Stock prices continue to churn, to put it kindly. By finishing Thanksgiving week 3.79% lower, the S&P 500 added another 10% correction (from the September 20th high) to the 2018 record book. The current negative mood may continue for a few more weeks and percentage points but at the moment, a bear market decline of 20% or more does not seem likely. No one knows what the next few weeks might hold but we continue to position our portfolios for positive equity returns over both the intermediate and long term.

Key economic and financial fundamentals remain healthy. There is little hard evidence to support the current fear the Fed will trigger recession by mindlessly raising interest rates too much, too quickly. As long as the economy continues to expand, even if at a lower rate than the previous quarter, interest rates are bound to move higher through 2019 as the demand for credit grows. In this atmosphere, PE ratios have adjusted from enthusiastic multiples we saw early this year to the more conservative levels available today. This is a reasonable development and long-term investors should take advantage of the lower prices.

On the One Hand

- Initial unemployment claims for the week rose by 3,000 from last week’s revised count 224,000. The four-week moving average for initial claims increased by 2,000 to 218,500. Continuing claims were down 2,000 to 1.668 million. While rising gently over the last 4 weeks, claims remain near multi-decade lows.

- The Leading Economic Index rose 0.1% in October following a revised (+0.1%) 0.6% increase in September. The Coincident Economic Index rose 0.2% after an increase of 0.1% in September. The Lagging Index rose 0.4% after declining 0.2% in September.

- After six consecutive months of declines, existing home sales rose 1.4% in October. On the other hand, sales were 5.1% lower than those in October 2017.

On the Other Hand

- While headline housing starts increased 1.5% in October, single-family starts fell 1.8% for the month to 1.228 units. The gain in overall starts came from the volatile multi-family sector where starts jumped 10.3%. Total starts are down 2.9% versus a year ago.

- Building permits slipped 0.6% to a seasonally adjusted annual rate of 1.263 million units.

- Durable goods orders for October decreased 4.4%. Even after excluding the volatile transportation (aircraft) orders, durable goods orders increased a paltry 0.1% following a 0.6% decline in September.

- The University of Michigan Index of Consumer Sentiment was lower for the second month in a row, declining to 97.5 in November from 98.6 in October.

All Else Being Equal

The economy is still expanding but the rate of growth may be slipping back under 3.0%. Moderate rates of growth will continue unless and until the U.S. productivity rate begins to pick up.

Based on the fundamentals of population growth and scrappage, the US needs about 1.5 million new housing units per year but last week’s report reported starts at an annual rate of 1.228 million and we have not built at the replacement rate since 2006.

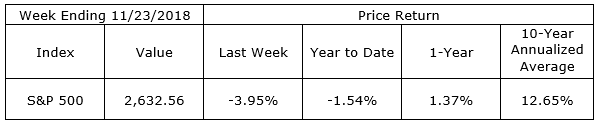

Last Week’s Market

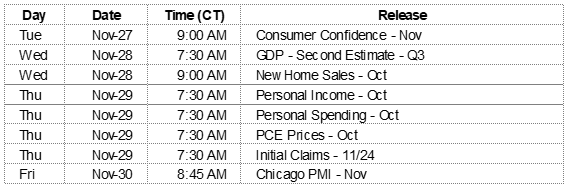

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.