The last Friday of 2019 saw the S&P 500 settle 0.58% higher for the week and up 28.59% year to date and over 30% considering dividends. This is a far cry from the expectations of many market watchers last year when the index was down 19% for the quarter to date on Christmas Eve and 12% lower for the year. At that time, few expected a market recovery like the one we just experienced.

Today, as was the case a year ago, it is pointless to attempt to estimate what a stock index will return in the coming twelve months. It is extremely valuable, however, to determine the amounts you will need to fund your purchases of goods and services a year from now (and even two or three years from now). Those funds should not be invested in the stock market but held instead in stable, interest-bearing accounts. Investors with funds allocated to growth-oriented investments should confirm their allocations are sufficient to achieve their long-term goals. Additionally, these funds should be in proportions which are aligned with the individual’s abilities to emotionally withstand the levels of volatility, which long-term investing is sure to produce. Resolve to project your personal financial plan over the next year and understand it is futile to attempt to estimate what stock market returns might be over the next twelve months.

On the One Hand

- November new home sales were up 1.3% to a seasonally adjusted annual rate of 719,000 units. On a year-over-year basis, new home sales were up 16.9%.

- Initial unemployment claims declined again this week by 13,000 to 222,000, nearly offsetting the sharp gain we saw two weeks ago. The four-week moving average for initial claims increased by 2,250 to 228,000. Continuing claims declined by 6,000 to 1.719 million. Initial claims have not been above 300,000 for 251 straight weeks.

On the Other Hand

- Total durable goods orders declined 2.0% in the month of November and October was revised downward to a 0.2% increase from an originally reported 0.6%. Nondefense capital goods, excluding aircraft, were up just 0.1% in November, putting the annual growth rate at just 0.7%.

All Else Being Equal

The data in the GDPNow model for estimating Q4 real growth now supports a 2.3% rate.

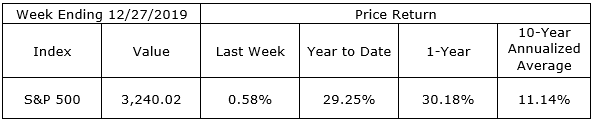

Last Week’s Market

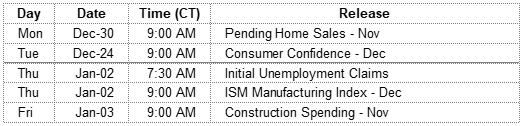

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.