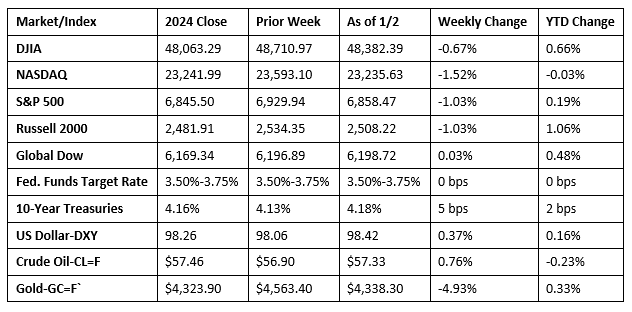

Wall Street began 2026 in rather lackluster style, with each of the major benchmark indexes listed here closing the week lower, with the exception of the Global Dow. A brief tech rally last Friday wasn’t enough to prevent stocks from closing the week in the red. The common year-end rally, known as the “Santa Claus rally,” never materialized as the market notched four straight losing sessions to close out December. Investors appear to be exercising caution as they await the Federal Reserve’s next move in response to sticky inflation and a cooling labor market. Among the 11 S&P 500 market sectors, only energy, utilities, industrials, and materials moved higher, while consumer discretionary, information technology, and financials saw associated stocks fall the furthest. Ten-year Treasury yields edged slightly higher, reflecting ongoing fiscal and inflation concerns. Crude oil prices ticked higher, while gold prices edged lower.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Manufacturing improved in December but at a slower pace when compared to November. The S&P Global US Manufacturing Purchasing Managers’ Index™ registered 51.8 in December, down from 52.2 in November and signaled the weakest expansion of the manufacturing sector in the last five months. New orders declined for the first time in 2025 and exports fell for the seventh straight month. Tariffs were reported to have weighed on export sales, especially to Canada.

- For the week ended December 27, there were 199,000 new claims for unemployment insurance, a decrease of 16,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended December 20 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended December 20 was 1,866,000, a decrease of 47,000 from the previous week’s level, which was revised down by 10,000. States and territories with the highest insured unemployment rates for the week ended December 13 were Washington (2.5%), New Jersey (2.4%), Massachusetts (2.2%), Minnesota (2.2%), California (2.1%), Illinois (2.1%), Rhode Island (2.1%), Alaska (2.0%), Montana (1.9%), and Puerto Rico (1.9%). The largest increases in initial claims for unemployment insurance for the week ended December 20 were in New Jersey (+3,343), Missouri (+1,608), Washington (+1,588), Oregon (+1,364), and Connecticut (+1,291), while the largest decreases were in New York (-1,285), Minnesota (-1,012), Georgia (-730), West Virginia (-713), and Wisconsin (-518).

- The national average retail price for regular gasoline was $2.811 per gallon on December 29, $0.030 per gallon below the prior week’s price and $0.195 per gallon less than a year ago. Also, as of December 29, the East Coast price decreased $0.039 to $2.781 per gallon; the Midwest price ticked up $0.001 to $2.606 per gallon; the Gulf Coast price dropped $0.053 to $2.390 per gallon; the Rocky Mountain price declined $0.058 to $2.434 per gallon; and the West Coast price fell $0.037 to $3.731 per gallon.

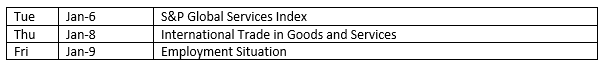

Eye on the Week Ahead

The first full week of January 2026 should include the jobs report for December. November saw weakening conditions in the labor market with the unemployment rate rising while job gains slowed.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2026 Broadridge Financial Solutions, Inc. All Rights Reserved.