In 2024, nearly all S&P 500 sectors posted gains in a year defined by AI enthusiasm and a robust U.S. economy. Overall, 66% of companies ended the year in positive territory as the index achieved its best two-year performance since the late 1990s.

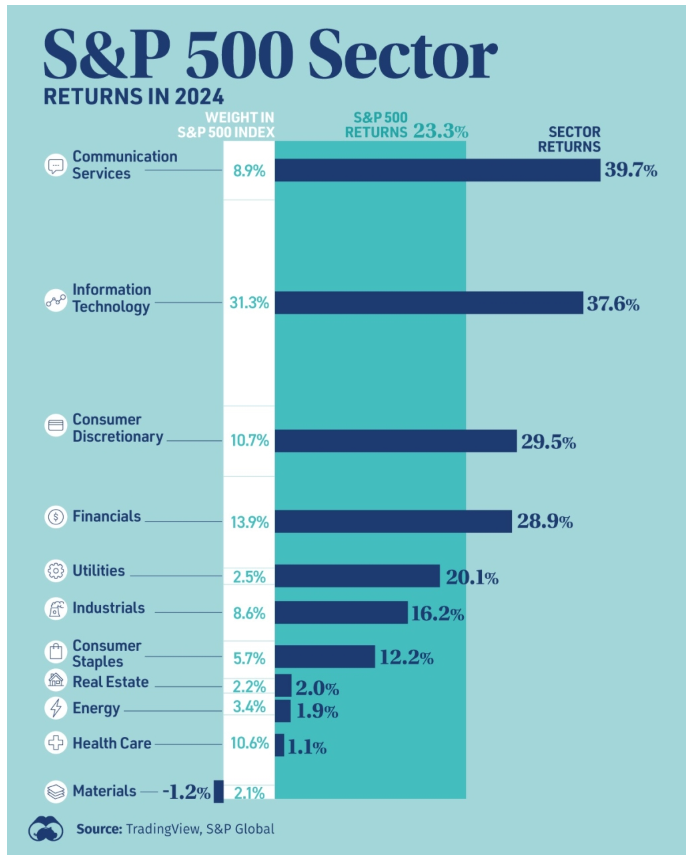

This graphic compares S&P 500 sector returns in 2024, along with each sector’s weight in the index.

Factors that influenced the stock market

Fueled by growth in digital advertising revenues and strong consumer spending, the communication services sector led the pack in 2024, followed closely by information technology. The outperformance of the top two sectors was driven largely by a small number of dominant technology companies.

With one of the lowest price-to-earnings ratios across S&P 500 sectors, financials also outperformed the index. The combination of interest rate cuts and Trump’s re-election boosted bank stocks, as lower interest rates tend to increase lending activity. Utilities experienced a sharp reversal from 2023 amid rising electricity demand from AI hyperscalers.

Materials was the only sector to see negative returns, weighed down by China’s economic slowdown and elevated interest rates.

As always, ever-changing economic and market conditions could impact stocks differently in 2025.

The investment return and principal value of stocks fluctuate with market conditions. Shares, when sold, may be worth more or less than their original cost. The S&P 500 Index is an unmanaged group of securities that is considered to be representative of the U.S. stock market in general. The performance of an unmanaged index is not indicative of the performance of any particular investment. Individuals cannot invest directly in an index. Rates of return will vary over time, particularly for long-term investments. Actual results will vary.

A portfolio invested only in companies in a particular industry or market sector may not be sufficiently diversified and could be subject to a significant level of volatility and risk. Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss.