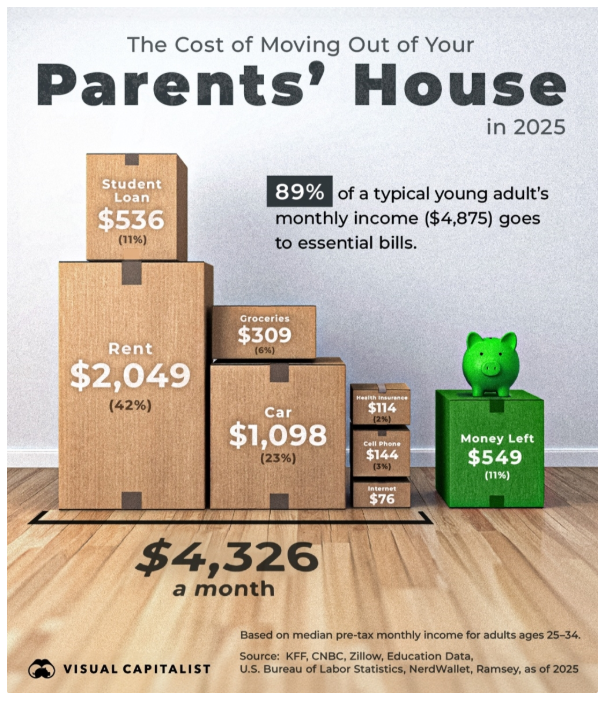

This chart shows the monthly expenses facing young adults ages 25 to 34 in the U.S. who move out of their parents’ home and the percentage each expense consumes based on a typical income for people in this age group.

Rent devours paychecks, and transportation and student debt compound costs

Moving out can be a milestone of independence, but it comes at a steep cost. From rent and student loans to car payments and groceries, the numbers show how quickly a paycheck disappears.

The single biggest cost is rent, which averages $2,049 per month — more than 42% of a typical young adult’s gross income. Rising rents have outpaced wage growth in many urban centers, putting pressure on younger renters.

In addition, with car expenses averaging $1,098 and student loan payments at $536, many young adults are paying more for these two categories than for food or health care. Transportation is often the second-largest expense after housing, especially in areas lacking robust public transit.

Taken together, essential bills eat up 89% of the typical young adult’s gross income, leaving less than $600 before taxes.

Child care is an added expense

Adding a child to the household increases the financial burden dramatically. (Child care costs are not included in the main chart.) At $1,094 per month, child care pushes the total cost of living above a typical income. However, this calculation does not account for a second income from a partner, which is often the case for parents and can ease financial strain. This might help explain why many young adults delay having children or return to multigenerational households.

Graphic created by Visual Capitalist; data from KFF, CNBC, Zillow, Education Data, U.S. Bureau of Labor Statistics, NerdWallet, Ramsey, Brookings, Urban Institute, Pew Research Center, as of 2025

Prepared by Broadridge Advisor Solutions. © 2025 Broadridge Financial Services, Inc.