Last week’s economic news continued to signal the expansion is continuing although at a slightly slower pace than was experienced in the quarters from Q3 2017 through Q3 2018. The slowing trend experienced over the last three quarters is not expected to stabilize in the two percent growth range for the foreseeable future. S&P 500 companies are estimated to finish 2019 with revenue growth of 3.9% and earnings growth of 2.5%. Corporate revenue is expected to rebound in 2020 by 5.0% with earnings growth of 10.0%. Consensus estimates of future economic activity like those noted above should always be taken with a grain of salt but so should the recent popular narrative which insists recession is imminent.

These are more reasons to focus your attention on your personal plan and the strategies for accomplishing your goals. For some reason, recent questions have focused on the increasing cost of long-term care and the pros and cons of using insurance to turn some of those uncertainties into predictable outcomes. Insurance can help make your future more predictable. Paulette Rupp shares her expertise in the article Ask a Trust Officer: Planning for the Long-term. The article does not have all the answers. Those, as in most areas of financial planning, are personal. It does however provide good general thoughts to help start forming your personal approach.

On the One Hand

- New home sales rose a surprising 7.1% in August to an annual rate of 713,000 units. Sales are up 18% from a year ago levels.

- Initial unemployment claims increased by 3,000 to 213,000 putting the four-week moving average for initial claims at 212,000, down 750. Continuing claims declined 15,000 to 1.650 million.

- The third estimate for second quarter GDP was unchanged at 2.0% of real growth. The GDP Price Deflator was also unchanged at 2.4%.

- Personal income was up 0.4% in August, driven by a 0.6% increase in wages and salaries. Personal spending was up 0.1% in August, a bit below expectations. A spending breather between the back to school season and the upcoming holiday spending season is not a bad thing. The economic bears with their narrative claiming consumers are overextended can be proven wrong with help from the data showing the personal savings rate in August increased to 8.1% from 7.8% the previous month. The PCE Price Index was unchanged – up 1.4% for the year.

- Durable goods orders rose better than expected by 0.2% in August.

- The University of Michigan’s Index of Consumer Sentiment printed its final reading for September at 93.2, up from the preliminary reading of 92.0 and the final August reading of 89.8.

On the Other Hand

The Consumer Confidence Index dropped to 125.1 in September from a 134.2 final reading in August which was downwardly revised from its 135.1 initial release.

All Else Being Equal

Consumers say they have become concerned, but the data has not yet reflected a downturn in their spending. We saw a similar sharp decline in consumer sentiment last December, but the sour mood did not result in a pullback in spending in the following months. The reports over the next several months will be closely scrutinized for signs of an actual downtrend in consumer spending.

As we close in on the end of the third quarter, the Atlanta Fed staff’s GDPNow estimate for real current quarter growth has crept back over 2.0% with its latest guess of 2.1%.

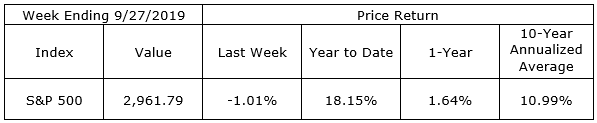

Last Week’s Market

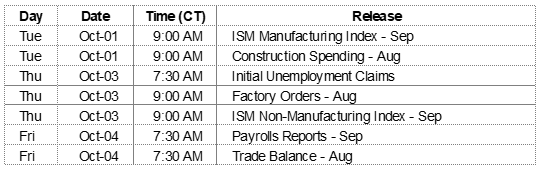

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.