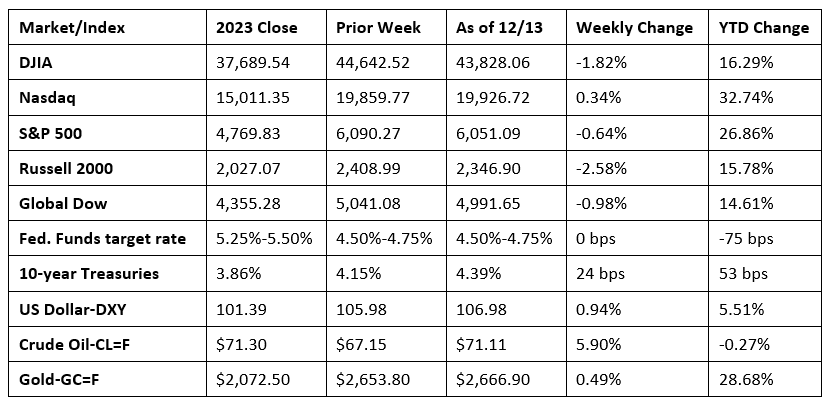

Stocks pulled back last week as tech shares pared gains from the prior week. The NASDAQ posted a minimal gain, while the S&P 500 retreated from recent record highs. Nine of the 11 market sectors declined last week, with only consumer discretionary and communication services advancing. Investors will be paying close attention to the Federal Open Market Committee, which meets December 17-18, at which time the Committee will have to decide if the recent uptick in price inflation is sufficient to defer another interest rate cut. While the November Consumer Price Index and Producer Price Index came in as expected (see below), data from both sources showed inflationary pressures moved further away from the Fed’s 2.0% target. This trend, coupled with a solid labor market, opens the possibility that the Committee may decide to wait until the January 2025 meeting before considering a further interest rate reduction. Nevertheless, the consensus remains that the Fed will reduce the federal funds rate by 25.0 basis points when it meets this week. Crude oil prices rose to their highest levels in three weeks, buoyed by expectations of an increase in demand following China’s economic stimulus and potential supply disruptions resulting from U.S. sanctions on Iran and Russia.

Wall Street saw stocks trend lower to kick off last week. Each of the benchmark indexes listed here lost value. The NASDAQ, the Russell 2000, and the S&P 500 each fell 0.6%. The Dow lost 0.5%, and the Global Dow dipped 0.2%. A Chinese government antitrust probe into a major AI company saw its shares tumble, which led a retreat in tech stocks. Investors also may have been reticent about risk pending the upcoming inflation data and next week’s Federal Reserve meeting. The yield on 10-year Treasuries rose 4.8 basis points to 4.20%. Crude oil prices advanced to $68.11 per barrel. The dollar gained 0.1%, and gold prices climbed 0.8%.

Stocks continued to slide last Tuesday as investors awaited the upcoming Consumer Price Index report. The Global Dow fell 0.5%, while the Russell 2000 lost 0.4%. The NASDAQ, the S&P 500, and the Dow each declined 0.3%. Ten-year Treasury yields climbed to 4.22%. Crude oil prices, at $68.38 per barrel, changed marginally. The dollar gained 0.3%, while gold prices rose 1.2%.

Following two days of losses, stocks climbed higher last Wednesday, led by a jump in tech shares, while stocks in communication services and consumer discretionary also trended higher. The NASDAQ gained 1.8% to reach a record high. The S&P 500 climbed 0.8%, the Russell 2000 advanced 0.6%, and the Global Dow rose 0.2%. The Dow slipped 0.2%. Bond prices fell, pushing yields higher, with 10-year Treasuries advancing to 4.27%. Crude oil prices surged 2.5% to $70.31 per barrel as supply concerns increased following the European Union’s approval of sanctions against Russian oil exports. The dollar rose 0.3%, and gold prices moved up 1.3%.

Last Thursday, a jump in producer prices (see below) and unemployment claims (see below) cooled investors’ appetite for risk. The Russell 2000 fell 1.4%. The NASDAQ slid 0.7%, the Dow and the S&P 500 dropped 0.5%, and the Global Dow dipped 0.3%. Ten-year Treasury yields gained 5.3 basis points to close at 4.32%. Crude oil prices declined 0.3% to settle at $70.08 per barrel. The dollar gained 0.3%, while gold prices fell 1.9%.

Stocks closed mostly lower last Friday, with only the NASDAQ ticking up 0.1%. The S&P 500 was unchanged, while the Russell 2000 dropped 0.6%, and both the Dow and the Global Dow fell 0.2%. Yields on 10-year Treasuries gained 7.5 basis points. Crude oil prices ended an up-and-down week by climbing 1.7%. The dollar was flat, while gold prices fell 1.6%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Consumer Price Index posted the largest gain in seven months after climbing 0.3% in November. For the 12 months ended in November, the CPI advanced 2.7%, up 0.1 percentage point from the comparable period ended in October. Core prices, excluding the more volatile food and energy prices, also advanced 0.3% last month and 3.3% over the last 12 months. Food prices increased 0.4% last month, driven by a 0.5% jump in prices for food at home. For the year, prices for food advanced 2.4%. Energy prices rose 0.2% in November but declined 3.2% over the last 12 months. Other categories that saw price increases in November include shelter, used cars and trucks, household furnishings and operations, medical care, new vehicles, and recreation. Prices for communication were among the few major categories that decreased over the month. Shelter costs rose 0.3% for the month and 4.7% for the year. While the latest increases in shelter costs showed some moderation, at nearly 40% of the total basket of goods and services, shelter costs continue to keep the CPI above the Federal Reserve’s 2.0% target.

- Prices at the wholesale level rose 0.4% in November, according to the latest Producer Price Index. Prices increased 0.3% (revised) the prior month. For the 12 months ended in November, producer prices advanced 3.0%, up 0.8 percentage point from the 12-month period ended in October. This was the largest 12-month increase since prices rose 4.7% for the year ended in February 2023. According to the Bureau of Labor Statistics, nearly 60.0% of the increase in the November PPI was attributable to a 0.7% increase in prices for goods. Prices for services moved up 0.2%. Food prices jumped 3.1% last month after being flat in October and have risen 5.1% since November 2023. Prices less food and energy increased 0.2% last month and 3.4% for the year. Prices less food, energy, and trade services inched up 0.1% in November and 3.5% for the last 12 months.

- The Treasury budget deficit for November was $367 billion, well above the October estimate and $53 billion more than the deficit from last November. Contributing to the November deficit were outlays for military active duty and retirement, veterans benefits, Supplemental Security Income, and Medicare payments to health maintenance organizations and prescription drug plans, which accelerated into November, because December 1, 2024, the normal payment date, fell on a non-business day. According to the Department of the Treasury report, November has been a deficit month 70 out of 71 fiscal years. Through the first two months of fiscal year 2025, the cumulative deficit is $624 billion.

- Prices for imports increased 0.1% for the second consecutive month in November and 1.3% over the last 12 months, the largest one-year advance since the period ended July 2024. After declining 0.8% in October, import fuel prices rose 1.0% in November, greatly contributing to the overall increase in import prices. Import prices excluding fuel were unchanged in November. Export prices were unchanged in November after increasing 1.0% the previous month. Higher nonagricultural prices in November offset lower agricultural prices. Export prices rose 0.8% over the past year, the largest 12-month advance since a 1.2% increase from July 2023 to July 2024.

- The national average retail price for regular gasoline was $3.008 per gallon on December 9, $0.026 per gallon below the prior week’s price and $0.128 per gallon less than a year ago. Also, as of December 9, the East Coast price ticked up $0.010 to $2.999 per gallon; the Midwest price decreased $0.094 to $2.808 per gallon; the Gulf Coast price rose $0.022 to $2.603 per gallon; the Rocky Mountain price declined $0.001 to $2.786 per gallon; and the West Coast price decreased $0.036 to $3.827 per gallon.

- For the week ended December 7, there were 242,000 new claims for unemployment insurance, an increase of 17,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended November 30 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended November 30 was 1,886,000, an increase of 15,000 from the previous week’s level. States and territories with the highest insured unemployment rates for the week ended November 23 were New Jersey (2.2%), Alaska (2.0%), Washington (2.0%), California (1.8%), Puerto Rico (1.8%), Rhode Island (1.8%), Minnesota (1.7%), Nevada (1.7%), Massachusetts (1.6%), and New York (1.6%). The largest increases in initial claims for unemployment insurance for the week ended November 30 were in Wisconsin (+1,785), North Dakota (+1,004), Kentucky (+731), Pennsylvania (+642), and Iowa (+252), while the largest decreases were in California (-10,113), Texas (-5,996), Florida (-2,373), Georgia (-2,239), and New York (-1,946).

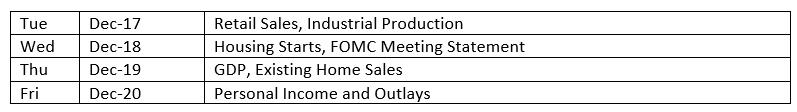

Eye on the Week Ahead

The Federal Reserve meets for the last time this year. Many expect the Fed to drop interest rates by 25.0 basis points. The third and final estimate of gross domestic product for the third quarter is also out this week. The last reading had the economy expanding at an annualized rate of 2.8%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.