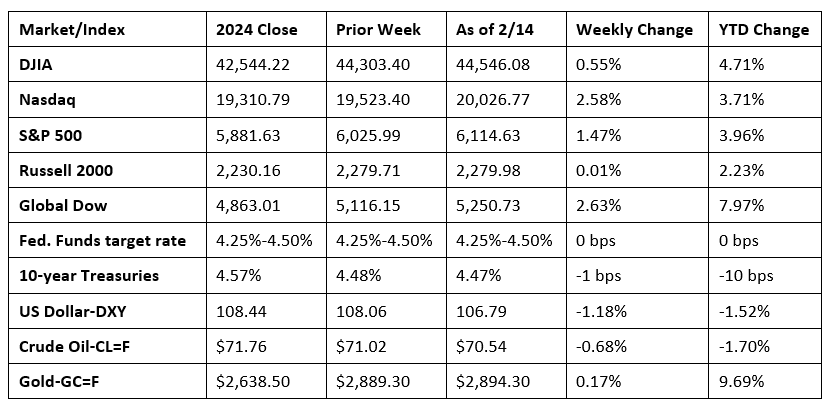

The markets ended the week higher, despite falling retail sales (see below) and ever-changing tariff proposals from the administration. Each of the benchmark indexes listed here gained ground, led by the Global Dow and the NASDAQ. Information technology and consumer staples led the market sectors, while consumer discretionary, health care, and financials underperformed. Crude oil prices trended lower, as did the dollar. Gold prices eked out a weekly gain.

Last week began on a high note as stocks made notable gains. The NASDAQ rose 1.0%, driven higher by gains in major tech stocks. The S&P 500 gained 0.7%, while the Dow and the Russell 2000 each advanced 0.4%. The Global Dow increased 0.3%. Yields on 10-year Treasuries ticked up to 4.49%. Crude oil prices jumped 2.0% to $72.44 per barrel on mounting supply concerns. The dollar index gained 0.3%, while gold prices rose 1.6%.

Stocks struggled last Tuesday following the announcement of new tariffs, which fueled concerns over a possible trade war. In addition, Fed Chair Jerome Powell reiterated that the Federal Open Market Committee was in no hurry to cut interest rates as the strength of the economy affords the chance to wait for inflationary pressures to move closer to the Fed’s 2.0% target. The Global Dow (0.4%) and the Dow (0.3%) climbed higher, while the S&P 500 was flat on the day. The Russell 2000 (-0.5%) and the NASDAQ (-0.4%) trended lower. Ten-year Treasury yields pushed higher, closing the session at 4.53%. Crude oil prices climbed 1.2% to settle at $73.17 per barrel. The dollar and gold prices lost value.

Last Wednesday saw stocks close mostly lower, with only the Global Dow (0.4%) adding value, while the NASDAQ was unchanged from the previous day. The Russell 2000 fell 0.8%, the Dow dropped 0.5%, and the S&P 500 lost 0.3%. January’s hot inflation report (see below) reinforced the cautious approach taken by the Fed, quelling hopes of interest rate cuts in the foreseeable future. Ten-year Treasury yields moved higher, reaching 4.63% by the close of trading. Crude oil prices gave back gains from the prior day, falling 2.7% to $71.31 per barrel. The dollar broke even, while gold prices dipped 0.3%.

Stocks climbed higher last Thursday despite a second batch of higher-than-expected inflation data. The NASDAQ gained 1.5%, the Global Dow rose 1.3%, the Russell 2000 advanced 1.2%, the S&P 500 moved up 1.0%, and the Dow added 0.8%. Yields on 10-year Treasuries cooled after dropping 11.2 basis points to close at 4.52%. Crude oil prices ticked up to $71.46 per barrel. The dollar lost 0.8%, while gold prices gained 1.0%.

Wall Street struggled to maintain gains last Friday, ending the session with mixed results. The NASDAQ and the Global Dow each rose 0.4%, while the Dow declined 0.4%. The Russell 2000 and the S&P 500 essentially broke even. Ten-year Treasury yields ticked lower, settling at 4.47%. Crude oil prices fell 1.1%. The dollar index slid 0.5%. Gold prices fell 1.7%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Consumer Price Index rose 0.5% in January, the largest one-month increase since August 2023. The January advance followed monthly advances of 0.4% in December and 0.3% in November. Excluding food and energy (core prices), prices rose 0.4% last month. Shelter costs rose 0.4% in January, accounting for nearly 30% of the monthly all items increase. Energy prices rose 1.1% over the month, as gasoline prices increased 1.8%. Prices for food also increased in January, rising 0.4%. Over the last 12 months, consumer prices increased 3.0%, after rising 2.9% over the 12 months ending December. Core prices rose 3.3% over the last 12 months. Over the same period, energy prices advanced 1.0% and prices for food increased 2.5%. While consumer prices have been ticking higher over the past several months, the January data offered more stark evidence that inflation is on the rise again, even before newly proposed tariffs influenced consumer prices.

- Wholesale prices moved higher in January. According to the latest report, the Producer Price Index rose 0.4% last month following an upwardly revised December increase of 0.5%. In January, prices for services increased 0.3%, and prices for goods advanced 0.6%. Prices less food and energy rose 0.3% in January, while prices less food, energy, and trade services also advanced 0.3%. Over the last 12 months, producer prices have risen 3.5%, the same increase as occurred for the 12 months ended in December.

- Retail sales, a measure of consumer spending, fell 0.9% in January but were up 4.2% from the previous year’s total. Excluding sales from motor vehicle and parts dealers and gasoline stations, retail sales fell 0.5% last month. Retail trade sales were down 1.2% from December 2024 but up 4.0% from last year. Sales for motor vehicle and parts dealers rose 6.4% from last year, while sales at food service and drinking places were up 5.4% from January 2024.

- Prices for U.S. imports increased 0.3% in January after advancing 0.2% in December. Higher fuel (+3.2%) and nonfuel (+0.1%) prices in January contributed to the overall increase in import prices. Prices for U.S. imports advanced 1.9% from January 2024 to January 2025. U.S. export prices rose 1.3% in January following a 0.5% advance the previous month. The January increase was the largest monthly advance since May 2022. U.S. export prices increased 2.7% over the past year, the largest 12-month advance since the year ended December 2022.

- Industrial production (IP) increased 0.5% in January after moving up 1.0% in December. In January, gains in the output of aircraft and parts contributed 0.2 percentage point to total IP growth following the earlier resolution of a work stoppage at a major aircraft manufacturer. Manufacturing output declined 0.1% in January, held down by a 5.2% decrease in manufacturing of motor vehicles and parts. Mining fell 1.2%, while utilities jumped 7.2%, as cold temperatures boosted the demand for heating. Total IP in January was 2.0% above its year-earlier level.

- The government deficit for January was $129.0 billion, $42.0 billion higher than the December deficit and $106.0 billion above the January 2024 deficit. Through the first four months of the fiscal year, the total deficit sits at $840.0 billion, over $300.0 billion higher than the cumulative deficit over the same period last year.

- The national average retail price for regular gasoline was $3.128 per gallon on February 10, $0.046 per gallon above the prior week’s price but $0.064 per gallon less than a year ago. Also, as of February 10, the East Coast price rose $0.031 to $3.050 per gallon; the Midwest price increased $0.066 to $2.985 per gallon; the Gulf Coast price fell $0.017 to $2.692 per gallon; the Rocky Mountain price advanced $0.053 to $3.020 per gallon; and the West Coast price increased $0.107 to $4.031 per gallon.

- For the week ended February 8, there were 213,000 new claims for unemployment insurance, a decrease of 7,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended February 1 was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended February 1 was 1,850,000, a decrease of 36,000 from the previous week’s level. States and territories with the highest insured unemployment rates for the week ended January 25 were New Jersey (2.9%), Rhode Island (2.9%), Minnesota (2.6%), California (2.4%), Illinois (2.4%), Massachusetts (2.4%), Washington (2.4%), Montana (2.3%), Pennsylvania (2.2%), Connecticut (2.0%), Michigan (2.0%), and New York (2.0%). The largest increases in initial claims for unemployment insurance for the week ended February 1 were in New York (+3,964), California (+3,418), Georgia (+1,049), Kansas (+855), and Texas (+798), while the largest decreases were in New Jersey (-978), Massachusetts (-854), Michigan (-493), Kentucky (-446), and Montana (-299).

Eye on the Week Ahead

The housing sector is prevalent this week with the latest data on housing starts and existing home sales for January. December saw both housing starts and completions surge, while the number of issued building permits lagged. Sales of existing homes increased in December and were up over 9.0% from a year earlier.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.