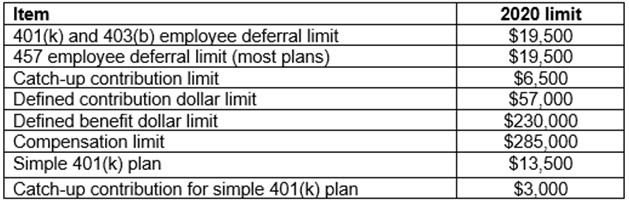

Lee Anne Thompson, E.R.P.A, Q.P.A., and Assistant Vice President & Employee Benefit Officer at The Trust Company of Kansas provided the 2020 retirement plan limits earlier this month. “The IRA contribution limit stays at $6,000 if the individual is younger than age 50 in 2019, and $7,000 if he or she attains age 50 or older in 2020. The limits for 401(k) plans also get a $500 bump up, as shown in the following table:”

Retirement plans were in the news again last week with the passage of what Congress has dubbed the SECURE Act. We will post details of the new legislation in future updates but a few of the provisions are worth highlighting now. The stretch is gone for non-spouse beneficiaries who inherit IRAs from owners who die after December 31, 2019. With exceptions for beneficiaries who are disabled, chronically ill, or are minor children, non-spouse beneficiaries will be required to deplete their inherited IRAs within 10 years. This unpopular feature for future beneficiaries is somewhat offset by new, beneficial provisions for account owners. An account owner will be allowed to contribute to his or her IRA beyond the current age limit of 70 1/2. Additionally, the beginning date for required distributions will be age 72, up from the current 70 1/2. More details along with planning options will be available in upcoming articles.

On the One Hand

- Housing starts increased by 3.2% in November to a seasonally adjusted annual rate of 1.365 million. Building permits increased by 1.4% in the month to a seasonally adjusted annual rate of 1.482 million.

- Fueled by the end of the GM strike, industrial production posted the largest monthly gain since 2017 in November, rising 1.10%. Auto production rose 12.4% in November, the largest monthly gain since 2009. Excluding the auto sector, industrial production posted a healthy gain of 0.5%. The capacity utilization rate increased nicely to 77.3% in November from the previous month’s rate of 76.6% but leaves plenty of room for further expansion.

- Initial jobless claims fell away from the previous week’s two year high, decreased 18,000 to a seasonally adjusted 234,000. The decline was good to see after last week’s increase of 49,000. The four-week moving average of initial claims rose 1,500 to 225,500. Continuing claims caught up with last week’s sharp increase in weekly claims, rising 51,000 to 1.72 million.

- GDP growth held firm as the third estimate for Q3 growth remained unchanged with a growth rate of 2.1%. The GDP price deflator was also unrevised at 1.8%.

- Personal income increased 0.5% in November. Personal spending rose 0.4% in the same month. The PCE Price Index was up 0.2% for the month and up 1.5% for the year ending in November.

- The final December reading for the University of Michigan Index of Consumer Sentiment was 99.3 up from the initial reading of 99.2 and firmly above the November level of 96.8.

On the Other Hand

- Existing home sales declined by 1.7% in November. Lack of supply and rising prices continue to limit growth in existing home sales. Total sales were up 2.7% year-over-year.

- The Leading Economic Index was unchanged in November following three straight months of decline. October was revised downward to a decline of 0.2% versus the initially reported decline of 0.1%.

All Else Being Equal

The New York Fed staff’s Nowcast rose above the 1% level last week to an estimate of 1.3% for Q4 2009 real GDP growth. The GDPNow estimate was down slightly to 2.1%.

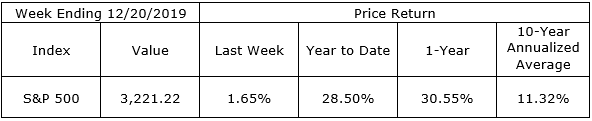

Last Week’s Market

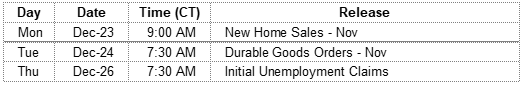

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.