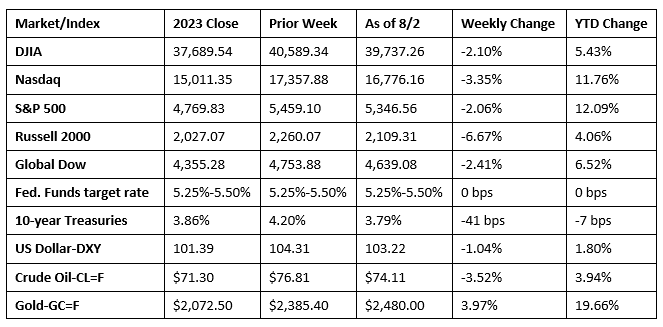

Wall Street experienced a notable downturn last week, with each of the benchmark indexes closing sharply in the red. A weaker-than-expected jobs report, rising unemployment claims, disappointing corporate earnings from major tech firms, and falling manufacturing data prompted the major sell-off last week. Evidence of a slowing economy may prompt the Federal Reserve to cut interest rates in September, but many analysts and investors believe the Fed is behind the curve in cutting rates, especially when other central banks have already done so. There was a huge swing in the market sectors last week, where utilities (4.5%) and real estate (3.9%) turned sharply higher, while information technology (-4.1%), consumer discretionary (-3.8%), and energy (-3.4%) turned sharply lower. Bond prices jumped higher as demand increased, pulling yields lower. Ten-year Treasury yields fell to their lowest level since December 2023. Crude oil prices dropped by more than 3.5%, while gold prices climbed higher.

The week kicked off with the Nasdaq, the S&P 500, and the Global Dow ticking up minimally, while the Dow dipped 0.1% and the Russell 2000 fell 1.1%. Investors awaited the release of quarterly earnings from several tech companies, the outcome of the Federal Reserve’s latest meeting, and labor data for July. Bond prices held steady, with yields on 10-year Treasuries slipping to 4.17%. Crude oil prices continued to fade, down 1.7% to $75.83 per barrel. The dollar gained 0.2%, while gold prices were essentially unchanged.

Last Tuesday saw investors flee stocks, particularly tech shares, and move to bonds after an acceleration of the unrest in the Middle East and ahead of the Fed’s meeting on Wednesday. The tech-heavy Nasdaq lost 1.3%, while the S&P 500 fell 0.5% behind weakness in technology, consumer discretionary, and consumer staples. However, the Dow (0.5%), the Russell 2000 (0.4%), and the Global Dow (0.2%) moved higher. Demand for bonds drove prices up and pulled yields lower. Ten-year Treasury yields fell to 4.14%. Crude oil prices declined to $75.08 per barrel. The dollar was unchanged, while gold prices gained 1.2%.

Stocks closed up last Wednesday as investors were encouraged that interest rates may be reduced in September following statements from the Federal Open Market Committee and its chair, Jerome Powell. Each of the benchmark indexes listed here climbed higher, led by the Nasdaq (2.6%), followed by the S&P 500 (1.6%), the Global Dow (1.2%), the Russell 2000 (0.5%), and the Dow (0.2%). Tech stocks, which had been trending lower, reversed course, helping to drive the indexes higher. Ten-year Treasury yields dipped to 4.10%. The dollar fell nearly 0.5%, while gold prices rose 1.7%. Crude oil prices, which had been sinking, jumped 5.1% to $78.53 per barrel.

A sharp sell-off in chip stocks sent the markets reeling last Thursday. Each of the benchmark indexes ended the session firmly in the red, led by the Russell 2000 (-3.0%) and the Nasdaq (-2.3%). The remaining benchmarks fell between 1.2% and 1.6%. Ten-year Treasury yields declined 3.2%, or 13.3 basis points, settling at 3.97%, moving below the 4.00% level for the first time since February. Crude oil prices dropped to $76.90 per barrel. The dollar and gold prices gained 0.3% and 0.6%, respectively. Investors reacted to contraction in the manufacturing sector (see below) and jobless claims rising to an 11-month high.

Stocks plunged lower last Friday as investors saw unemployment claims rise and job gains fall. The interest-sensitive Russell 2000 lost 3.5%, followed by the Nasdaq (-2.4%), Global Dow (-2.1%), the S&P 500 (-1.8%), and the Dow (-1.5%). Ten-year Treasury yields dropped over 18.0 basis points, crude oil prices fell 2.9%, the dollar slipped 1.1%, while gold prices were unchanged.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Federal Open Market Committee met last week and decided to keep the target range at its current 5.25%-5.50%. However, it appears that if inflation continues to stabilize, the FOMC may lend more consideration to reducing interest rates when it next meets in September.

- Employment slowed in July, according to the latest data from the Bureau of Labor Statistics. Employment rose by only 114,000 last month, well below the 12-month average of 215,000. In July, employment continued to trend up in health care, in construction, and in transportation and warehousing, while information lost jobs. The number of unemployed, at 7.2 million, increased by 352,000 over June’s estimate. The unemployment rate increased for the second straight month in July, ticking up 0.2 percentage point to 4.3%. Both the number of unemployed and the unemployment rate are above the July 2023 estimates, at 5.9 million and 3.5%, respectively. The number of long-term unemployed (those jobless for 27 weeks or more) changed little at 1.5 million in July. This measure is up from 1.2 million a year earlier. The long-term unemployed accounted for 21.6% of all unemployed people in July. The labor force participation rate increased 0.1 percentage point to 62.7%, while the employment-population ratio dipped 0.1 percentage point to 60.0%. The May estimate was revised down by 2,000, from 218,000 to 216,000, and the change for June was revised down by 27,000, from 206,000 to 179,000. With these revisions, employment in May and June combined was 29,000 lower than previously reported. In July, average hourly earnings increased by $0.08, or 0.2%, to $35.07. Over the past 12 months, average hourly earnings have increased by 3.6%. The average workweek edged down by 0.1 hour to 34.2 hours in July.

- According to the latest Job Openings and Labor Turnover Summary, the number of job openings, at 8.2 million, was unchanged in June from May but was 941,000 less than the estimate from a year earlier. The number of hires (5.3 million) fell by 314,000, and 554,000 over the year. The number of total separations (5.1 million) declined by 302,000 and 544,000 from a year earlier.

- Manufacturing regressed in July as new orders declined for the first time in three months. The S&P Global US Manufacturing Purchasing Managers’ Index™ fell to 49.6 in July from 51.6 in June. A reading below 50.0 indicates contraction, which occurred for the first time in seven months. New orders decreased at the fastest pace in 2024. Some costs to manufacturers increased markedly in July as survey respondents noted increases in costs for energy, freight, labor, and raw materials. Nevertheless, the rate of overall cost inflation eased to a four-month low.

- The national average retail price for regular gasoline was $3.484 per gallon on July 29, $0.013 per gallon over the prior week’s price but $0.273 per gallon less than a year ago. Also, as of July 29, the East Coast price fell $0.014 to $3.395 per gallon; the Midwest price increased $0.050 to $3.476 per gallon; the Gulf Coast price rose $0.047 to $3.094 per gallon; the Rocky Mountain price advanced $0.072 to $3.395 per gallon; and the West Coast price decreased $0.031 to $4.106 per gallon.

- For the week ended July 27, there were 249,000 new claims for unemployment insurance, an increase of 14,000 from the previous week’s level. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended July 20 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended July 20 was 1,877,000, an increase of 33,000 from the previous week’s level, which was revised down by 7,000. This is the highest level for insured unemployment since November 27, 2021, when it was 1,878,000. States and territories with the highest insured unemployment rates for the week ended July 13 were New Jersey (2.7%), Rhode Island (2.6%), Puerto Rico (2.4%), California (2.2%), Minnesota (2.0%), Connecticut (1.8%), Massachusetts (1.8%), Pennsylvania (1.8%), Illinois (1.7%), Nevada (1.7%), New York (1.7%), and Washington (1.7%). The largest increases in initial claims for unemployment insurance for the week ended July 20 were in Texas (+5,962), Tennessee (+769), Delaware (+259), and the Virgin Islands (+7), while the largest decreases were in New York (-8,091), Michigan (-6,941), California (-5,326), Missouri (-3,610), and Kentucky (-3,301).

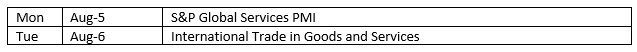

Eye on the Week Ahead

There isn’t much in terms of economic reports available this week. Of some interest is the S&P Global’s survey of service providers for July. The services sector has shown marked resilience during the period of restrictive economic policy and has steadily expanded.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.