Volatility is the price investors pay for long-term wealth creation. Markets fluctuate, sometimes wildly, and this is the reason a person should never invest funds which will be needed in the immediate future in investments which trade in volatile public markets.

The definition of immediate future is a personal one, which is why it is called personal financial planning. A good rule of thumb recommends you calculate the amount of cash you intend to pull from your portfolio of financial assets over the next year and then multiply it by at least two and possibly three, depending on your level of comfort. Add to this amount the probable cost of any financial emergencies which could arise over the time period. Your answer is the dollar amount you should set aside and manage for wealth preservation, not wealth creation. Those funds will be safe and available to you regardless of what happens in the stock market.

The goals for funds managed for wealth preservation are safety and liquidity. A price will be paid for this safety and liquidity and it will be the relatively low return a person will receive on these funds to be preserved. These low returns are at or slightly below the rate of inflation, but the purchasing power of these dollars will not be significantly affected over the short time period involved.

With immediate needs taken care of in capital preservation accounts, you can relax and focus on the volatile, wealth creation portion of your financial portfolio. These long-term investments will be affected by the compounding of inflation over the many years which will be devoted to wealth creation. It is very important to select financially sound, growth-oriented companies with good management in order to achieve the long-term returns necessary to overcome inflation. Even then, these investments will fluctuate in value in the short-term, sometimes wildly. As uncomfortable as this can be, volatility is a feature of such investments.

Market downturns are normal occurrences for long-term equity investors intent on wealth creation. How normal are such events? Below are the statistics, which we have shown before but deserve to be echoed:

Market declines since 1900 have occurred with the following frequency:

| Size of Downturn | Frequency |

| 5% | 3 times per year |

| 10% | Once per year |

| 20% | Once every 3.5 years |

Given the fact that there are no reliable methods for consistently predicting such declines, the statistics illustrate why investors should diversify broadly and rebalance strategically. You and your advisor can work together to replenish the funds in your capital preservation accounts as they become drawn down over time.

On the One Hand

- Initial claims declined by 17,000 to 216,000. The four-week moving average for initial claims increased by 2,500 to 221,750. Continuing claims for the week ending December 29 decreased by 28,000 to 1.722 million.

- The Consumer Price Index (CPI) for December declined 0.1% month-over-month which resulted in a 1.9% year-over-year increase. The CPI is below the Fed’s target and provides incentive for the FOMC to hold interest rates at current levels.

On the Other Hand

- The ISM non-manufacturing index declined to 57.6 in December from 60.7 in November. While slowing, as is the manufacturing index, both remain above 50.0 and in expansion territory but the turndown needs to be monitored in coming months.

- The Treasury Budget for November showed a $204.9 billion deficit, up from a deficit of $138.5 billion for the same period a year ago. The fiscal year-to-date deficit is $305.4 billion compare to a deficit of $201.8 billion for the same period one year ago. Over the past 12 months, the Treasury budged deficit is $882.6 billion.

All Else Being Equal

Frets about the Fed will begin to subside for a few weeks as corporate earnings begin to dominate the financial news. The fourth quarter reporting cycle will begin this week. We expect positive results for both Q4 2018 and 2019 guidance.

The latest data has the Atlanta Fed’s estimate for real fourth quarter 2018 GDP at 2.8%, up from last week’s estimate of 2.6%.

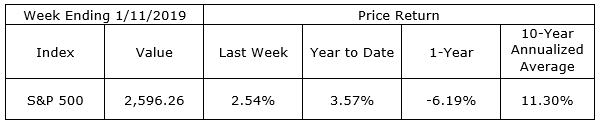

Last Week’s Market

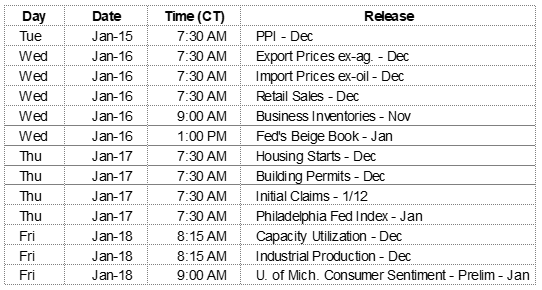

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.