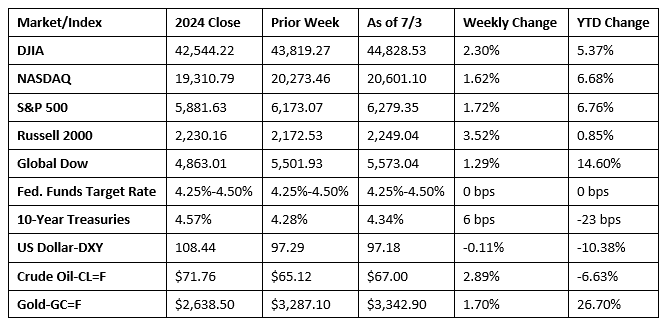

Stocks advanced notably during the Fourth of July holiday-shortened week. Both the S&P 500 and the NASDAQ recorded record highs as investors were encouraged by a better-than-expected labor report (see below). Tech stocks and AI-driven companies moved higher following the White House’s decision to lift export restrictions on chip-design software to China. All 11 market sectors gained last week, led by materials, financials, industrials, and consumer discretionary. The favorable jobs report also helped drive bond yields higher, with 10-year Treasury yields climbing 6.0 basis points. Crude oil prices posted weekly gains, despite slipping at the end of the week. Prices rose during the week after Iran decided to halt cooperation with the United Nations’ nuclear watchdog, which heightened global tensions and threatened production and demand. Gold prices also closed last week higher, after a strong labor report dulled hopes for a Federal Reserve interest rate decrease.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Employment grew by 147,000 in June, which exceeded expectations but was in line with the average monthly gain of 146,000 over the prior 12 months. Job gains occurred in state government and health care. The federal government continued to lose jobs. Employment in April and May was revised up by 16,000 combined. The unemployment rate ticked down 0.1 percentage point to 4.1%. The labor force participation rate also dipped 0.1 percentage point to 62.3%, while the employment-population ratio, at 59.7%, was unchanged from the previous month. The total number of unemployed fell by 222,000 to 7.0 million. In June, the number of long-term unemployed (those jobless for 27 weeks or more) increased by 190,000 to 1.6 million, largely offsetting a decrease in the prior month. The long-term unemployed accounted for 23.3% of all unemployed people. Average hourly earnings rose by $0.08, or 0.2%, to $36.30 in June. Over the past 12 months, average hourly earnings have increased by 3.7%. The average workweek edged down by 0.1 hour to 34.2 hours in June.

- The number of job openings in May increased by 374,000 to 7.8 million, according to the latest Job Openings and Labor Turnover Summary. The number of job openings increased in accommodation and food services (314,000) and in finance and insurance (91,000). The number of job openings decreased in federal government (39,000). The number of hires ticked down by about 100,000 to 5.5 million, while the number of total separations was little changed at 5.2 million. In May, the number of layoffs and discharges were little changed at 1.6 million and 1.0 million, respectively.

- The goods and services trade deficit was $71.5 billion in May, up $11.3 billion, or 18.7%, from April. May exports were $279.0 billion, $11.6 billion, or 4.0%, less than April exports. May imports were $350.5 billion, $0.3 billion, or 0.1%, less than April imports. The May increase in the goods and services deficit reflected an increase in the goods deficit of $11.2 billion to $97.5 billion and a decrease in the services surplus of $0.1 billion to $26.0 billion. Year to date, the goods and services deficit increased $175.0 billion, or 50.4%, from the same period in 2024. Exports increased $73.6 billion, or 5.5%. Imports increased $248.7 billion, or 14.8%.

- According to S&P Global, the U.S. manufacturing sector expanded again in June, with operating conditions improving to the greatest degree in over three years. Output increased for the first time since February, while new orders rose for a sixth successive month due to improved domestic and international demand. However, tariffs remained a prevalent theme, notably affecting purchasing decisions and prices. The latest data showed manufacturers increasing their purchases to the greatest extent since April 2022, reflecting efforts to build up inventories given ongoing trade and price uncertainty. Nonetheless, input costs still rose sharply, with inflation hitting its highest level for nearly three years. This prompted a rise in output charges, which increased to the highest level since September 2022.

- The services sector saw expansion in June, but at a slower pace than in the previous month. The S&P Global US Services PMI® Business Activity Index registered 52.9 in June, down from 53.7 in May. The increase in business activity in June marked the 29th successive month of gains. However, business activity in the services sector remained well below levels recorded in the second half of 2024. An increase in domestic economic activity drove the overall June advance, while international sales fell for the third straight month as tariffs and U.S. trade policy uncertainty continued to weigh on foreign demand.

- The national average retail price for regular gasoline was $3.164 per gallon on June 30, $0.049 per gallon below the prior week’s price and $0.315 per gallon less than a year ago. Also, as of June 30, the East Coast price decreased $0.041 to $3.031 per gallon; the Midwest price dropped $0.036 to $3.051 per gallon; the Gulf Coast price declined $0.105 to $2.739 per gallon; the Rocky Mountain price dipped $0.002 to $3.175 per gallon; and the West Coast price fell 0.053 to $4.109 per gallon.

- For the week ended June 28, there were 233,000 new claims for unemployment insurance, a decrease of 4,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended June 21 was 1.3%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended June 21 was 1,964,000, unchanged from the previous week’s level, which was revised down by 10,000. States and territories with the highest insured unemployment rates for the week ended June 14 were California (2.2%), Minnesota (2.2%), New Jersey (2.2%), Puerto Rico (2.2%), Rhode Island (2.0%), Washington (2.0%), the District of Columbia (1.9%), Massachusetts (1.8%), Illinois (1.7%), and Pennsylvania (1.7%). The largest increases in initial claims for unemployment insurance for the week ended June 21 were in New Jersey (+5,923), Connecticut (+2,333), Oregon (+1,171), Massachusetts (+1,091), and Rhode Island (+710), while the largest decreases were in Minnesota (-5,193), Pennsylvania (-3,515), Texas (-2,419), Illinois (-1,849), and Virginia (-1,206).

Eye on the Week Ahead

Next week is very light on economic reports, with only the release of the Treasury budget statement for June.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.