Every May, interest rates on federal student loans are reset for the upcoming school year. The rates are calculated by combining the yield on the 10-year U.S. Treasury note with an additional fixed amount set by Congress.

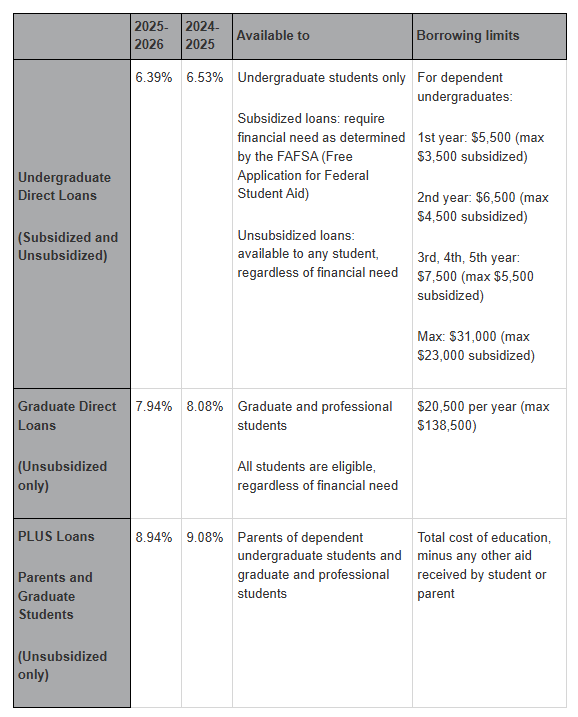

Based on this calculation, interest rates on federal student loans are set to decrease slightly for the 2025-2026 school year, halting four straight years of increases. (Last year’s interest rate for undergraduate Direct Loans hit a decade high, while rates for graduate Direct Loans and PLUS Loans hit their highest levels in more than 20 years.) The 2025-2026 interest rates apply to new federal student loans issued July 1, 2025, through June 30, 2026. The rate is fixed for the life of the loan.

Note: With a subsidized loan, the federal government pays the interest that accrues while the student is in school, during the six-month grace period after graduation, and during any authorized deferment periods, so no interest accrues for the borrower during those times.

With an unsubsidized loan, the borrower is responsible for paying the interest that accrues during these periods. If a borrower does not make payments on the accrued interest while in school, it will be added to the principal balance of the loan after graduation, a process called capitalization.

Borrowers in default face new collection efforts

In April, the Department of Education announced that it would resume collections on defaulted federal student loans starting in May, after halting collection efforts for more than five years since the start of the pandemic. The new policy applies to the roughly five million borrowers who are currently in default (those who have not made a monthly loan payment in over 360 days) and the four million borrowers who are close to default.

Before official collection efforts start, borrowers should receive email communications from the Office of Federal Student Aid (FSA) encouraging them to start making payments, enroll in an income-driven repayment plan, or sign up for loan rehabilitation. Subsequently, borrowers in default (whether student or parent) who are unable to make payments after “sufficient notice and opportunity” will be referred to a federal debt collection service and subject to involuntary collection efforts, including wage garnishment (automatic deductions from a borrower’s paycheck). The FSA office expects to send required notices to borrowers about wage garnishment later this summer. Borrowers in default and borrowers who are delinquent on their student loans (missing a payment for 90 days or more) also risk a negative impact to their credit score, which can make it harder to obtain a credit card, get a car or home loan, or rent an apartment.

Sources: Edvisors, May 8, 2025; U.S. Department of Education, 2025

This content has been reviewed by FINRA.

Prepared by Broadridge Advisor Solutions. © 2025 Broadridge Financial Services, Inc.