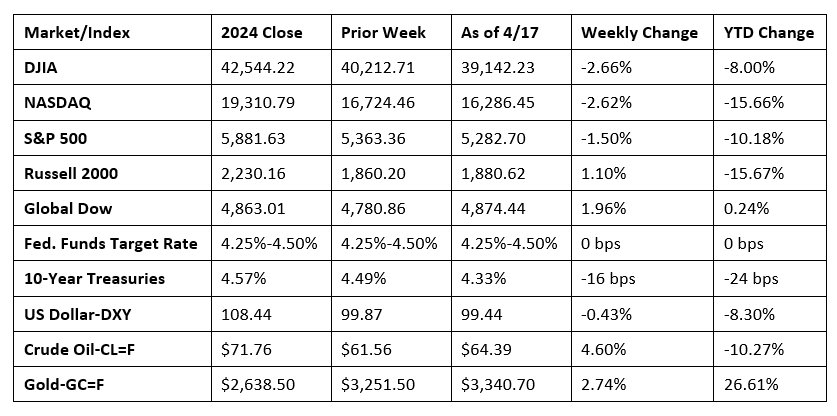

Stocks ended an abbreviated week of trading with mixed results as the U.S. markets closed a day early in observance of Good Friday. Throughout the week, investors weighed trade talks, interest rate uncertainty, and concerns of a global economic retreat. Big tech shares began the week on a positive note as investors hoped a temporary tariff exemption for electronics imports would remain in force. However, the optimism from earlier in the week proved short-lived as tech shares declined, pulled lower by some of the megacaps. By the close of trading, only the Russell 2000 and the Global Dow posted gains among the benchmark indexes listed here. Ten-year Treasury yields slipped lower as three straight days of declines more than offset last Thursday’s gains. Crude oil prices rose nearly 5.0% as sanctions targeting Iran’s oil exports stoked fears of increasing global supply constraints.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- U.S. import prices decreased 0.1% in March following a 0.2% increase in February. The decline in March import prices was the first since September 2024 and was largely attributable to a 2.3% decrease in import fuel prices. Since March 2024, import prices increased 0.9%. Export prices were unchanged in March after rising 0.5% in the previous month. U.S. export prices have not declined on a one-month basis since September 2024. Export prices advanced 2.4% from March 2024 to March 2025.

- Retail sales rose 1.4% in March after advancing 0.2% in February. From March 2024, retail sales increased 4.6%. Retail trade sales also increased 1.4% from February 2025, and 4.6% from last year. Motor vehicle and parts dealers sales were up 8.8% from last year, while nonstore (online) retail sales were up 4.8% from March 2024.

- According to the Federal Reserve’s report, industrial production decreased 0.3% in March but rose at an annual rate of 5.5% in the first quarter of 2025. The March decline in industrial production was driven by a 5.8% drop in utilities, as temperatures were warmer than is typical for the month. On the other hand, manufacturing rose 0.3% and mining advanced 0.6% last month. Overall, total industrial production in March was 1.3% above its year-earlier level.

- The number of issued residential building permits rose 1.6% in March but was 0.2% below the March 2024 rate. Single-family building permits in March were 2.0% below the February estimate. Residential housing starts in March were 11.4% below the prior month’s total but were 1.9% higher than the estimate from a year ago. Single-family housing starts in March were 14.2% under the February figure. Residential housing completions in March were 2.1% below the February estimate but 3.9% above the March 2024 figure. Completions of single-family houses in March were 0.9% higher than the February total.

- The national average retail price for regular gasoline was $3.168 per gallon on April 14, $0.075 per gallon below the prior week’s price and $0.460 per gallon less than a year ago. Also, as of April 14, the East Coast price ticked down $0.063 to $3.016 per gallon; the Midwest price decreased $0.095 to $3.008 per gallon; the Gulf Coast price fell $0.094 to $2.747 per gallon; the Rocky Mountain price decreased $0.067 to $3.098 per gallon; and the West Coast price declined $0.053 to $4.267 per gallon.

- For the week ended April 12, there were 215,000 new claims for unemployment insurance, a decrease of 9,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended April 5 was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended April 5 was 1,885,000, an increase of 41,000 from the previous week’s level, which was revised down by 6,000. States and territories with the highest insured unemployment rates for the week ended March 29 were New Jersey (2.6%), Rhode Island (2.5%), California (2.3%), Massachusetts (2.2%), Minnesota (2.2%), Washington (2.2%), Illinois (2.0%), the District of Columbia (1.9%), New York (1.8%), and Oregon (1.8%). The largest increases in initial claims for unemployment insurance for the week ended April 5 were in California (+5,410), Tennessee (+2,665), Oregon (+1,331), Virginia (+1,139), and Florida (+1,105), while the largest decreases were in Kentucky (-2,955), Iowa (-1,254), New York (-1,085), Kansas (-145), and Arkansas (-134).

Eye on the Week Ahead

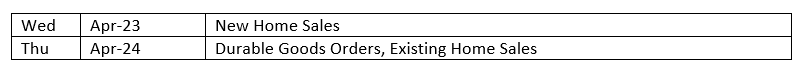

Economic reports focus on the real estate sector this week. The March data on sales of both new and existing homes is available. February was a good month for sales of existing homes and new single-family homes. However, mortgage rates have remained elevated, which could impact sales during the spring season.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.