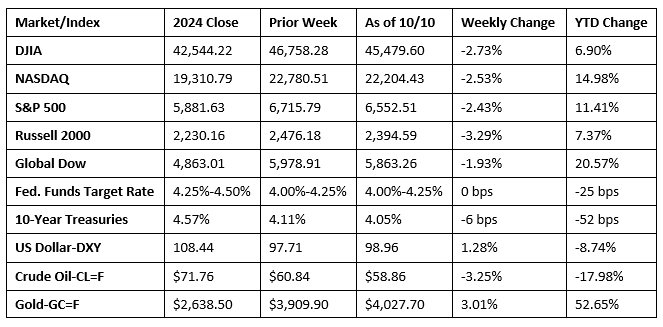

Wall Street was marked by volatility throughout last week. Major indexes, particularly the S&P 500 and the NASDAQ, reached new record highs earlier in the week, driven by an advance in AI stocks and favorable corporate earnings reports. However, the market endured a significant selloff last Friday, reversing much of the week’s earlier gains. Investor sentiment turned negative following a threat by President Trump to impose a “massive increase in tariffs” on Chinese imports, reigniting fears of a trade war. As a result, the S&P 500 declined following a seven-day winning streak. The Dow also declined, while the NASDAQ saw the sharpest losses, with tech shares among the biggest decliners. The government shutdown continued into its second week, increasing uncertainty and delaying the release of key economic data. Ten-year Treasury yields fell below 4.10%, while gold prices climbed above $4,000.00 per ounce, a jump that could be a sign of investor anxiety over deficits and potential inflation.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The release of most economic data has been delayed due to the government shutdown.

- The national average retail price for regular gasoline was $3.124 per gallon on October 6, $0.006 per gallon above the prior week’s price but $0.012 per gallon less than a year ago. Also, as of October 6, the East Coast price ticked up $0.001 to $2.984 per gallon; the Midwest price rose $0.005 to $2.933 per gallon; the Gulf Coast price increased $0.047 to $2.719 per gallon; the Rocky Mountain price decreased $0.044 to $3.066 per gallon; and the West Coast price dipped $0.012 to $4.226 per gallon.

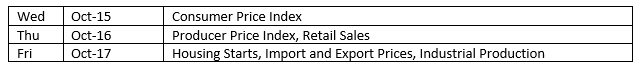

Eye on the Week Ahead

Inflation data for September is ordinarily out this week with the release of the Consumer Price Index. However, the government shutdown has delayed the release of this information.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2025 Broadridge Financial Solutions, Inc. All Rights Reserved.