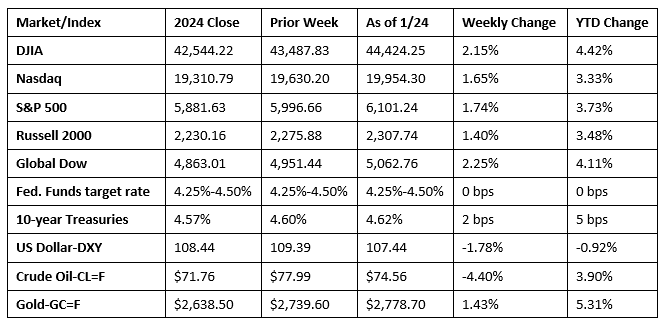

Wall Street closed up last week as investors considered the bevy of executive orders issued by President-elect Donald Trump during his first week in office. Each of the benchmark indexes listed here ended the week higher, led by the Global Dow and the Dow. Communication services, health care, and industrials outperformed among the market sectors, while energy lagged. Ten-year Treasury yields ticked higher. Crude oil prices dropped nearly 4.5%, the largest weekly decline since November. The dollar index extended its decline to a one-month low. Gold reached its highest level since October.

With the U.S. stock market closed last Monday in observance of Martin Luther King Jr. Day, investors had a little extra time to consider the impact of President Trump’s moves after his first day in office. Market gains were broad-based, with health care and industrials leading the sectors. Each of the benchmark indexes listed here advanced, led by the Russell 2000, which gained 1.9%. The Dow moved up 1.2%, followed by the S%P 500 (0.9%), while the NASDAQ and the Global Dow each advanced 0.6%. Ten-year Treasury yields slipped to 4.57%. Crude oil prices declined 2.3% to close at about $76.09 per barrel. The dollar fell 1.3%, while gold prices rose 0.2%.

Stocks continued to rally last Wednesday. The NASDAQ gained 1.3%, the S&P 500 rose 0.6%, the Dow rose 0.3%, and the Global Dow edged up 0.1%. The Russell 2000 declined 0.6%. Yields on 10-year Treasuries ticked up to 4.59%. Crude oil prices fell 0.6% to $75.41 per barrel. The dollar index moved up 0.2%, and gold prices climbed 0.3%.

Each of the benchmark indexes listed here posted solid gains last Thursday, with the S&P 500 (0.5%) reaching its first record high of 2025. The Dow added 0.9%, the Global Dow rose 0.8%, the Russell 2000 advanced 0.5%, and the NASDAQ gained 0.2%. The yield on 10-year Treasuries climbed to 4.63%. Crude oil prices fell again, closing at $74.28 per barrel. The dollar and gold prices edged lower.

The rally for stocks stalled last Friday as tech shares struggled. Among the benchmark indexes listed here, only the Global Dow (1.3%) was able to tick higher. The NASDAQ (-0.5%) fell the furthest, while the Dow, the S&P 500, and the Russell 2000 each declined 0.3%. The decline in crude oil prices continued, ten-year Treasury yields fell to 4.62%, the dollar slumped, while gold prices rose 0.5%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Sales of existing homes rose 2.2% in December, the strongest pace since February 2024. Year over year, sales increased 9.3%. Total inventory sat at a 3.3-month supply at the current sales pace. The median existing home price was $404,400 in December, unchanged from the November figure but 6.0% above the December 2023 estimate. Single-family home sales advanced 1.9% in December and were up 10.1% from a year ago. The median existing single-family home price was $409,300 in December, marginally ahead of the November rate, and up 6.1% from December 2023. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.96% as of January 23. That’s down from 7.04% one week ago but up from 6.69% one year ago.

- The national average retail price for regular gasoline was $3.109 per gallon on January 20, $0.066 per gallon above the prior week’s price and $0.047 per gallon higher than a year ago. Also, as of January 20, the East Coast price climbed $0.071 to $3.069 per gallon; the Midwest price increased $0.086 to $2.985 per gallon; the Gulf Coast price rose $0.026 to $2.691 per gallon; the Rocky Mountain price advanced $0.032 to $2.911 per gallon; and the West Coast price increased $0.061 to $3.871 per gallon.

- For the week ended January 18, there were 223,000 new claims for unemployment insurance, an increase of 6,000 from the previous week’s level. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended January 11 was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended January 11 was 1,899,000, an increase of 46,000 from the previous week’s level, which was revised down by 6,000. This is the highest level for insured unemployment since November 13, 2021, when it was 1,974,000. States and territories with the highest insured unemployment rates for the week ended January 4 were Rhode Island (3.2%), New Jersey (3.1%), Minnesota (2.7%), Washington (2.5%), Illinois (2.4%), Massachusetts (2.4%), California (2.3%), Connecticut (2.2%), Montana (2.2%), and Pennsylvania (2.2%). The largest increases in initial claims for unemployment insurance for the week ended January 11 were in Michigan (+14,985), California (+12,731), Texas (+11,439), Illinois (+5,634), and Missouri (+4,845), while the largest decreases were in New York (-15,396), Washington (-3,877), Wisconsin (-3,830), Oregon (-2,954), and Minnesota (-2,046).

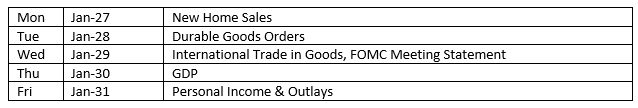

Eye on the Week Ahead

The Federal Open Market Committee meets for the first time this year, when the Committee is expected to keep the federal funds rate range at its current 4.25%-4.50%. Investors will be paying particular attention to any indications from the Fed of future interest rate decreases. An inflation indicator favored by the Fed is the personal consumption expenditures price index, which is out this week for December. Also available is the first iteration of gross domestic product for the fourth quarter of 2024.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.