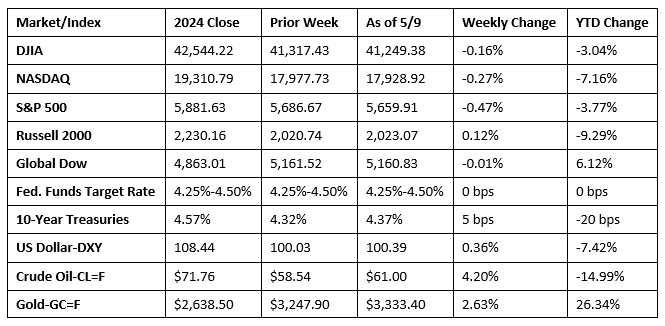

Stocks closed mostly lower last week as investors looked ahead to trade negotiations between the United States and China over the weekend. Despite the announcement of a trade deal between the United States and the United Kingdom, investors remained unsure of the extent of that deal and, more particularly, whether any meaningful progress would be made with China. As has been the case over the last several weeks, the stock market was marked by volatility. Stocks began last week closing lower as President Trump threatened new tariffs, including a levy on foreign films. Crude oil prices dropped to their lowest level since the beginning of 2021 as OPEC+ agreed to increase production, raising fears of a global supply surplus. Wall Street saw a minimal reversal last Wednesday after the Federal Reserve decided to keep interest rates at their present level (see below). Thereafter, stocks moved up and down for the remainder of the week. Among the market sectors, consumer discretionary, industrials, and financials performed well, while health care, consumer staples, and communications services underperformed.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- As expected, the Federal Open Market Committee left the federal funds rate at its current range of 4.25%-4.50% following its meeting last week. While noting that economic activity has expanded at a solid pace and the unemployment rate has stabilized, the Committee warned that the risks of higher unemployment and higher inflation have risen. Furthermore, the FOMC statement indicated that uncertainty about the economic outlook has increased further. The Committee next meets in mid-June. Fed Chair Jerome Powell spoke after the meeting and ultimately suggested that the best course of action for the Committee is to wait for further clarity relative to the impact of the tariff policy on the economy and inflation.

- Growth in the services sector in April was the slowest in nearly a year and a half, according to the latest purchasing managers survey from S&P Global. Uncertainty over U.S. trade policies, especially regarding tariffs, was reported to have limited demand and weighed on business expectations, which slumped to the lowest level in two and a half years. Survey respondents indicated that tariffs have driven operating expenses higher through a rise in supplier charges, which caused service providers to increase their selling prices.

- According to the latest report from the Bureau of Economic Analysis, the goods and services deficit was $140.5 billion in March, an increase of 14.0% from the February estimate. Exports rose 0.2% to $278.5 billion, while imports advanced 4.4% to $419.0 billion. Year to date, the goods and services deficit increased $189.6 billion, or 92.6%, from the same period in 2024. Exports increased $41.1 billion, or 5.2%. Imports increased $230.7 billion, or 23.3%.

- The national average retail price for regular gasoline was $3.147 per gallon on May 5, $0.014 per gallon above the prior week’s price but $0.496 per gallon less than a year ago. Also, as of May 5, the East Coast price ticked up $0.011 to $2.998 per gallon; the Midwest price increased $0.035 to $3.027 per gallon; the Gulf Coast price rose $0.036 to $2.722 per gallon; the Rocky Mountain price decreased $0.016 to $3.118 per gallon; and the West Coast price declined $0.036 to $4.156 per gallon.

- For the week ended May 3, there were 228,000 new claims for unemployment insurance, a decrease of 13,000 from the previous week’s level. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended April 26 was 1.2%, a decrease of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended April 26 was 1,879,000, a decrease of 29,000 from the previous week’s level, which was revised down by 8,000. States and territories with the highest insured unemployment rates for the week ended April 19 were New Jersey (2.5%), Rhode Island (2.5%), California (2.3%), Washington (2.1%), District of Columbia (1.8%), Illinois (1.8%), Massachusetts (1.8%), New York (1.8%), Puerto Rico (1.8%), Minnesota (1.7%), and Nevada (1.7%). The largest increases in initial claims for unemployment insurance for the week ended April 26 were in New York (+15,418), Massachusetts (+3,301), Georgia (+1,207), Puerto Rico (+1,012), and Nebraska (+570), while the largest decreases were in Connecticut (-2,340), Rhode Island (-1,850), Missouri (-1,696), Michigan (-1,436), and Washington (-700).

Eye on the Week Ahead

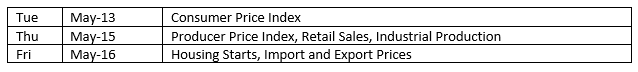

Inflation data for April is available this week, with the releases of several important reports. Both the Consumer Price Index and the Producer Price Index are out this week. In March, the CPI fell 0.1%, while the PPI dropped 0.4%. It will be interesting to see if tariffs have any impact on those readings for April.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.