Stocks dropped, taking the S&P 500 down over three percent for the week, as doubts about a near term continuation of what had already been a 20% rally this calendar year mounted. Continued weakness in stock prices is likely to be with us through the remainder of the summer with the correction totaling 5% to 10%. Even though the economy continues in expansion mode and corporate revenue and earnings have been better than expected, it will be ignored as anxiety increases. Do not forget, historically a five percent correction has been experienced an average of three times per year and a 10% or greater correction is an annual event.

Lower rates are likely to move lower still, given that the 10-year Treasury finished the week yielding 1.89%, down from its mid-July yield of 2.12%. Lower interest rates, sometimes an indication of short-term fear among investors seeking safety, eventually become the impetus for higher stock prices.

None of these short-term market moves should have any effect on achieving your long-term goals and plans. If the volatility is unsettling, visit with your advisor if she or he has not already been in touch with you. Stay focused on the variables of your plan for which you have control.

On the One Hand

- Personal income rose 0.4% in June while personal consumption rose 0.3%. Personal income is up 4.9% in the past year, while spending has increased by 3.9%. Consumer prices as measured by the PCE deflator rose 0.1% in June and are up 1.4% versus a year ago.

- The Conference Board’s Consumer Confidence Index soared to 135.7 in July from an upwardly revised 124.3 in June. The index sits at the highest reading since last November and the third-highest reading since October of 2000.

- Pending home sales were 2.8% higher in June, beating the consensus expectation of 1.2% as well as the May growth rate of 1.1%.

- The second-quarter Employment Cost Index rose 0.6%, in line with expectations, following the Q1 increase of 0.7%. Wages and salaries (approximately 70% of compensation costs) were up 0.7% and benefits (the remaining 30%) rose 0.5%.

- While initial unemployment claims for the week rose 8,000 to 215,000, initial claims have been below 300,000 for 230 weeks in a row. The four-week moving average declined by 1,750 to 211,500. Continuing claims rose by 22,000 to 1.699 million.

- July nonfarm payrolls increased by 164,000. Downward revisions to the May (down 31,000) and June (down 10,000) reports have average job growth over the last three periods at 140,000 per month. The unemployment rate held steady at 3.7%. July average hourly earnings were up 0.3% but the average workweek in July was 34.3 hours, down from 34.4 hours in June, the manufacturing workweek decreased by 0.3 hours to 40.0 hours, and factory overtime declined by 0.2 hours to 3.2 hours. The labor force participation rate ticked higher to 63.0% in July versus 62.9% in June.

- The University of Michigan’s Index of Consumer Sentiment’s final post for July stood at 98.4, up slightly from the preliminary print of 98.2 and the final June reading of 98.2.

On the Other Hand

- Total construction spending declined 1.3% in June after a 0.5% decline in May. Year-over-year, total construction spending was down 2.1% with private construction spending down 4.6% and public construction spending up 6.1%.

- The ISM Manufacturing Index for July was 51.2%, down from 51.7% in June and the lowest reading for the index since August 2016. The reading above 50.0% does signal growth but the trend has been slowing.

- Total trade in June was down 1.9% for the month to $467.8 billion. The trade deficit was just 0.3% lower for the month at $55.2 billion.

- Factory orders rose just 0.6% in June following a downwardly revised 1.3% decline (from -0.7%) in May and a 1.2% decline in April.

All Else Being Equal

Continuing solid employment growth and subdued inflation did not dissuade the FOMC from reducing its currently low short-term lending rates by one-quarter of one percent to a range of 2.00-2.25%. In addition, another cut in September was suggested due primarily to concern about the impact increased tariffs will have on already slowing world trade.

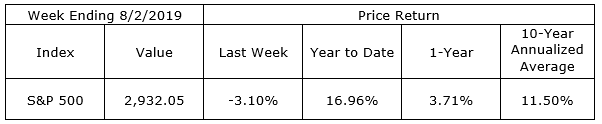

Last Week’s Market

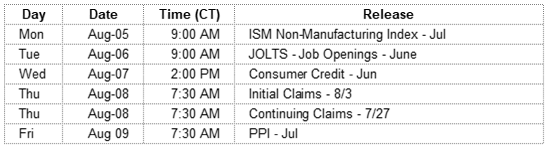

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.