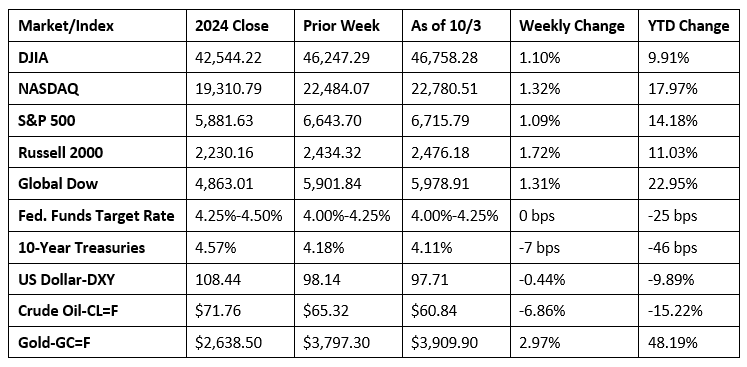

Investor optimism over AI companies and expectations of interest rate cuts helped propel stocks last week. The S&P 500, the Dow, and the NASDAQ reached record highs despite the government shutdown, which caused delays in the release of key economic data (see below). In addition to surging AI stocks, major tech and chip stocks also drove the market. Information technology and health care led the market sectors, while energy showed weakness due to slumping crude oil prices. Ten-year Treasury yields eased slightly during the week, partially due to uncertainty over the employment sector. Bearish crude oil prices were dragged lower by expectations of a production increase by OPEC+.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Ordinarily the Bureau of Labor Statistics would release the jobs data for September and the weekly unemployment statistics. However, that information is unavailable due to the government shutdown.

- The number of job openings was unchanged at 7.2 million in August. The number of job openings for July was revised up by 27,000 to 7.2 million. In August, both hires and total separations were little changed at 5.1 million. Within separations, both quits (3.1 million), and layoffs and discharges (1.7 million) were little changed.

- Manufacturing expanded in September but at a slower pace than in the previous month. The S&P Global US Manufacturing Purchasing Managers’ Index™ registered 52.0 in September, down from 53.0 in August. Although up for a ninth successive month, new orders rose in September only modestly and at a pace below the survey average. Exports were a source of demand weakness, falling overall for a third month in a row. Tariffs were reported to have weighed on export sales, especially to Canada and Mexico.

- Similar to the manufacturing sector, growth in the services sector signaled a weaker expansion of business activity in September. Slower growth was linked to a softer expansion of new work despite an improvement in foreign demand for the first time in six months. On the price front, cost pressures remained elevated, driven principally by tariffs and higher salary payments, with increases passed on to purchasers. The S&P Global US Services PMI® Business Activity Index™ recorded 54.2 in September, down from 54.5 in August but above the 50.0 no-change mark that separates growth from contraction.

- The national average retail price for regular gasoline was $3.118 per gallon on September 29, $0.055 per gallon below the prior week’s price and $0.061 per gallon less than a year ago. Also, as of September 29, the East Coast price decreased $0.047 to $2.983 per gallon; the Midwest price declined $0.080 to $2.928 per gallon; the Gulf Coast price fell $0.044 to $2.672 per gallon; the Rocky Mountain price decreased $0.074 to $3.110 per gallon; and the West Coast price dipped $0.034 to $4.238 per gallon.

Eye on the Week Ahead

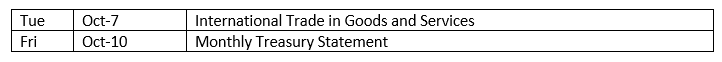

There isn’t a great deal of economic data this week. However, investors likely will be looking ahead to next week when the latest Consumer Price Index is released.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2025 Broadridge Financial Solutions, Inc. All Rights Reserved.