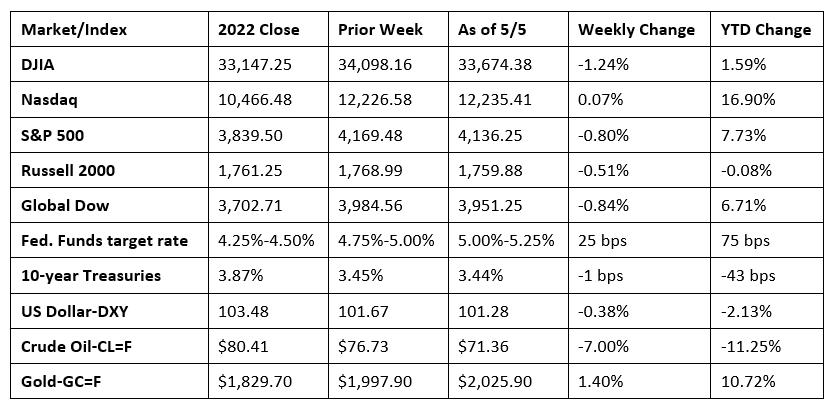

Stocks closed last week generally lower, with only the Nasdaq eking out a minimal gain. A rally last Friday wasn’t enough to recoup losses experienced during the week. Investors had quite a bit to digest over the past week. The Federal Reserve hiked the federal funds rate 25 basis points and gave no clear indication as to whether and when more rate increases may be coming. Regional banks continued to struggle, however bank stocks rallied late in the week to help ease investor concerns. The April jobs report was solid, but also showed the pace of hiring was slowing. Crude oil prices continued to tumble on concerns of a slowing U.S. economy and tepid Chinese demand. Gold prices rebounded from the prior week, once again moving above the $2,000.00 per ounce mark.

Wall Street opened last week with a whimper, with stocks unable to maintain early momentum, ultimately closing lower. Monday saw each of the benchmark indexes listed here end the session marginally lower, with the exception of the Russell 2000, which ended the day flat. Ten-year Treasury yields added 12.2 basis points to close at 3.57%. Crude oil prices fell 1.3% to $75.75 per barrel. The dollar advanced 0.5%, while gold prices fell 0.4%.

Markets fell last Tuesday, pulled lower by declining financial and energy stocks. Investor concerns ticked higher following news that other regional banks were in jeopardy of failing, which came ahead of Wednesday’s anticipated 25-basis point interest rate hike by the Federal Reserve. The Russell 2000 was hit the hardest, dropping 2.1%, followed by the Global Dow and the S&P 500, which slipped 1.2%. The Dow and the Nasdaq lost 1.1%. Ten-year Treasury yields fell 13.5 basis points to 3.43% as bond prices surged on growing demand. Crude oil prices settled at about $71.64 per barrel, down 5.3% on recession concerns. The dollar slid lower, while gold prices gained 1.7%.

Last Wednesday saw investors respond to the latest interest rate hike from the Federal Reserve by selling stocks. Of the benchmark indexes listed here, only the small caps of the Russell 2000 ended the day in the black, gaining 0.4%. The remaining indexes posted losses, led by the Dow (-0.8%), followed by the S&P 500 (-0.7%), the Nasdaq (-0.5%), and the Global Dow (-0.1%). Crude oil prices dropped nearly 5.0% to $68.26 per barrel, hitting the lowest level since late March amid concerns of a U.S. recession and waning demand in China. The dollar declined for the second straight day. Gold prices advanced nearly 1.0%.

Thursday proved to be another rough day for Wall Street. Investors contemplated more troubling news on the financial front as more regional banks faced possible closures. The Russell 2000 lost 1.2%, followed by the Dow (-0.9%), the Global Dow (-0.8%), the S&P 500 (-0.7%), and the Nasdaq (-0.5%). Bond prices continued to advance, pulling yields lower, with the yield on 10-year Treasuries falling 5.2 basis points to 3.35%. Crude oil prices slipped lower, closing at roughly $68.55 per barrel. The dollar and gold prices climbed higher.

Stocks closed higher last Friday on the heels of a strong jobs report (see below). The Russell 2000 (2.4%) and the Nasdaq (2.3%) led the way, followed by the S&P 500 (1.9%), the Dow (1.7%), and the Global Dow (1.3%). Ten-year Treasury yields added 9.5 basis points to 3.44%. Crude oil prices rose 4.0%. Both the dollar and gold prices ended the session in the red.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- As expected, the Federal Open Market Committee raised the target range for the federal funds rate 25 basis points to 5.00%-5.25%. The FOMC noted that job gains have been robust and the unemployment rate has remained low, while inflation remains elevated. Despite the failure of several banks in the last few months, the Committee indicated that the banking system was sound and resilient. In attempting to moderate rising inflation, the Committee admitted that “tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation.” While the extent of the effects of the Committee’s actions remains uncertain, it “would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

- The job sector continued to show strength in April. There were 253,000 new jobs added in April, not far off from the average monthly gain of 290,000 over the prior six months. In April, employment continued to trend up in professional and business services, health care, leisure and hospitality, and social assistance. The unemployment rate dipped 0.1 percentage point to 3.4%, while the number of unemployed persons declined by 182,000 to 5.7 million. The labor force participation rate and the employment-population ratio were unchanged in April, settling at 62.6% and 60.4%, respectively. In April, average hourly earnings rose by $0.16, or 0.5%, to $33.36. Over the past 12 months, average hourly earnings have increased by 4.4%. The average workweek was unchanged at 34.4 hours in April.

- On the last day of March, the number of job openings decreased by 384,000 to 9.6 million, according to the latest Job Openings and Labor Turnover report. The March number of job openings was 1.6 million lower than at the end of December. In March, the number of hires was little changed at 6.1 million from the previous month. The number of total separations (quits, layoffs, and discharges) changed marginally at 5.9 million. The number of quits was flat at 3.9 million, although the number of layoffs and discharges increased by 248,000 to 1.8 million.

- The manufacturing sector improved slightly in April, according to the latest S&P Global survey of purchasing managers. The S&P Global US Manufacturing Purchasing Managers’ Index™ (PMI™) registered 50.2 in April, up from 49.2 in March. This is the first reading above 50.0 in six months and the highest since October 2022. A reading above 50.0 indicates acceleration in manufacturing. Survey respondents noted a rise in new domestic orders, but not foreign new orders as exports lagged. Employment and prices rose, with producer costs and selling prices accelerating.

- The services sector expanded in April as company output, new orders, and employment all accelerated. Inflationary pressures caused input costs to rise at the fastest rate in three months, while selling prices increased at the quickest pace since August 2022. Overall, the S&P Global US Services PMI Business Activity Index registered 53.6 in April, up from 52.6 in March, marking the third consecutive month of growth for service providers.

- The goods and services trade deficit was $64.2 billion in March, down $6.4 billion, or 9.1%, from the February deficit, according to the latest data from the Census Bureau. March exports were $256.2 billion, $5.3 billion, or 2.1%, more than February exports. March imports were $320.4 billion, $1.1 billion, or 0.3%, less than February imports. Year to date, the goods and services deficit decreased $77.6 billion, or 27.6%, from the same period in 2022. Exports increased $61.4 billion, or 8.7%. Imports decreased $16.2 billion, or 1.6%.

- The national average retail price for regular gasoline was $3.600 per gallon on May 1, $0.056 per gallon less than the prior week’s price and $0.582 less than a year ago. Also, as of May 1, the East Coast price decreased $0.051 to $3.492 per gallon; the Gulf Coast price fell $0.108 to $3.147 per gallon; the Midwest price declined $0.068 to $3.484 per gallon; the Rocky Mountain price dropped $0.013 to $3.534 per gallon; and the West Coast price dipped $0.001 to $4.547 per gallon.

- For the week ended April 29, there were 242,000 new claims for unemployment insurance, an increase of 13,000 from the previous week’s level, which was revised down by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended April 22 was 1.2%, a decrease of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended April 22 was 1,805,000, a decrease of 38,000 from the previous week’s level, which was revised down by 15,000. States and territories with the highest insured unemployment rates for the week ended April 15 were California (2.4%), New Jersey (2.4%), Rhode Island (2.1%), Massachusetts (2.0%), Minnesota (1.8%), New York (1.8%), Alaska (1.7%), Illinois (1.6%), Oregon (1.6%), Puerto Rico (1.6%), and Washington (1.6%). The largest increases in initial claims for unemployment insurance for the week ended April 22 were in Massachusetts (+8,774), Illinois (+2,482), New York (+1,487), Michigan (+625), and Colorado (+604), while the largest decreases were in California (-3,754), Ohio (-3,236), New Jersey (-2,962), Connecticut (-2,076), and Rhode Island (-1,426).

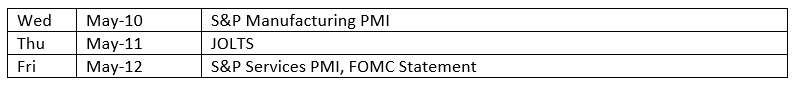

Eye on the Week Ahead

Inflation data for April is available this week with the releases of the Consumer Price Index and the Producer Price Index. March saw the CPI inch up 0.1%, while the PPI declined 0.5%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.