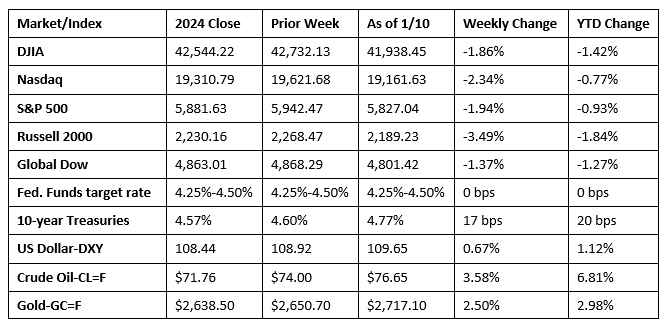

Stocks fell sharply last week as favorable economic data furthered sentiment that the Federal Reserve would keep interest rates elevated for a longer period of time this year. Each of the benchmark indexes lost value with only energy and health care advancing, while the remaining market sectors ended the week in the red. Crude oil prices rose to levels not seen since October as new sanctions against Russia’s oil sector raised concerns of global supply disruptions. Ten-year Treasury yields ended the week at their highest levels in 14 months. The dollar index closed at its strongest rate since 2022. Gold prices climbed above $2,700.00 per ounce, extending gains for the fourth straight session.

A tech rally boosted the NASDAQ (1.2%) and the S&P 500 (0.6%) last Monday. The Global Dow gained 0.5%, while the Dow and the Russell 2000 each fell 0.1%. Ten-year Treasury yields closed the session at 4.61%. The surge in crude oil prices ended with prices tumbling 0.7% to $73.48 per barrel. The dollar lost 0.6%, while gold prices fell 0.3%.

The prior day’s tech rally proved short-lived as stocks tumbled last Tuesday. The NASDAQ fell 1.9%, followed by the S&P 500 (-1.1%), the Russell 2000 (-0.7%), the Dow (-0.4%), and the Global Dow (-0.3%). Investors may have surmised that favorable economic conditions will support fewer interest rate cuts, which dragged stocks lower, but sent bond yields higher. Ten-year Treasury yields closed at 4.68% after gaining 6.5 basis points. Crude oil prices rose 0.9% to $74.25 per barrel. The dollar advanced 0.4%, and gold prices rose 0.7%.

Stocks closed mixed last Wednesday as the Dow (0.3%) and the S&P 500 (0.2%) advanced, while the Russell 2000 (-0.5%), the Global Dow (-0.2%), and the NASDAQ (-0.1%) edged lower. Ten-year Treasury yields closed the session at 4.69%, near their highest level since 2008. Crude oil prices fell 1.3% to $73.30 per barrel. The dollar (0.4%) and gold prices (0.6%) climbed higher.

The U.S. stock market and the Nasdaq stock exchange were closed last Thursday, which was declared a national day of mourning for deceased President Jimmy Carter.

Wall Street took a tumble last Friday. A strong jobs report (see below) dampened hopes of more interest rate cuts by the Federal Reserve in 2025. The small caps of the Russell 2000 declined 2.2%. The Dow and the NASDAQ each lost 1.6%. The S&P 500 fell 1.5%, while the Global Dow dipped 1.3%. Ten-year Treasury yields rose to 4.77%, the dollar rose 0.4%, and gold prices increased 1.1%. Crude oil prices jumped 3.7%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Employment rose by 256,000 in December, well above the 2024 average monthly gain of 186,000. In December, employment trended up in health care, government, and social assistance. Retail trade added jobs in December following a job loss in November. Employment for October was revised up by 7,000 to 43,000 but was revised down in November by 15,000 to 212,000. With these revisions, employment in October and November combined was 8,000 lower than previously reported. Employment rose by 2.2 million in 2024, down from 3.0 million in the previous year. The total number of unemployed in December was 6.9 million, a reduction of 235,000 from the November total. The unemployment rate ticked down 0.1 percentage point to 4.1%. After increasing earlier in the year, the unemployment rate has been either 4.1% or 4.2% for the past seven months. In December, the number of long-term unemployed (those jobless for 27 weeks or more) declined by 103,000 to 1.6 million but was up by 278,000 from a year earlier. The labor force participation rate was unchanged at 62.5%, while the employment-population ratio rose 0.2 percentage point to 60.0%. In December, average hourly earnings rose by $0.10, or 0.3%, to $35.69. Over the past 12 months, average hourly earnings have increased by 3.9%. The average workweek was 34.3 hours for the fifth month in a row.

- The S&P Global US Services PMI® Business Activity Index reached a 33-month high of 56.8 in December following a reading of 56.1 in November. According to a survey of purchasing managers by S&P Global, the services sector saw a strengthening in business activity and new orders in December as customers showed a greater willingness to spend following the results of the presidential election. With the number of orders growing, companies increased employment for the first time in five months. Meanwhile, cost inflation eased to the slowest pace in almost a year, with charges rising only modestly.

- The goods and services trade deficit report, released January 7, was for November 2024 and revealed the trade deficit was $78.1 billion, 6.2% above the October deficit. November exports were $273.4 billion, 2.7% more than October exports. November imports were $351.6 billion, 3.4% more than October imports. Year to date, the goods and services deficit increased $93.9 billion, or 13.0%, from the same period in 2023. Exports increased $111.5 billion, or 4.0%. Imports increased $205.3 billion, or 5.8%.

- According to the Job Openings and Labor Turnover Summary, the number of job openings was little changed at 8.1 million in November but was down by 833,000 from a year earlier. Job openings increased in professional and business services (+273,000), finance and insurance (+105,000), and private educational services (+38,000) but decreased in information (-89,000). The number of hires in November increased marginally at 5.3 million but was 300,000 under the November 2023 rate. The number of total separations in November was little changed at 5.1 million but was down by 287,000 over the year.

- The national average retail price for regular gasoline was $3.047 per gallon on January 6, $0.041 per gallon above the prior week’s price but $0.026 per gallon less than a year ago. Also, as of January 6, the East Coast price climbed $0.034 to $2.990 per gallon; the Midwest price increased $0.063 to $2.938 per gallon; the Gulf Coast price rose $0.042 to $2.655 per gallon; the Rocky Mountain price advanced $0.018 to $2.899 per gallon; and the West Coast price increased $0.023 to $3.793 per gallon.

- For the week ended January 4, there were 201,000 new claims for unemployment insurance, a decrease of 10,000 from the previous week’s level. This was the lowest level in 11 months. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended December 28 was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended December 28 was 1,867,000, an increase of 33,000 from the previous week’s level, which was revised down by 10,000. States and territories with the highest insured unemployment rates for the week ended December 21 were New Jersey (2.4%), Rhode Island (2.3%), Minnesota (2.2%), Washington (2.2%), Alaska (2.0%), California (2.0%), Massachusetts (1.9%), Illinois (1.8%), Montana (1.8%), Nevada (1.7%), New York (1.7%), and Pennsylvania (1.7%). The largest increases in initial claims for unemployment insurance for the week ended December 28 were in Michigan (+7,881), New Jersey (+5,731), Pennsylvania (+5,319), Massachusetts (+3,611), and Connecticut (+3,348), while the largest decreases were in California (-9,263), Texas (-8,351), Florida (-1,691), North Carolina (-1,456), and Tennessee (-1,412).

Eye on the Week Ahead

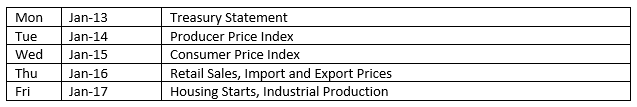

There’s plenty of important economic data released this week. Most of the economic reports will cover December and include annual figures for 2024. Most investors will pay particular attention to the Consumer Price Index, the Producer Price Index, and the report on industrial production.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.