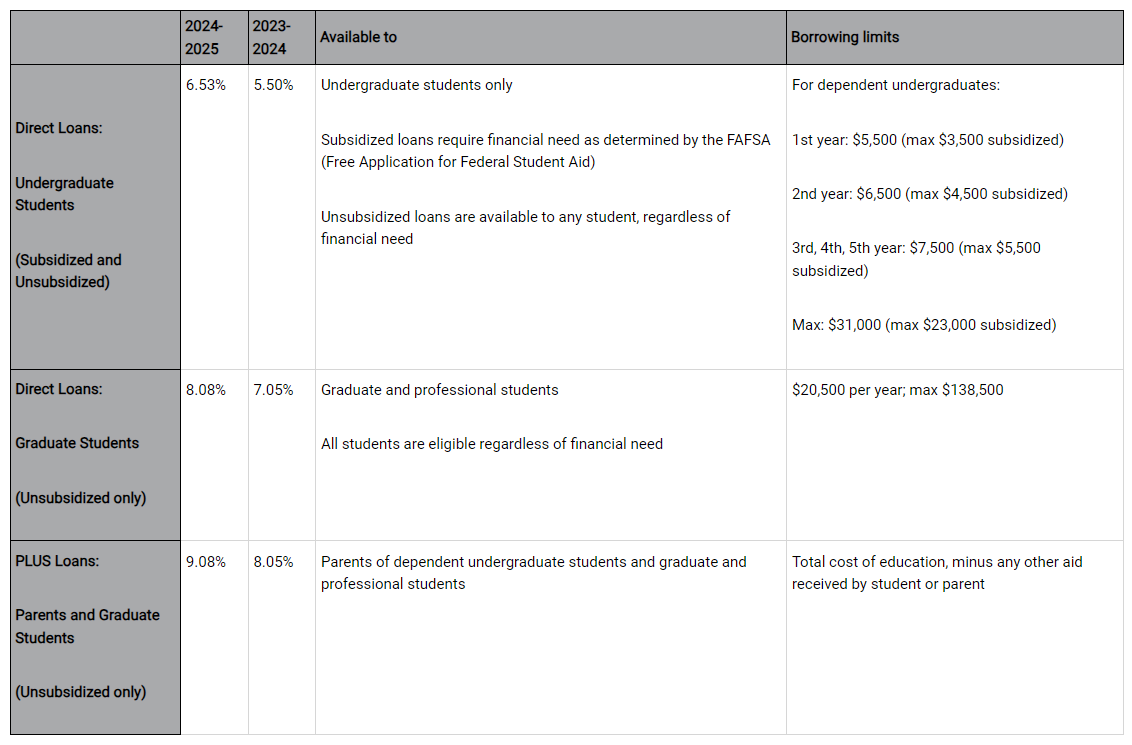

Based on this calculation, interest rates on federal student loans are set to increase for the 2024-2025 school year by more than 1%, the fourth straight year of increases.1 According to financial aid expert Mark Kantrowitz, the new rate for undergraduate Direct Loans is the highest in over a decade, while the new rates for graduate Direct Loans and graduate and parent PLUS Loans are at the highest level in more than 20 years.2 The rates apply to new federal student loans issued July 1, 2024, through June 30, 2025, and the interest rate is fixed for the life of the loan.

Ongoing inflationary pressures have played a part in the higher rates, similar to last year. The federal funds rate set by the Federal Open Market Committee of the Federal Reserve directly influences the yield on the 10-year Treasury note, which in turn influences the interest rate on federal student loans.

1) U.S. Department of Education, 2024

2) CNBC.com, May 14, 2024