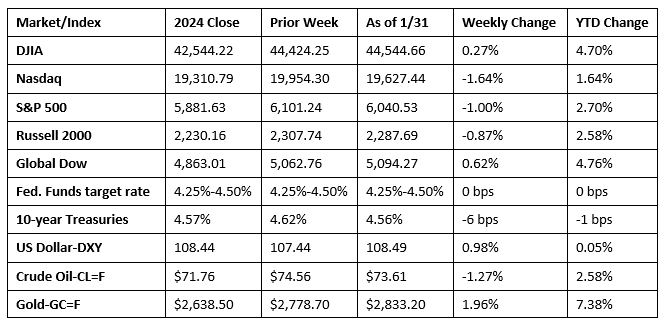

Stocks trended higher for much of last week until Friday, when a Friday slide pulled several of the benchmark indexes listed here lower. Only the Dow and the Global Dow ended the week with gains, while the NASDAQ, the S&P 500, and the Russell 2000 finished in the red. Last Friday, word that the president would enforce tariffs against Canada, China, and Mexico cooled investors’ appetite for risk, sending bond yields and the dollar higher. Crude oil prices ended the week on an uptick but not enough to prevent prices from closing last week lower.

Wall Street got off to a rough start last Monday as the tech sector took a dive, particularly several chip makers. The NASDAQ fell 3.1%, while the S&P 500 (-1.5%) and the Russell 2000 (-1.1%) trended lower. The Dow (0.7%) and the Global Dow (0.2%) closed higher. Ten-year Treasury yields fell to 4.52% as investors shunned stocks for bonds. Crude oil prices dipped to $73.05 per barrel. The dollar and gold prices closed in the red.

Last Tuesday, tech shares rebounded from the prior day’s downturn, leading stocks higher. The NASDAQ led the benchmark indexes listed here, gaining 2.0% by the close of trading. The S&P 500 climbed 0.9%, the Dow rose 0.3%, and the Russell 2000 added 0.2%. The Global Dow fell 0.1%. Ten-year Treasury yields closed at 4.55%. Crude oil prices reversed a stretch of losses, gaining 1.1% to settle at $74.00 per barrel. The dollar advanced 0.5%, while gold prices rose 1.2%.

Stocks trended lower last Wednesday after the Federal Reserve held interest rates unchanged, as expected. The NASDAQ and the S&P 500 each fell 0.5%, the Dow lost 0.3%, and the Russell 2000 slipped 0.2%. The Global Dow inched up 0.2%. Investors turned their focus to an upcoming batch of key corporate earnings, while continuing to assess potential tariffs and other aspects of President Trump’s economic policy. Ten-year Treasury yields remained unchanged at 4.55%. Crude oil prices slipped 1.2% to $72.92 per barrel. The dollar and gold prices each ticked up 0.1%.

Last Thursday saw stocks close higher after a choppy day of trading. The Russell 2000 (1.1%) and the Global Dow (0.7%) led the benchmark indexes listed here, followed by the S&P 500 (0.5%), the Dow (0.4%), and the NASDAQ (0.3%). Ten-year Treasury yields dipped 4.3 basis points to 4.51%. The dollar ticked up 0.1%, while gold prices rose 2.1%. Crude oil prices gained 0.8% to settle at $73.17 per barrel.

Stocks gave up gains last Friday after news that President Trump was pushing ahead with tariffs against China, Canada, and Mexico. The Russell 2000 lost 0.9%, followed by the Dow (-0.8%), the Global Dow (-0.6%), the S&P 500 (-0.5%), and the NASDAQ (-0.3%). Yields on 10-year Treasuries gained 5.7 basis points to settle at 4.56%. Crude oil prices climbed nearly 1.0%. The dollar jumped 0.7%, while gold prices fell 0.4%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Federal Open Market Committee met last week and decided, unanimously, to maintain the current federal funds target rate range at 4.25%-4.50%. While noting that both the economy and the labor market remained solid, inflation stayed elevated. The Committee made its decision despite President Trump’s request that it cut interest rates. Subsequent to the meeting, Fed Chair Jerome Powell indicated that the Fed needed to allow the economic policies of the Trump administration to be articulated prior to making any assessment.

- According to the advance estimate, gross domestic product increased at an annual rate of 2.3% in the fourth quarter of 2024. The third quarter GDP rose 3.1%. The increase in GDP in the fourth quarter primarily reflected increases in consumer spending (4.2%) and government spending (2.5%) that were partly offset by a decrease in investment (-5.6%). Imports, which are a subtraction in the calculation of GDP, decreased 0.8%. The personal consumption expenditures (PCE) price index rose 2.3% in the fourth quarter. The PCE price index excluding food and energy rose 2.5%.

- In December, personal income rose 0.4%, compared to a 0.3% increase in November. Personal consumption expenditures, a measure of consumer spending, jumped from 0.4% in November to 0.7% last month. Prices consumers paid for goods and services increased 0.3% in December after inching up 0.1% the previous month. Consumer prices less food and energy increased 0.2% last month following a 0.1% advance in November.

- Sales of new single-family homes rose 3.6% in December and 6.7% above the December 2023 estimate. For 2024, sales were 2.5% above the 2023 figure. Total inventory sat at an 8.5-month supply at the current sales pace. The median sales price was $427,000 in December, higher than the November price of $402,500 and above the December 2023 estimate of $418,300. For 2024, the average median sales price was $420,100. The average sales price in December was $513,600 ($485,000 in November), which exceeded the December 2023 price of $493,000. For 2024, the average sales price was $512,200 ($514,000 for 2023).

- New orders for manufactured durable goods in December, down four of the last five months, decreased 2.2%, according to the U.S. Census Bureau. This followed a 2.0% November decrease. Excluding transportation, new orders increased 0.3%. Excluding defense, new orders fell 2.4%. Transportation equipment, also down four of the last five months, drove the December decline, falling 7.4%. From December 2023, new orders for durable goods fell 1.5%.

- The advance report on the international trade in goods showed the deficit was $122.1 billion in December, up $18.6 billion, or 18.0%, from November. Exports of goods for December were $167.5 billion, $7.8 billion, or 4.5% less than November exports. Imports of goods for December were $289.6 billion, $10.8 billion, or 3.9%, more than November imports.

- The national average retail price for regular gasoline was $3.103 per gallon on January 27, $0.006 per gallon below the prior week’s price but $0.008 per gallon higher than a year ago. Also, as of January 27, the East Coast price climbed $0.007 to $3.076 per gallon; the Midwest price decreased $0.039 to $2.946 per gallon; the Gulf Coast price rose $0.005 to $2.696 per gallon; the Rocky Mountain price advanced $0.009 to $2.920 per gallon; and the West Coast price increased $0.010 to $3.881 per gallon.

- For the week ended January 25, there were 207,000 new claims for unemployment insurance, a decrease of 16,000 from the previous week’s level. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended January 18 was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended January 18 was 1,858,000, a decrease of 42,000 from the previous week’s level, which was revised up by 1,000. States and territories with the highest insured unemployment rates for the week ended January 11 were New Jersey (2.9%), Rhode Island (2.9%), California (2.5%), Minnesota (2.5%), Illinois (2.4%), Washington (2.4%), Massachusetts (2.3%), Montana (2.1%), Puerto Rico (2.1%), Alaska (2.0%), Michigan (2.0%), Pennsylvania (2.0%), and West Virginia (2.0%). The largest increases in initial claims for unemployment insurance for the week ended January 18 were in California (+5,725), West Virginia (+649), Arkansas (+312), the District of Columbia (+195), and Oklahoma (+135), while the largest decreases were in Michigan (-9,351), Texas (-7,323), Ohio (-5,314), Illinois (-5,304), and Georgia (-4,692).

Eye on the Week Ahead

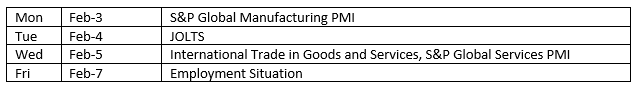

This week’s focus is on the labor sector with the releases of the JOLTS report and the employment situation. Overall, employment has been steady, which has factored into the Federal Reserve’s decision to maintain rates.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.