Four-hundred fifty of the S&P 500 companies have reported second quarter earnings. To date, earnings were reported at a rate of 5.7% above estimates while aggregate revenue was 0.8% above expectations. Results relative to expectations will generally have an immediate impact on market prices and in the cases of individual companies may have long-term implications. For a clear understanding of where the economy stands, it is necessary to compare recent revenues and earnings, not to expectations, but to actual past performance. Factset Research provides this data as well.

The blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) earnings decline for the second quarter is -0.7% today. If -0.7% is the actual decline for the quarter, it will mark the first time the index has reported two straight quarters of year-over-year declines in earnings since Q1 2016 and Q2 2016. Five sectors are reporting year-over-year growth in earnings, led by the Health Care and Financials sectors. Six sectors are reporting a year-over-year decline in earnings, led by the Materials and Industrials sectors.

The blended revenue growth rate for the second quarter is 4.1% today. If 4.1% is the final growth rate for the quarter, it will mark the lowest revenue growth rate for the index since Q3 2016 (2.7%). Eight sectors are reporting year-over-year growth in revenues, led by the Communication Services and Health Care sectors. Three sectors are reporting a year-over-year decline in revenues, led by the Materials sector.

S&P 500 companies are reporting reasonable revenue growth although somewhat slower than in previous quarters. Company earnings have contracted slightly as profit margins have declined. The decline from last year’s historically high margins has been expected. Rising raw materials prices and higher labor costs are also factors but not unexpected. The costs of the trade disputes are also beginning to show up in the reports from multinationals.

While relative margin compression is expected to continue for at least one more quarter (due to the previously mentioned historically high margins of 2018), the U.S. economic outlook continues to be favorable. While the conditions for recession are not currently present, tariff and other trade issues will remain front and center and continue to influence expectations and equity market volatility for the intermediate term.

On the One Hand

- Existing home sales were up 2.5% in July to a seasonally adjusted annual rate of 5.42 million. Sales were 0.6% higher than the same period a year ago.

- Initial unemployment claims were down 12,000 to 209,000. The four-week moving average edged higher by 500 to 214,500. Continuing claims dropped 54,000 to 1.674 million.

- The Leading Economic Index increased 0.5% in July and the June index was revised upward to a decline of 0.1% from the 0.3% decline reported initially.

On the Other Hand

- Sales of new single-family houses slumped 12.8% in July to a seasonally adjusted annual rate of 635,000. June sales were revised upward from a seasonally adjusted annual rate of 646,000 to 728,000. Although a disappointing monthly decline, year-over-year new home sales were up 4.3%.

- The Bureau of Labor Statistics announced its preliminary estimate of the upcoming annual benchmark revision to its establishment survey employment series. The revisions over the last 10 years have averaged plus or minus 0.2% of total nonfarm employment. The preliminary estimate of the benchmark revision indicates a downward adjustment to the March 2019 total nonfarm employment of -501,000 or -0.3%.

- The Manufacturing Purchasing Managers’ Index (PMI) dipped below the expansion point to 49.9 in August, down from 50.4 in the previous month. The reading is the first month of contraction in the manufacturing sector since September 2009.

All Else Being Equal

The annual Jackson Hole Economic Symposium sponsored by the Federal Reserve Bank of Kansas City took place Thursday through Saturday. Central bankers, finance ministers, academics and financial market participants from around the world met to cuss and discuss economic conditions and policies around the world. The hairs of thoughts expressed by various participants will be split for days by many members of the financial services industry and media as they spin their reports to support their current market positions and predictions.

Meanwhile, back at the office, the Atlanta Fed’s staff crunched the numbers and calculated no change to its GDPNow estimate for current quarter real growth of 2.2%.

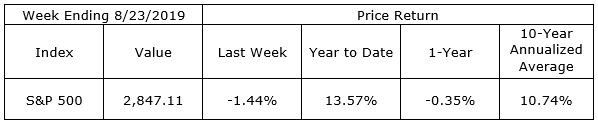

Last Week’s Market

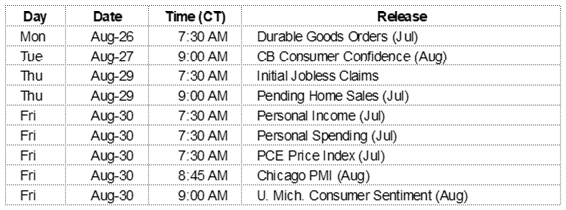

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.