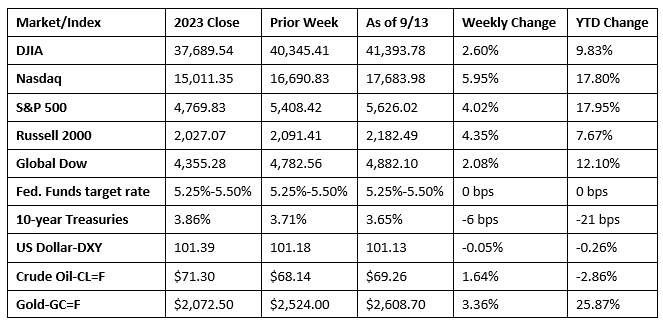

Equities rallied notably last week as investors awaited this week’s Federal Reserve meeting in anticipation of at least a 25.0-basis-point reduction in interest rates. Nine of the 11 market sectors ended last week higher, led by information technology. Only financials and energy lagged. The yield on 10-year Treasuries slipped to its lowest level since May 2023. Crude oil prices posted the first weekly advance in over a month. The dollar fell amid expectations of the aforementioned interest rate cut.

Investors took advantage of devalued stocks last Monday, sending values higher. Each of the benchmark indexes listed here gained ground, with the Dow, the NASDAQ, and the S&P 500 all climbing 1.2%. The Global Dow advanced 0.4%, while the Russell 2000 ticked up 0.3%. Ten-year Treasury yields continued the prior week’s tailspin, falling to 3.69%. Prices for crude oil gained 1.5% to close at $68.68 per barrel. The dollar and gold prices each increased 0.4%.

Equities closed mixed last Tuesday. For the second straight day, tech shares helped drive the NASDAQ (0.8%) and the S&P 500 (0.5%) higher, while bank and energy stocks dragged the Dow (-0.2%) lower. The Global Dow dipped 0.2%, while the small caps of the Russell 2000 ended the session flat. Investors were occupied with the presidential debate that evening, plus the Consumer Price Index report released on Wednesday. Bond prices continued to move higher, pulling yields down. Ten-year Treasury yields fell 5.1 basis points to 3.64%. Crude oil prices declined to $66.24 per barrel, the lowest price since 2021. For the last several months, oil prices have been impacted by weakening demand in China, coupled with OPEC’s 2024 and 2025 downwardly revised demand projections. The dollar edged up 0.1%, and gold prices rose 0.5%.

Stocks climbed higher last Wednesday following the presidential debate and a favorable CPI report. Once again, tech stocks led the charge, helping to propel each of the benchmark indexes listed here. The NASDAQ rose 2.2%, followed by the S&P 500 (1.1%), the Russell 2000 and the Dow (0.3%), and the Global Dow (0.1%). Crude oil prices rallied, climbing 2.2% to $67.19 per barrel. Yields on 10-year Treasuries ticked up to 3.65%. The dollar inched up 0.1%, while gold prices slipped 0.1%. Investors were encouraged by the CPI, which came in at an annual rate of 2.5%, the lowest since February 2021.

Wall Street enjoyed a second straight positive day of trading last Thursday. Stocks saw gains in most sectors, with technology, megacaps, and AI shares moving higher. The small caps of the Russell 2000 (1.2%) led the benchmark indexes, followed by the Global Dow (1.1%), the NASDAQ (1.0%), the S&P 500 (0.8%), and the Dow (0.6%). Ten-year Treasury yields inched up to 3.68%. Crude oil prices rose 2.8% to $69.18 per barrel. The dollar lost 0.4%, while gold prices advanced 1.8%.

Stocks closed the week higher last Friday. Each of the benchmark indexes posted solid gains, with the Russell 2000 leading the charge after climbing 2.5%. The Dow and the NASDAQ added 0.7%, the Global Dow rose 0.6%, and the S&P 500 advanced 0.5%. Yields on 10-year Treasuries fell to 3.65%. Crude oil prices ticked up 0.4% to $69.26 per barrel. The dollar dipped 0.2%, while gold prices rose 1.1%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Consumer Price Index increased 0.2% in August and 2.5% over the last 12 months. This is the smallest 12-month increase since February 2021. Excluding food and energy prices, the CPI rose 0.3% last month (0.2% in July) and 3.2% since August 2023. The index for shelter rose 0.5% in August and was the main factor in the all items increase. The food index increased 0.1% in August after rising 0.2% in July. The energy index fell 0.8% over the month after being unchanged the preceding month. Over the last 12 months, prices for food rose 2.1%, energy fell 4.0%, and shelter rose 5.2%.

- Prices at the producer level increased 0.2% in August, in line with expectations. Over the last 12 months, producer prices rose 1.7%. The August increase was attributable to a rise in prices for services. Nearly 60.0% of the increase in prices for services was due to a 0.3% advance in prices for services less trade, transportation, and warehousing. Prices for goods were unchanged last month. Goods prices less foods, energy, and trade services advanced 0.3% in August, the same as in July. For the 12 months ended in August, prices less foods, energy, and trade services moved up 3.3%.

- According to the monthly Treasury statement of receipts and outlays, the August deficit was $380.00 billion, well above the $244.00 billion deficit for July and higher than the August 2023 surplus of $89.00 billion. With only one more month left in the fiscal year, the total deficit sat at $1,897.00 trillion, $373.00 billion above the deficit over the same period last fiscal year.

- U.S. import prices declined 0.3% in August after increasing 0.1% in both June and July. The August monthly decline was the largest drop since December 2023, when prices fell 0.7%. Most of the August decrease in import prices is attributable to import fuel prices, which decreased 3.0% in August after increasing 1.1% the previous month. The August drop in fuel prices was the largest one-month decline since prices fell 8.0% in December 2023. Despite the August decline, import prices rose 0.8% over the past 12 months. Prices for U.S. exports fell 0.7% in August after advancing 0.5% the previous month. Lower prices for nonagricultural and agricultural exports each contributed to the decrease in export prices in August. Over the last 12 months, export prices declined 0.7%, the first year-over-year price drop since April 2024.

- The national average retail price for regular gasoline was $3.236 per gallon on September 9, $0.053 per gallon under the prior week’s price and $0.586 per gallon less than a year ago. Also, as of September 9, the East Coast price fell $0.084 to $3.149 per gallon; the Midwest price decreased $0.073 to $3.098 per gallon; the Gulf Coast price dipped $0.044 to $2.800 per gallon; the Rocky Mountain price declined $0.044 to $3.357 per gallon; and the West Coast price rose $0.003 to $4.104 per gallon.

- For the week ended September 7, there were 230,000 new claims for unemployment insurance, an increase of 2,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended August 31 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended August 31 was 1,850,000, an increase of 5,000 from the previous week’s level, which was revised up by 7,000. States and territories with the highest insured unemployment rates for the week ended August 24 were New Jersey (2.8%), Rhode Island (2.6%), California (2.1%), Puerto Rico (2.0%), Connecticut (1.9%), Minnesota (1.9%), Massachusetts (1.8%), New York (1.8%), Nevada (1.7%), Pennsylvania (1.7%), and Washington (1.7%). The largest increases in initial claims for unemployment insurance for the week ended August 31 were in Massachusetts (+2,230), Wisconsin (+820), Ohio (+806), Pennsylvania (+724), and Washington (+399), while the largest decreases were in Texas (-1,396), New York (-1,185), North Dakota (-919), California (-833), and Indiana (-796).

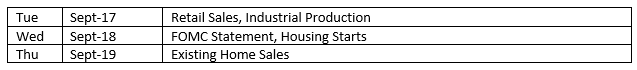

Eye on the Week Ahead

The focus will be squarely on the Federal Open Market Committee, which meets this week for the first time since July. Many observers predict that the Fed will cut rates by 50.0 basis points in light of inflation moving closer to the 2.0% Fed target and the slowdown in employment.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.