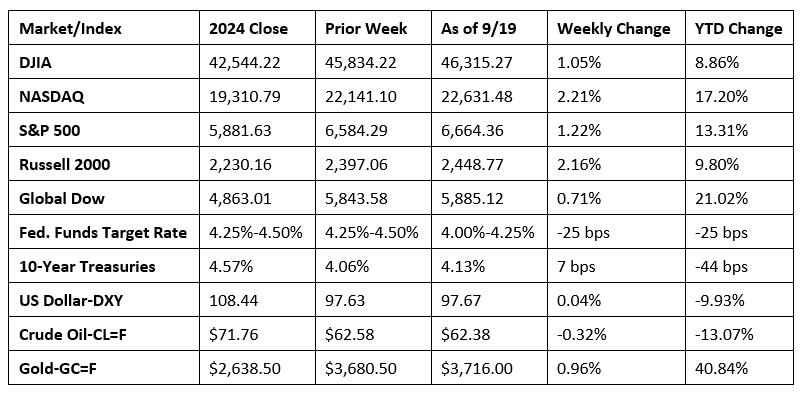

The stock market continued its record-setting run last week with the Dow, the S&P 500, and the NASDAQ each reaching new record highs. The small caps of the Russell 2000 also hit a new high for the first time in four years, which signaled a broadening of the rally beyond tech stocks. The major impetus for last week’s market performance was the Federal Reserve’s decision to trim interest rates (see below) for the first time this year. In addition, the Fed projects that more rate cuts are possible before the end of this year, which investors view as a positive for economic growth and corporate earnings. While inflation appears to have moderated somewhat, the Fed’s challenge is to support a cooling job market without reigniting inflationary pressures. The interest rate cut also influenced the bond market, with 10-year Treasury yields ticking higher as bond prices declined. Crude oil prices fell on concerns about waning global demand, abundant supplies, and implications from the aforementioned interest rate cut.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- As expected, the Federal Open Market Committee cut the federal funds rate by 25 basis points, bringing the range to 4.00%-4.25%. This reduction is the first since December and was nearly unanimous, with newly appointed Governor Stephen Miran favoring a 50-basis-point decrease. In reaching its decision, the Fed noted that growth of economic activity moderated in the first half of the year, while job gains have slowed and the unemployment rate edged up but remained low. Inflation remained somewhat elevated. The Committee indicated that uncertainty about the economic outlook remained heightened, while the downside risks to employment have risen. The Fed expects to lower interest rates by another 50 basis points by the end of 2025 and by 25 basis points in 2026, slightly more than projected in June.

- Estimates of U.S. retail and food services sales for August rose 0.6% from the previous month and climbed 5.0% from August 2024. Retail sales for July were revised up 0.1 percentage point to 0.6%. Retail trade sales were up 0.6% from July 2025 and 4.8% from last year. Nonstore (online) retailer sales were up 2.0% in August from the previous month and 10.1% from last year. Sales at food services and drinking places increased 0.7% last month and 6.5% from August 2024.

- Both import and export prices exceeded expectations last month. U.S. import prices advanced 0.3% in August following a 0.2% increase in July. Prices for U.S. imports were unchanged from August 2024 to August 2025. A 0.8% decline in import fuel prices was offset by a 0.4% rise in nonfuel import prices, which was the largest monthly increase since April 2024. Prices for U.S. exports increased 0.3% in August after rising 0.3% the previous month. Higher prices for nonagricultural exports drove the increase. U.S. export prices rose 3.4% over the 12-month period ended in August, the largest 12-month increase since the comparable period ended December 2022.

- Industrial production (IP) ticked up 0.1% in August after decreasing 0.4% in July. Manufacturing output rose 0.2% last month after edging down 0.1% in July. Within manufacturing, the production of motor vehicles and parts increased 2.6%, while factory output rose 0.1%. Mining moved up 0.9%, while utilities decreased 2.0%. Over the last 12 months, total industrial production has risen 0.9%.

- The number of residential building permits issued in August was 3.7% less than the July estimate and 11.1% below the August 2024 rate. Issued building permits for single-family homes fell 2.2% in August from the prior month. Residential housing starts in August were 8.5% below the July estimate and 6.0% less than the August 2024 rate. Single-family housing starts in August were 7.0% under the July figure. Residential housing completions in August were 8.4% above the July estimate but 8.4% below the August 2024 rate. Single-family housing completions in August were 6.7% above the July estimate.

- The national average retail price for regular gasoline was $3.168 per gallon on September 15, $0.024 per gallon below the prior week’s price and $0.012 per gallon less than a year ago. Also, as of September 15, the East Coast price decreased $0.047 to $3.016 per gallon; the Midwest price declined $0.074 to $2.981 per gallon; the Gulf Coast price increased $0.041 to $2.774 per gallon; the Rocky Mountain price fell $0.060 to $3.180 per gallon; and the West Coast price rose $0.079 to $4.273 per gallon.

- For the week ended September 13, there were 231,000 new claims for unemployment insurance, a decrease of 33,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended September 6 was 1.3%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended September 6 was 1,920,000, a decrease of 7,000 from the previous week’s level, which was revised down by 12,000. States and territories with the highest insured unemployment rates for the week ended August 30 were New Jersey (2.7%), Rhode Island (2.1%), California (2.0%), Massachusetts (2.0%), Washington (2.0%), Puerto Rico (1.9%), the District of Columbia (1.8%), Minnesota (1.8%), Nevada (1.7%), New York (1.7%), and Oregon (1.7%). The largest increases in initial claims for unemployment insurance for the week ended September 6 were in Texas (+15,346), Michigan (+3,018), Connecticut (+1,454), North Dakota (+684), and Minnesota (+325), while the largest decreases were in New York (-3,623), Tennessee (-2,994), California (-1,702), Illinois (-1,063), and Massachusetts (-830).

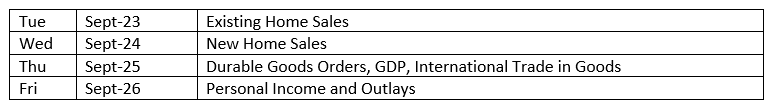

Eye on the Week Ahead

There’s plenty of economic data available this week covering several sectors. The latest information on sales of existing and new homes is out this week. The final estimate for the second quarter gross domestic product is also available later in the week. Data on inflation closes out the week with the release of the personal consumption expenditures price index for August.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2025 Broadridge Financial Solutions, Inc. All Rights Reserved.